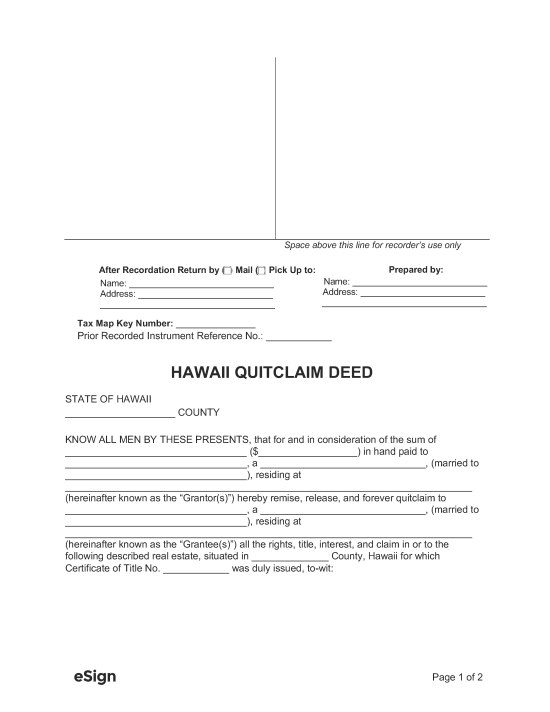

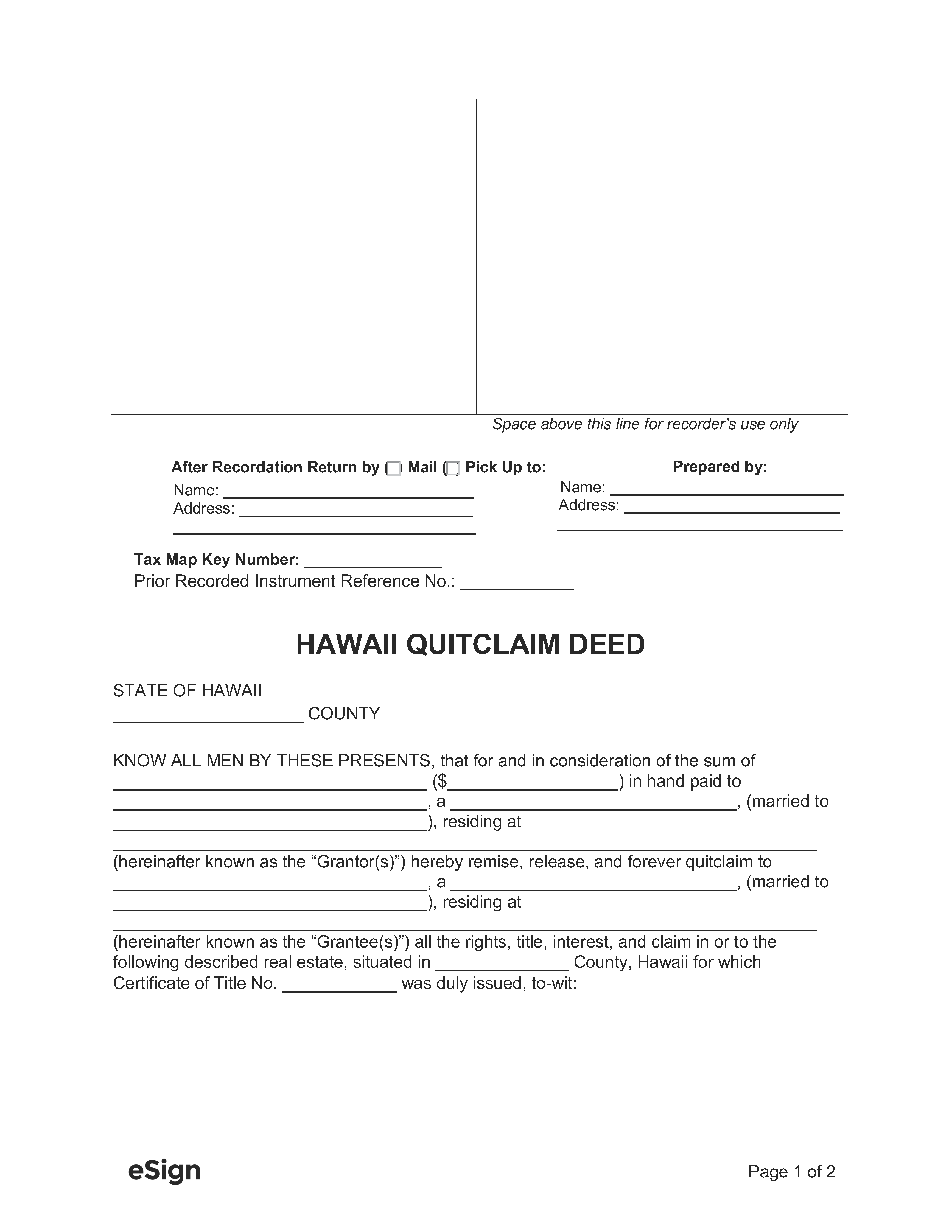

Recording Details

- Signing Requirements – The grantor’s signature must be notarized.[1]

- Where to Record – Hawaii Bureau of Conveyances[2]

- Recording fees – As of this writing, $36 (land court), $41 (regular system)[3]

Formatting Requirements

The Registrar of the Bureau of Conveyances may reject any deed that fails to conform to the following requirements[4]:

- Paper: Maximum 8.5″ x 11″

- Margins: 3.5″ margin at the top of the first page for recording information; the following 1″ is for the return mailing address, which must start 1.5″ from the left margin and not exceed 3.5″ per line

Form P-64A – This Conveyance Tax Certificate must be completed and filed with a deed unless exempt in accordance with § 247-3.[5]

Form P-64B – An Exemption From Conveyance Tax document must be recorded with a deed if the grantor is exempt from the imposed tax in accordance with § 247-3.