Recording and Resources

Formatting

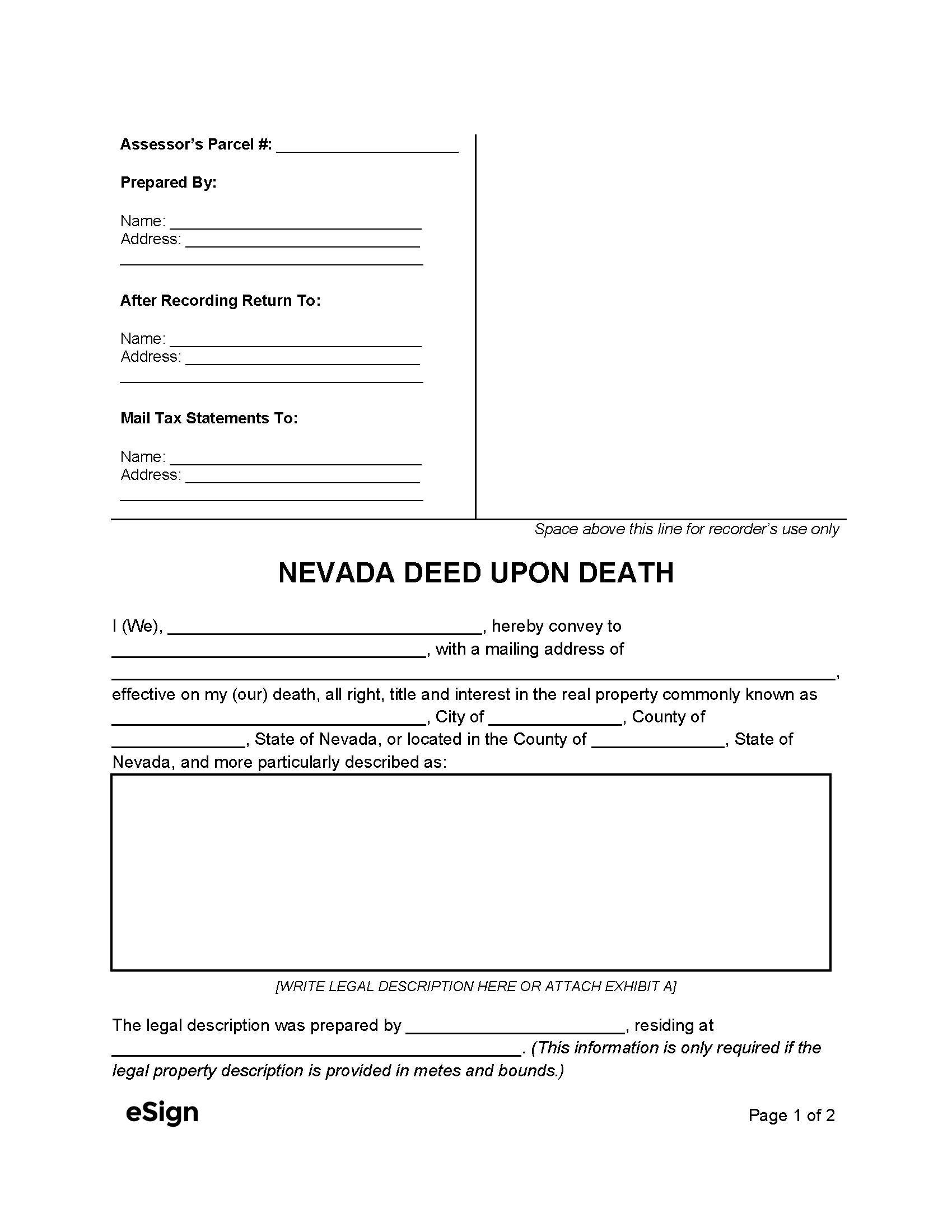

- Paper: 8.5″ x 11″

- Margins: 1″ (3″ x 3″ space on top-right corner of first page required)

- Font: 10pt min.[1]

Signing and Recording

- Signing Requirements: Notarization[2]

- Where to Record: County Recorder[3]

- Recording fees: Varies (approx. $42) (as of this writing)[4]

Resources