Kansas Vehicle Registration (3 Steps)In Kansas, a recently purchase vehicle must be registered within 60 days of the date the title was assigned to the new owner. Failure to register within that time period will likely result in penalties and fees, which may vary by county.[1]

1. Application FormsTo apply for a certificate of title and register a vehicle, a Title and Registration Application (TR-212a) must be completed and the following documents should be collected[2]:

Kansas Motor Vehicle Power of Attorney – A POA can be used by the seller to allow the buyer to complete the assignment of the vehicle’s title. 2. TaxesBefore visiting a county treasurer, sales tax and property tax must be paid in order to receive a certification of title.[3] 3. County TreasurerAll application documents must be brought to a County Treasurer’s Office. The treasurer will demand that all titling and registration fees be paid to complete the registration process.

|

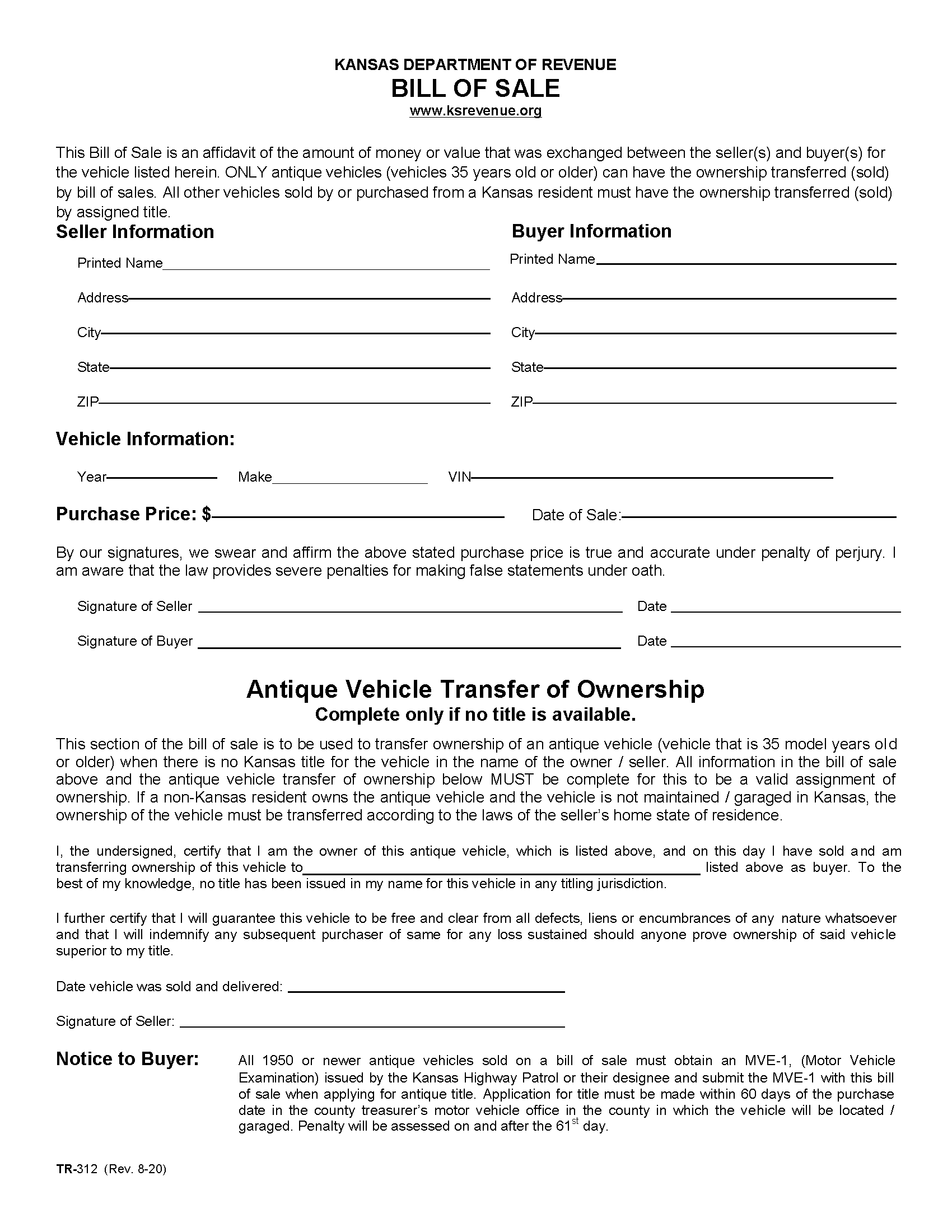

Kansas Motor Vehicle Bill of Sale Form

A Kansas motor vehicle bill of sale is a proof of purchase document that records a transaction between the seller of a vehicle and a buyer. This form contains the names and addresses of both parties, a description of the vehicle, and the date of the sale. Once signed by both parties, the bill of sale serves as an affidavit (legal confirmation) that the purchase price was paid by the buyer.