Recording Details

- Signing Requirements – The grantor must sign before two witnesses and have their signature acknowledged by a notary public.[1]

- Where to Record – County Recorder’s Office (Circuit Clerk)[2]

- Recording fees – $15 for first page, $5 for each additional page (as of this writing)[3]

Formatting Requirements

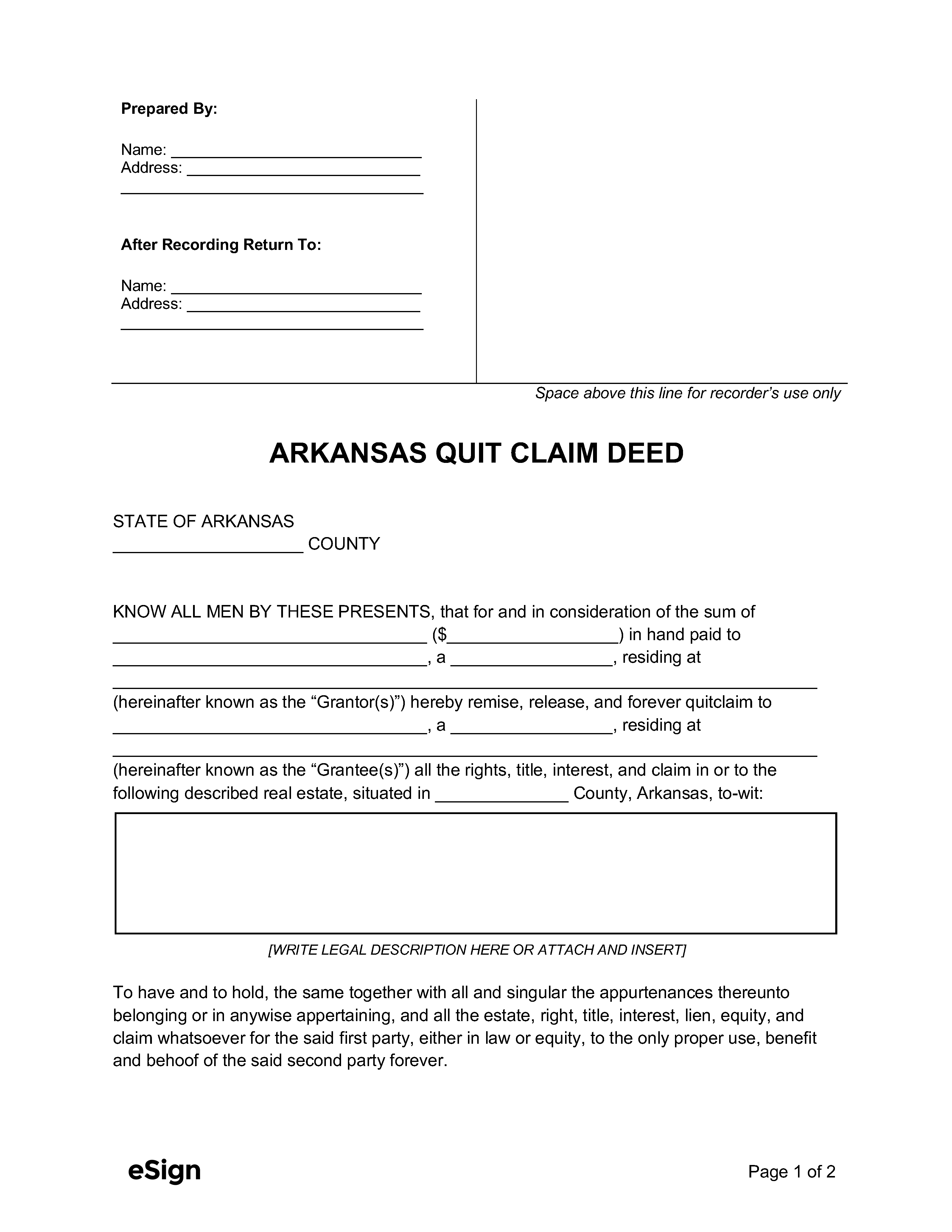

County recorders will only accept quit claim deeds that comply with the following formatting requirements[4]:

- Paper: 8.5″ x 11″

- Margins: 2.5″ margin on the top right of the first page, 0.5″ on the sides and bottom of all pages, and 2.5″ on the bottom of the last page

Arkansas Real Property Tax Affidavit of Compliance Form – The Department of Finance and Administration requires this form to be submitted with deeds to indicate whether tax has been paid or the property is exempt.[5]