Formatting Requirements

Deeds require the grantor’s notarized signature before recording.[1] Once signed, the deed must be recorded with the County Recorder of the transferred property’s jurisdiction.[2]

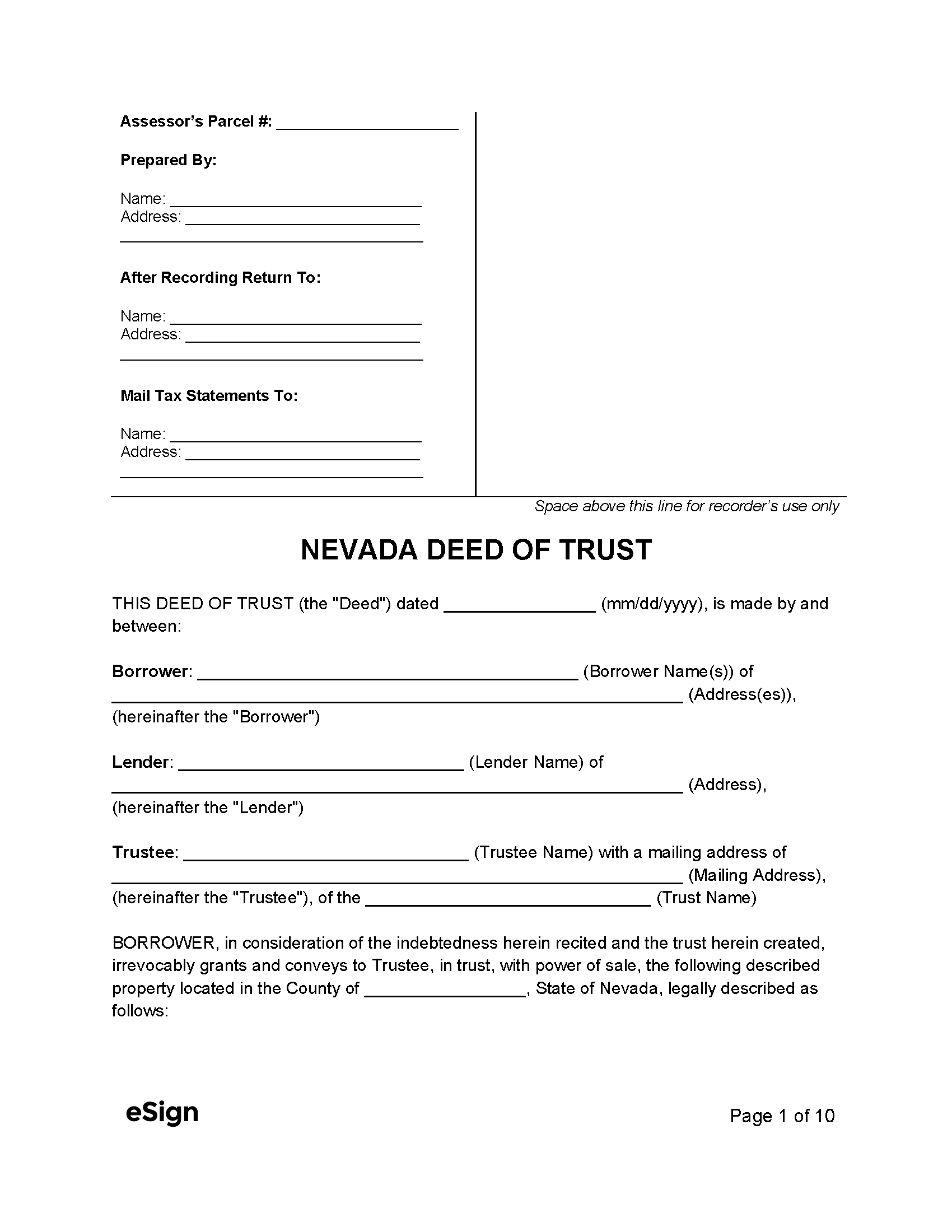

Documents will be accepted for recording only if they meet the following guidelines[3]:

- White paper, 8.5″ x 11″

- Black ink, 10pt font size min.

- 1″ margins and 3″ x 3″ space on the first page’s top right corner