Kansas Vehicle Registration (3 Steps)In Kansas, a recently purchase vehicle must be registered within 60 days of the date the title was assigned to the new owner. Failure to register within that time period will likely result in penalties and fees, which may vary by county.[1]

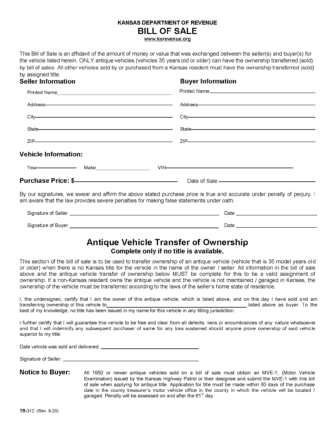

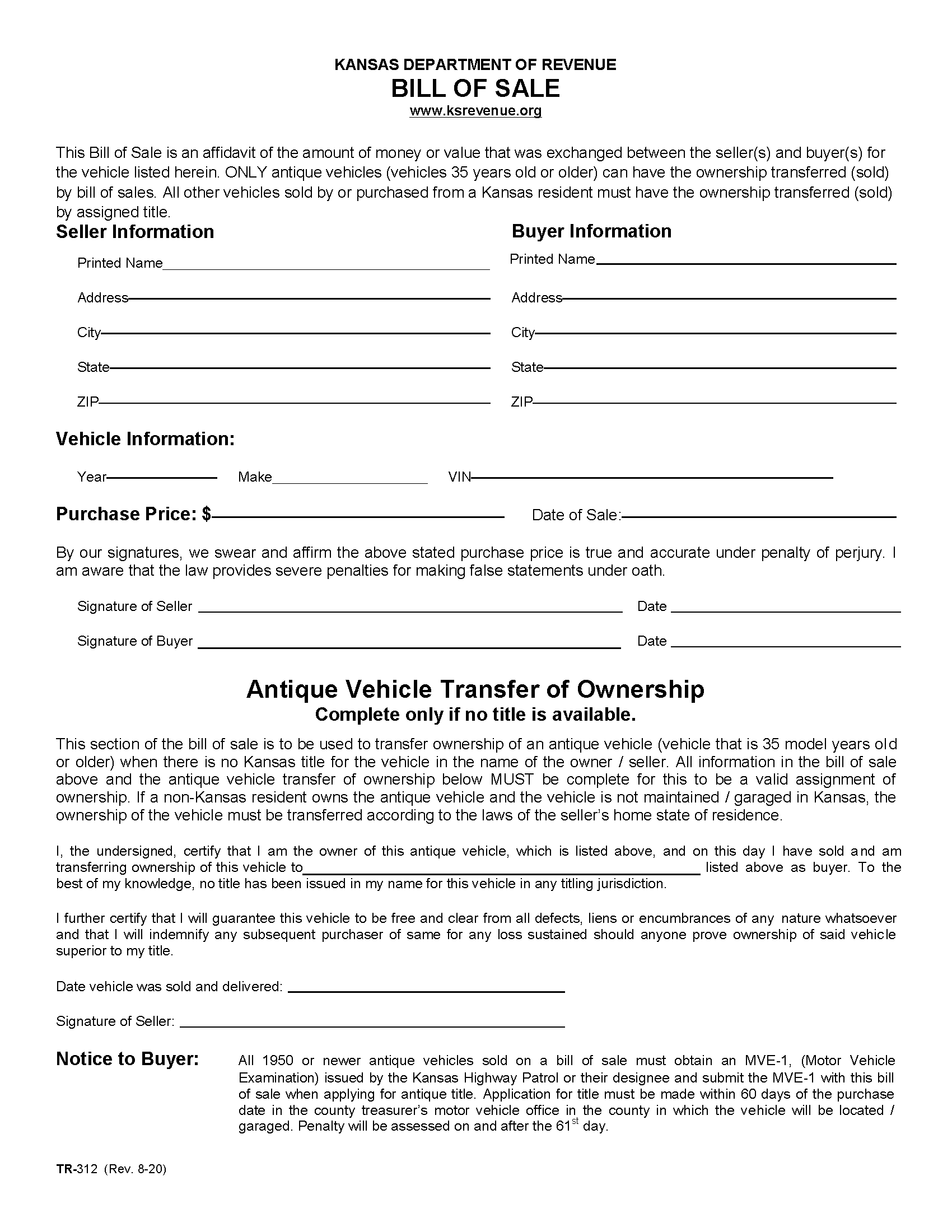

1. Application FormsTo apply for a certificate of title and register a vehicle, a Title and Registration Application (TR-212a) must be completed and the following documents should be collected[2]:

Kansas Motor Vehicle Power of Attorney – A POA can be used by the seller to allow the buyer to complete the assignment of the vehicle’s title. 2. TaxesBefore visiting a county treasurer, sales tax and property tax must be paid in order to receive a certification of title.[3] 3. County TreasurerAll application documents must be brought to a County Treasurer’s Office. The treasurer will demand that all titling and registration fees be paid to complete the registration process.

|