Forms by County

Formatting Requirements

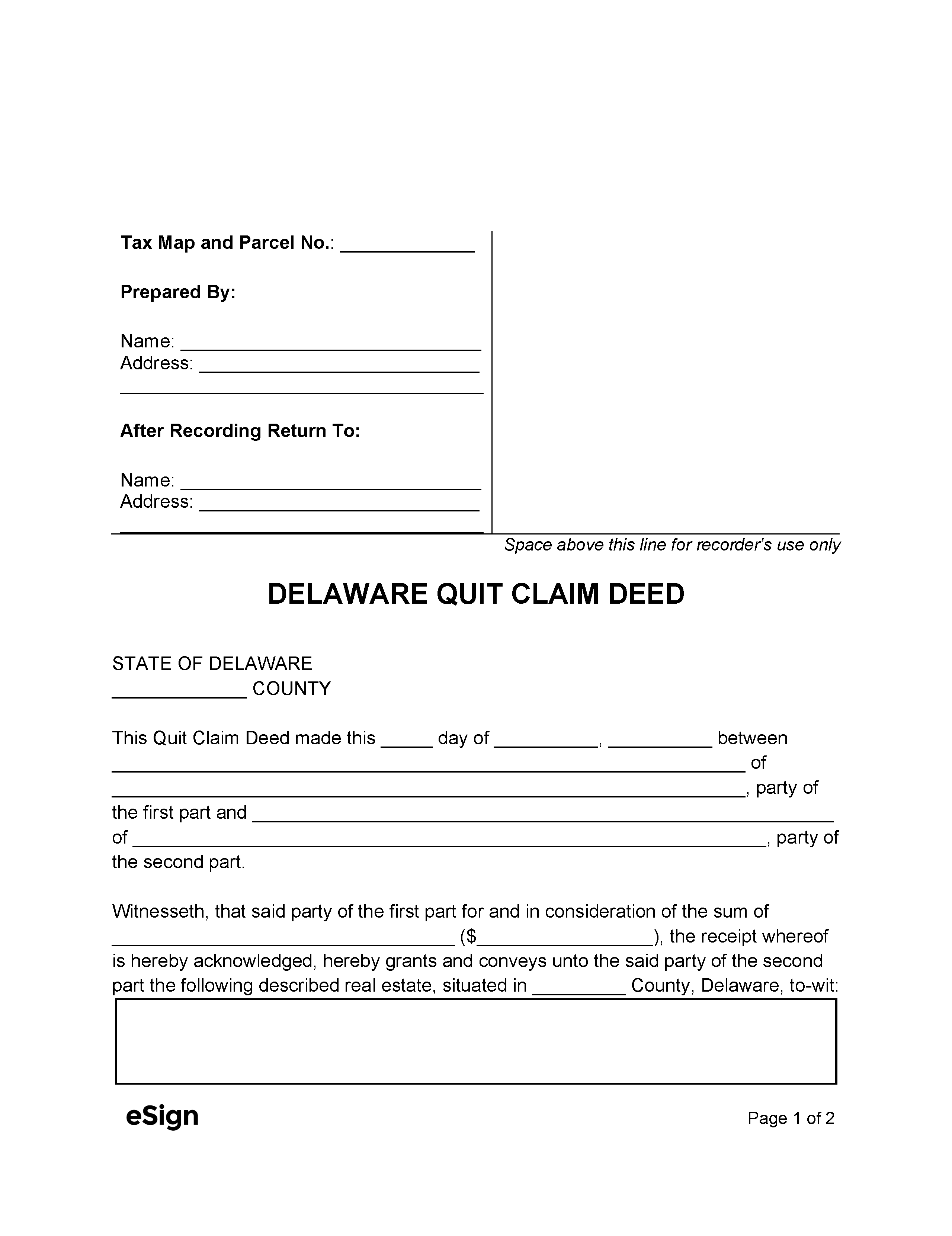

The recorder’s office in each county sets different formatting requirements for deeds and other documents affecting real property[4]:

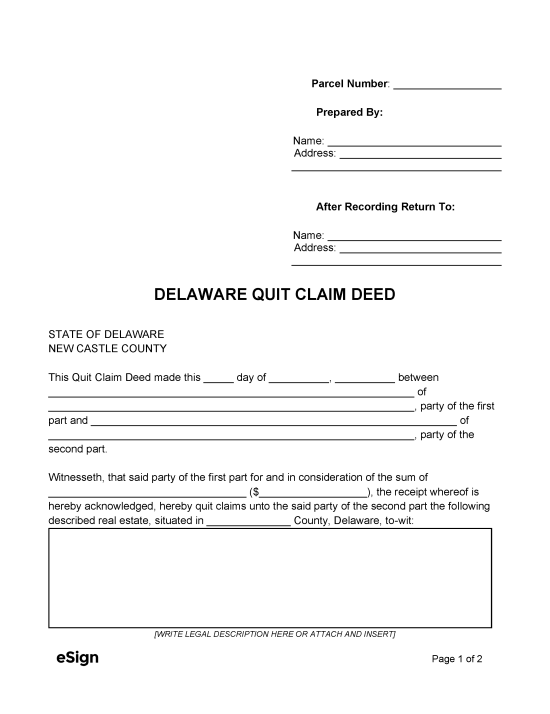

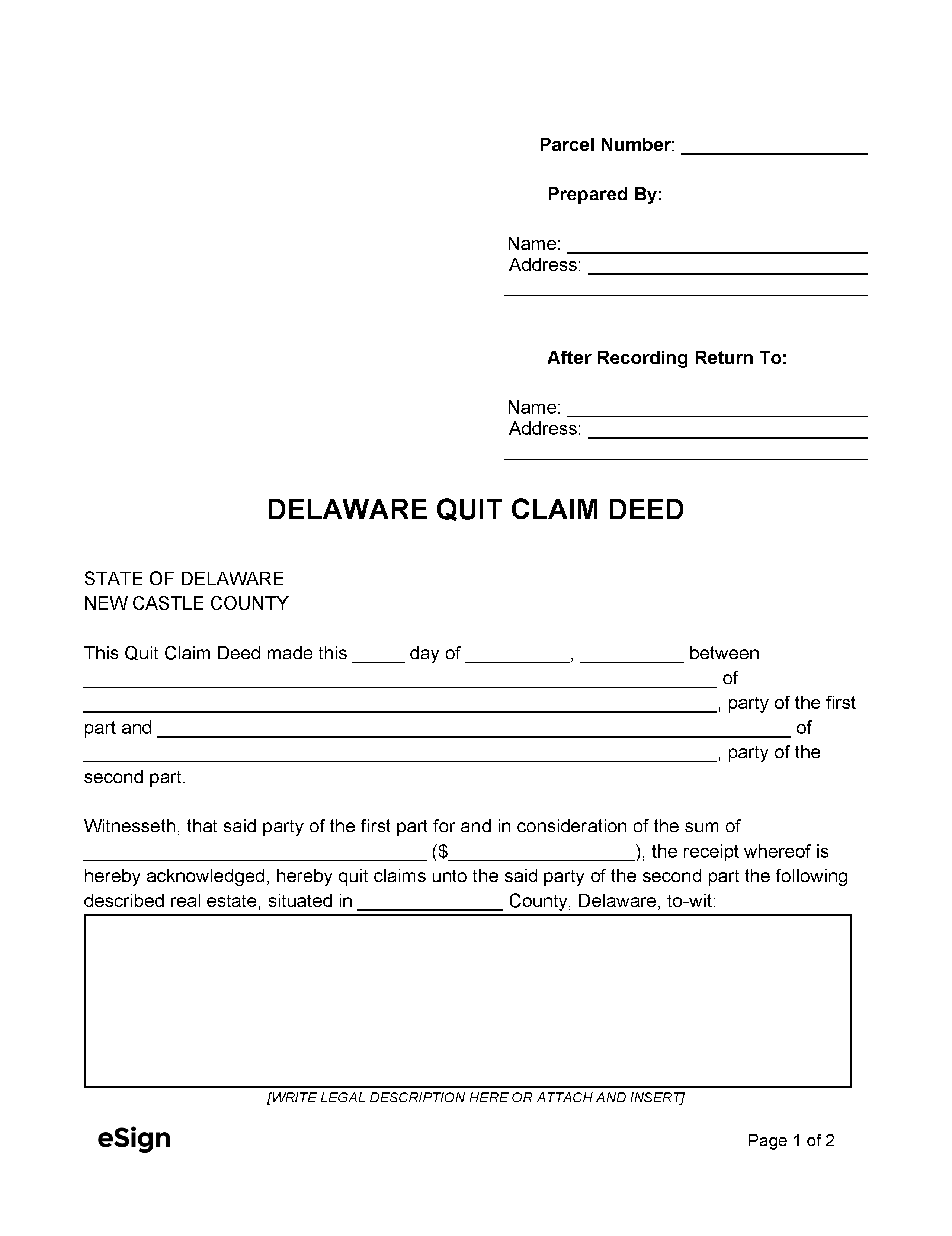

Quitclaim Deed (Preview)

Additional Forms

State-Wide

Form RTT-TAX – The Realty Transfer Tax Return form must be filed with any deed to calculate the transfer tax to be paid by the grantor and grantee.[5]

Form REW-EST – The Declaration of Estimated Income Tax form must be filed to determine whether income tax will be owed for the property transfer.

Form RTT-SCH – This affidavit is filed at the same time as a deed to claim credit as a First-time Home Buyer (FHB), if applicable.

County-Specific

Kent County New Property Owner Information Form – Deeds filed in Kent County must be accompanied by this form in order to update property records.

Kent County First Time Homebuyer Certification Form – If a deed is filed by a first-time homebuyer in Kent County, they must also complete and file this deed to prove it is their first property.

Sussex County Transfer Tax Affidavit – This Sussex County-specific affidavit is required when filing deeds to calculate tax owed on property transfers.

Sussex County FHB Affidavit – Must accompany a deed to be recorded in Sussex if the grantee is a first-time home buyer.

General Information Sheet – In Sussex County, a general information sheet must be printed out and filed at the same time as a deed.