Recording Requirements

- The grantor must have the document notarized.[1]

- The deed must be printed on paper sized between 8.5″ x 11″ and 8.5″ x 14″.[2]

- The font must be at least 10pt.

- Margins:

- 1.75″ top margin on the first page

- 1″ top margin on each other page

- 0.75″ on the sides of all pages

- 1.5″ margin on the bottom section of the last page

The deed will be recorded at the Registry of Deeds in the county where the property is located.[3] At the time of this writing, the fee is $22 for the first page and $2 for every other page.[4]

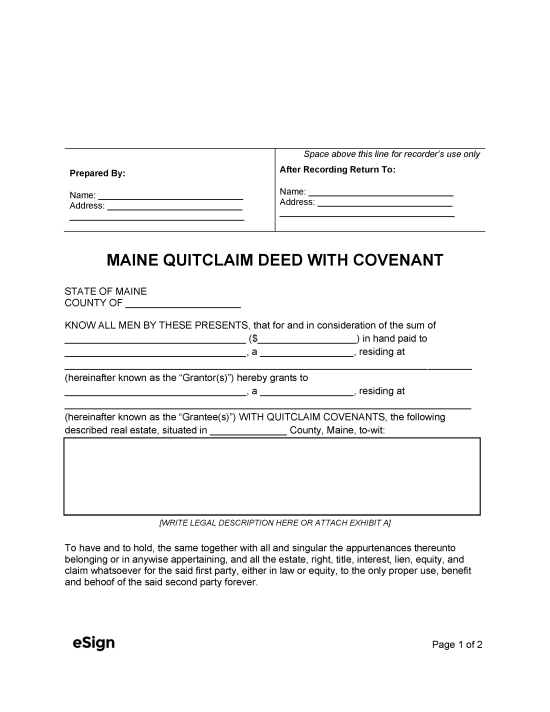

Quitclaim Deed With Covenant (Preview)

Additional Forms

Real Estate Transfer Tax Declaration (Form RETTD) (Online|PDF) – This must be filed with the deed unless the property is exempt from transfer tax.[5]

Sources

- § 203

- MRDOA Recording Requirements (download only)

- § 201

- § 751(1), Fee Schedule

- § 4641-D