Deed Requirements

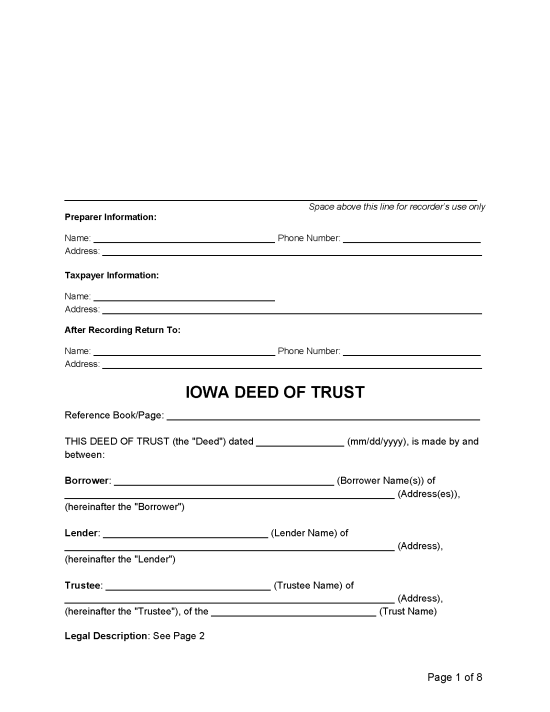

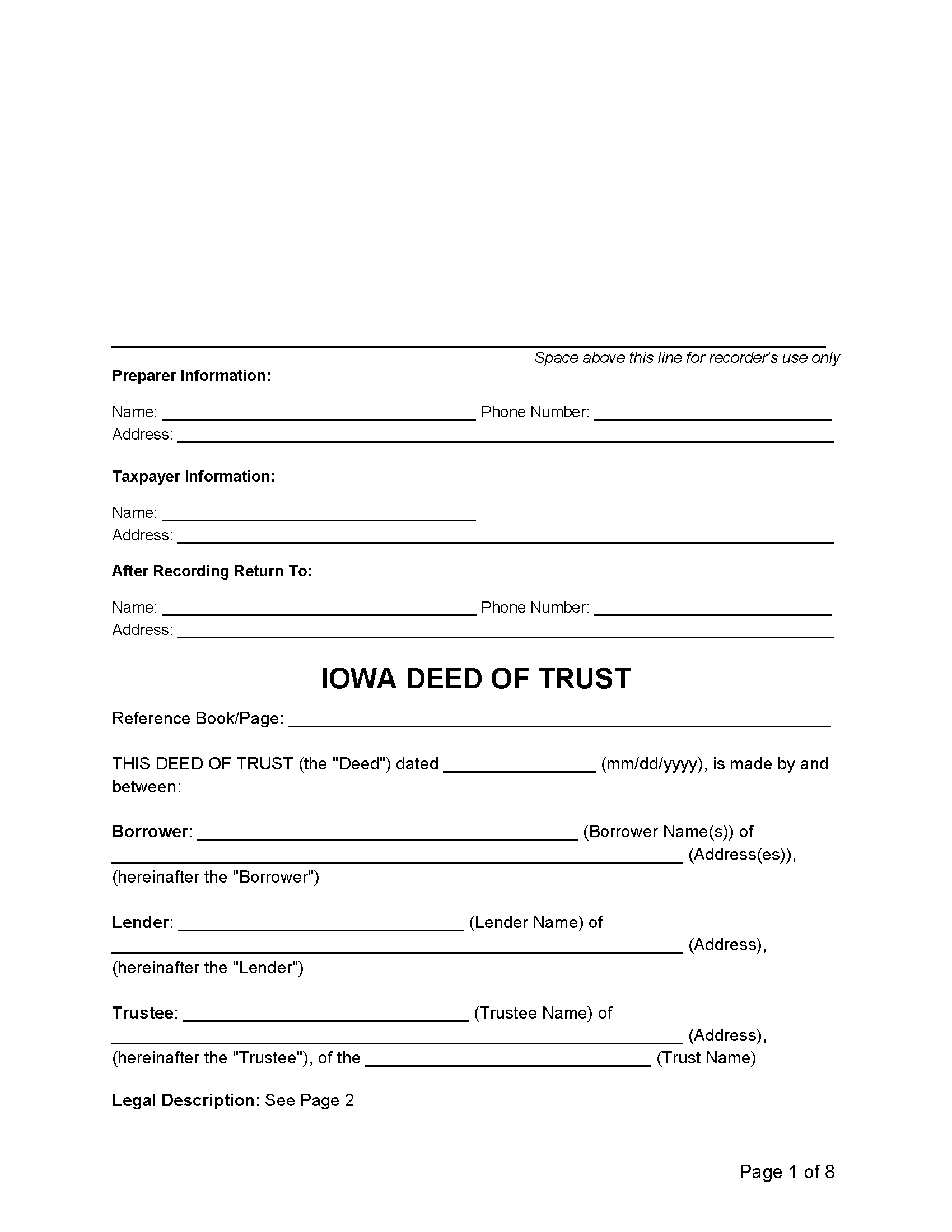

Deeds must be signed by the borrower, notarized, and filed with the County Recorder’s Office.[1] The document must be formatted as follows before recording[2]:

- 3″ top margin on first page, 0.75″ margins on all other sides

- 8pt for pre-printed text, 10pt for inputted text

- White paper, 20lb

- Black or blue ink for signatures

Deed of Trust or Mortgage

Under Iowa statutes, both deeds of trust and mortgages can be used to secure real estate loans. However, unlike in some other states that allow deeds of trust, Iowa does not recognize “power of sale” clauses as valid. Instead, if a default occurs, the parties must agree to a voluntary nonjudicial foreclosure if they seek to avoid court proceedings.[3]