How to Format

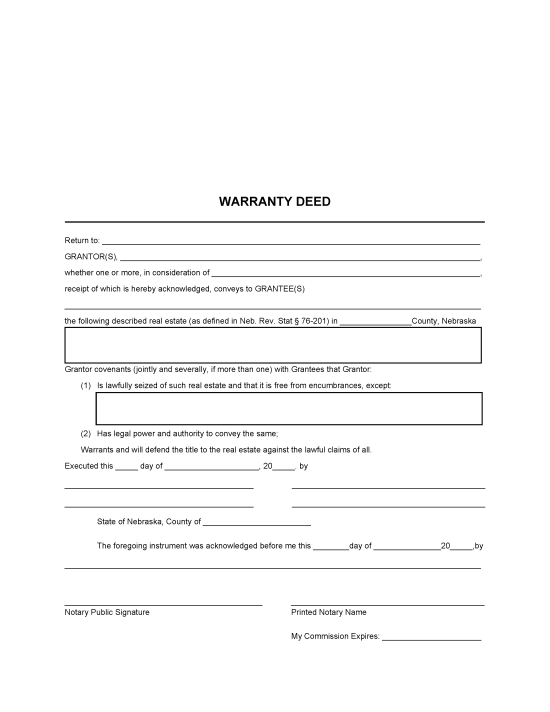

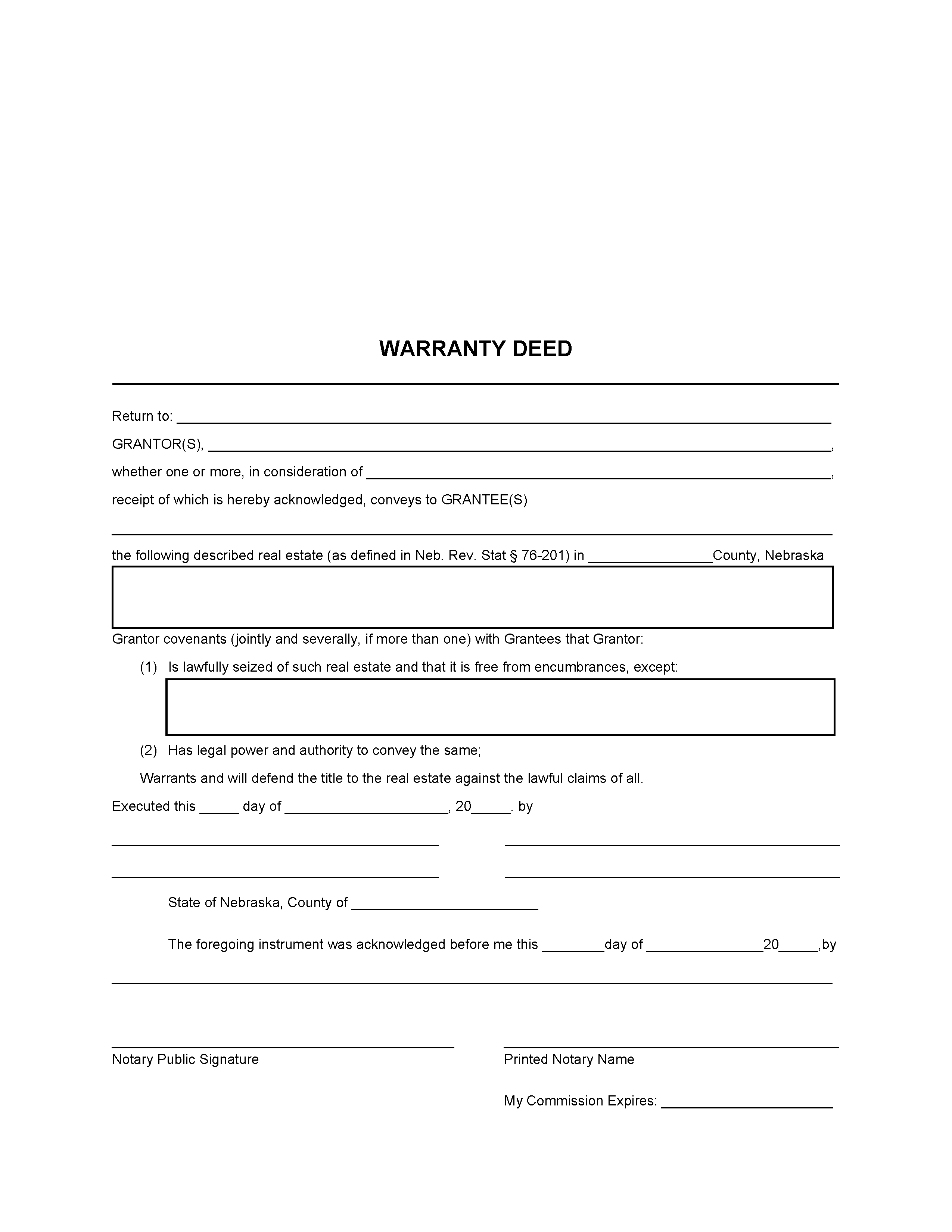

Layout

- The deed must be on paper that is not less than 8.5 by 11 inches and no more than 8.5 by 14 inches.

- The ink must be black and the font must be at least 8pt.

- There must be free space at the top of the first page that is 3 inches by 8.5 inches. Every other margin must be 1 inch.[1]

Signatures

Notarization of the grantor’s signature is required.[2]

Recording

When the grantor and notary public have signed the warranty deed, it must be taken to the County Register of Deeds for recording.[3] The fee to record the deed is $10 for the first page and $6 for every extra page.[4]

Certificate of Exemption – Submitted with Form 521 if the transaction is exempt from documentary stamp tax.[5]