Summary

- For requesting the removal of debt(s) on a credit report.

- Reasons include debt that is expired, faulty, or already settled.

- Can be sent to the major reporting bureaus: Equifax, Experian, and TransUnion.

Contents |

Sample

- Download (Blank): PDF, Word (.docx), OpenDocument

- Download (With Sample Data): PDF, Word (.docx), OpenDocument

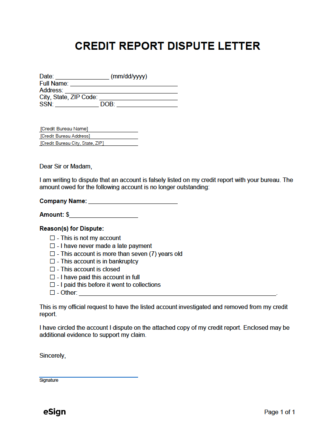

CREDIT REPORT DISPUTE LETTER

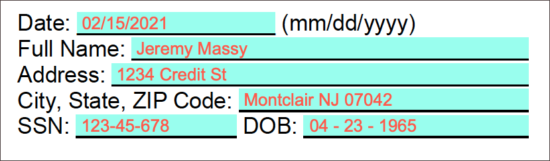

Date: [MM/DD/YYYY]

Name: [SENDER FULL NAME]

Address: [SENDER ADDRESS]

City, State, ZIP Code: [SENDER CITY, STATE, ZIP]

SSN: [SENDER SSN] DOB: [SENDER DOB]

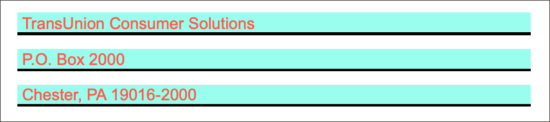

[CREDIT BUREAU NAME]

[CREDIT BUREAU ADDRESS]

[CREDIT BUREAU CITY, STATE, ZIP]

Dear Sir or Madam,

I am writing to dispute that an account is falsely listed on my credit report with your bureau. The amount owed for the following account is no longer outstanding:

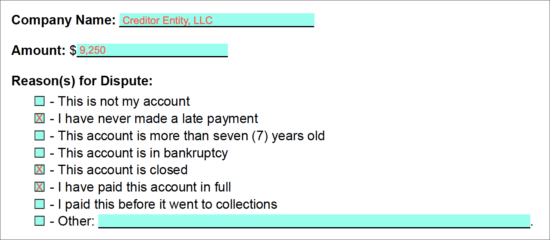

Company Name: [DEBT HOLDER NAME]

Amount: $[AMOUNT OWED]

Reason for Dispute:

☐ – This is not my account

☐ – I have never made a late payment

☐ – This account is more than seven (7) years old

☐ – This account is in bankruptcy

☐ – This account is closed

☐ – I have paid this account in full

☐ – I paid this before it went to collections

☐ – Other: [OTHER REASON].

This is my official request to have the listed account investigated and removed from my credit report.

I have circled the account I dispute on the attached copy of my credit report. Enclosed may be additional evidence to support my claim.

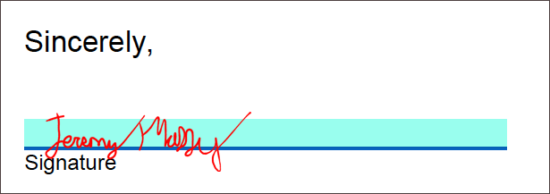

Sincerely,

_________________________________

Signature

What Can be Disputed?

Consumers can request the following types of debt to be removed from their report:

- Wrongly listed debt.

- Debt that has already been paid in full.

- Incorrect/unjust late payments.

- Debt that is older than seven (7) years.

- Foreclosures older than seven (7) years.

- Bankruptcies older than 7-10 years.

How to Dispute your Credit Report

The steps below outline the process one needs to take to challenge an item on a credit report.

Step 1 – Receive your Credit Report

It’s recommended that a consumer obtain their credit report before applying for a major loan (such as a mortgage), taking steps to repair their credit, or after being denied credit. All citizens have the right to obtain one (1) free credit report a year from the three (3) of the major credit reporting bureaus. To obtain the report(s), go to AnnualCreditReport.com and click “Request your free credit reports.”

Step 2 – Look for Inaccuracies

Examine the report(s) line-by-line while looking for the following issues:

- Debt that isn’t yours (falsely listed).

- Late payments that are incorrect or unjust.

- Debt/foreclosures/bankruptcies that are older than seven (7) years.

- Debt that’s already been paid off.

If the debt is in any way questionable, it’s in the consumer’s best interests to report it, as there are no consequences or penalties for doing so.

Step 3 – Gather Evidence

The consumer should go through old receipts, mail, documents, and any other notation that supports the consumer’s claim. For example, if the consumer is reporting a debt that is over seven (7) years old, they should locate documentation relating to the debt that is dated at least seven (7) years in the past. If the consumer will be mailing in their dispute, they should not include originals but make copies of all files they attach.

Step 4 – Create + Send the Dispute

Consumers can create and send a dispute online or by mail. For those comfortable with computers, online is the recommended option.

Online

The following are links for creating a dispute online with any of the three major credit bureaus:

- Experian (click “Start a new dispute online”)

- Equifax (click “Submit a Dispute”)

- TransUnion (click “Start Dispute”)

By Mail

The sender will need to download and complete all fields on the Credit Report Dispute Letter. Once completed, the letter will need to be mailed using certified mail to the applicable reporting agency using one of the following addresses:

| Experian P.O. Box 4500 Allen, TX 75013 |

Equifax Information Services, LLC P.O. Box 740256 Atlanta, GA 30374-0256 |

TransUnion Consumer Solutions P.O. Box 2000 Chester, PA 19016-2000 |

Step 5 – Receive Response

Once received, the credit bureau has thirty (30) days to respond to the inquiry (unless they find the inquiry senseless). At this time, they will also send all applicable data relating to the dispute to the entity that originally provided the information. Once received by the original provider, it is their duty to review all information pertaining to the dispute. Should they discover the information isn’t accurate, they will inform all three (3) credit bureaus so the information can be corrected.

After the completion of the investigation, the results will be sent to the consumer via mail.

Positive Result (Change to Report)

If the investigation results in a change to the credit report, the consumer will be mailed the following documents:

-

- A statement of the results;

- A free copy of their report (with the change(s) added); and

- The contact info of the creditor (“information provider”) that originally sent the disputed information.

At this point, the consumer will have completed the dispute. No further action would be required.

Negative Result (No Change to Report)

Should the bureau’s investigation result in no change to the report, the consumer will receive a statement that includes the information provider’s name, phone number, and mailing address.

With this information, the consumer can send the debt holder a “Validation of Debt Letter.” This letter makes a formal request to the holder of the debt to provide information on the original creditor. Because it is a Federal requirement for the debt holder to provide this information, if they do not provide such details within thirty (30) days, the consumer is no longer responsible for the debt and can have it removed from their report (by sending another credit dispute letter).

Instructions (How to Write)

Step 1 – Sender Info

In the first section of the letter, the consumer will need to enter the following information:

- The date (mm/dd/yyyy) they signed/completed the document.

- Their full name.

- Their mailing address (street, city, state, and ZIP).

- Their SSN (not a requirement for all credit bureaus).

- Their DOB (not a requirement for all credit bureaus).

Step 2 – Credit Reporting Bureau

Enter the address of the credit reporting bureau. Addresses can be found in Step 4 above.

Step 3 – Disputed Payment

For the “Company Name” field, enter the full name of the company (the creditor) that holds the debt. Then, enter the total amount ($) of debt as listed on the credit report, followed by checking the applicable box(es) relating to the reason(s) for disputing. If no boxes apply, the sender can check “Other” and provide their reasons for disputing the item.

Step 4 – Signature

The sender must sign their name at the very bottom of the document. This can be completed by printing the document and signing by hand or by uploading the completed form to eSign and placing a digital signature on the letter. The sender can now attach any supplemental documentation and send the letter to the credit bureau(s).