Recording and Resources

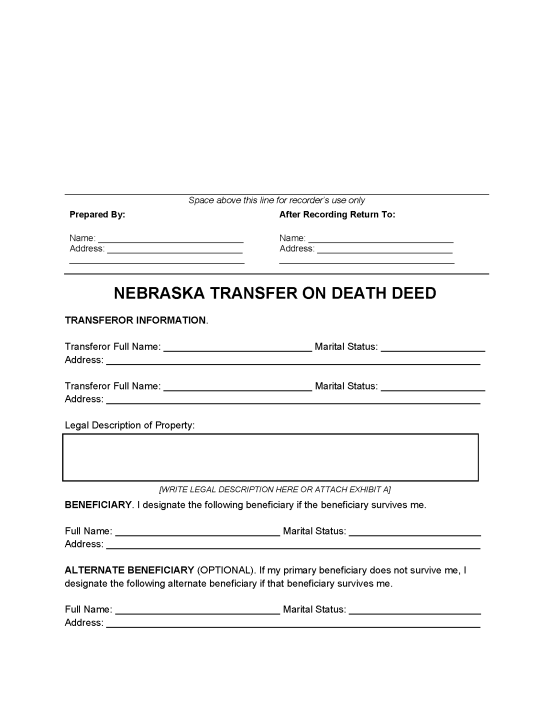

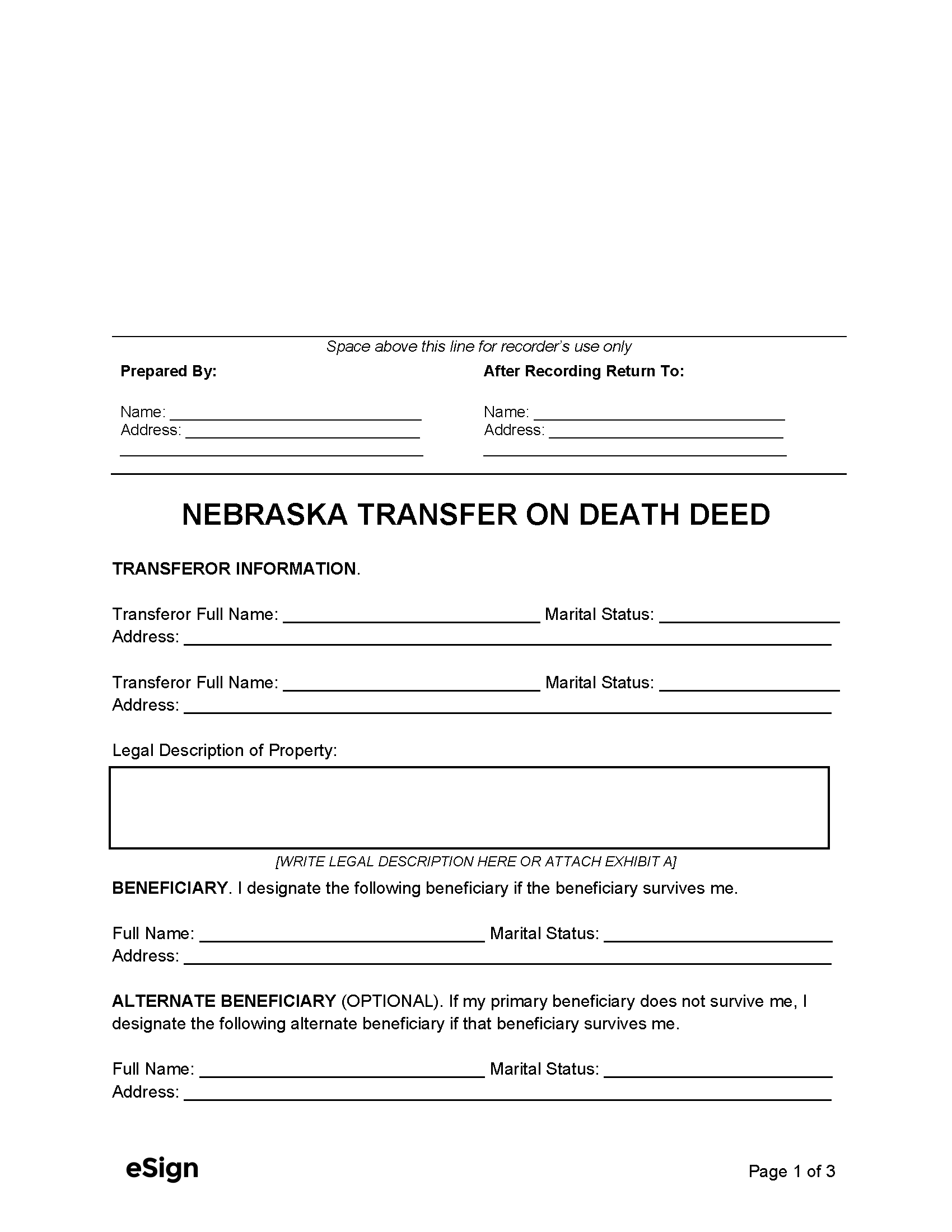

Formatting

- Paper: 8.5″ x 11″ – 8.5″ x 14″

- Margins: 3″ top of first page, 1″ all other sides and pages

- Font: Min. 8pt, black or blue ink[1]

Signing and Recording

- Signing Requirements: Notary public and two disinterested witnesses[2]

- Where to Record: County Register of Deeds[3]

- Recording fees: $10 first page + $6 per additional page (as of this writing)[4]

Resources

Additional Forms

- Real Estate Transfer Statement (Form 521): After the transferor’s death, the beneficiary must provide this form along with the death certificate to the Register of Deeds to transfer the property into their name.