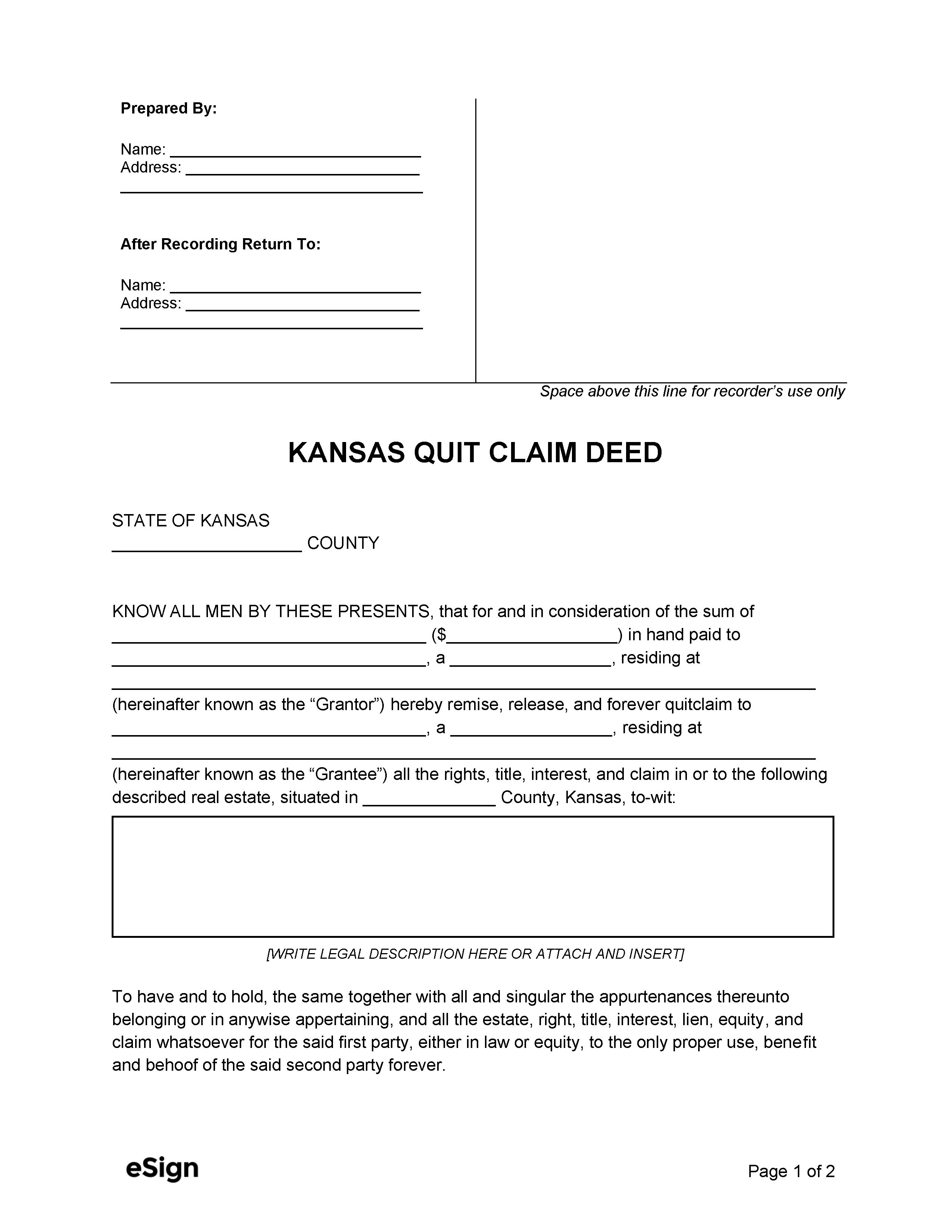

Recording Details

- Signing Requirements – The grantor’s signature must be acknowledged by a notary public or other authorized individual.[1]

- Where to Record – Register of Deeds[2]

- Recording fees – $21 for the first page, $17 for each additional page, as of this writing[3]

Formatting Requirements

State statutes require that deed instruments be recorded on paper no larger than 8.5″ x 14″.[4] Each county may have additional formatting requirements, such as specific margins and font size.

Real Estate Sales Validation Questionnaire – Unless exempt, a deed must be accompanied by this questionnaire when recording with the register of deeds.[5]