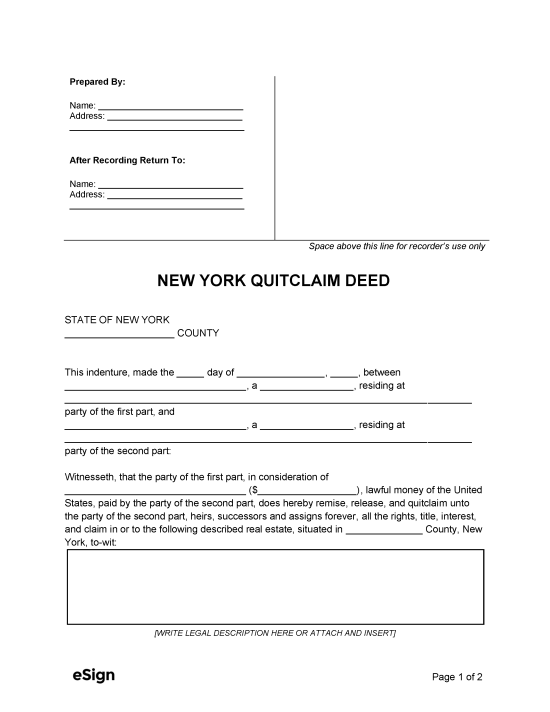

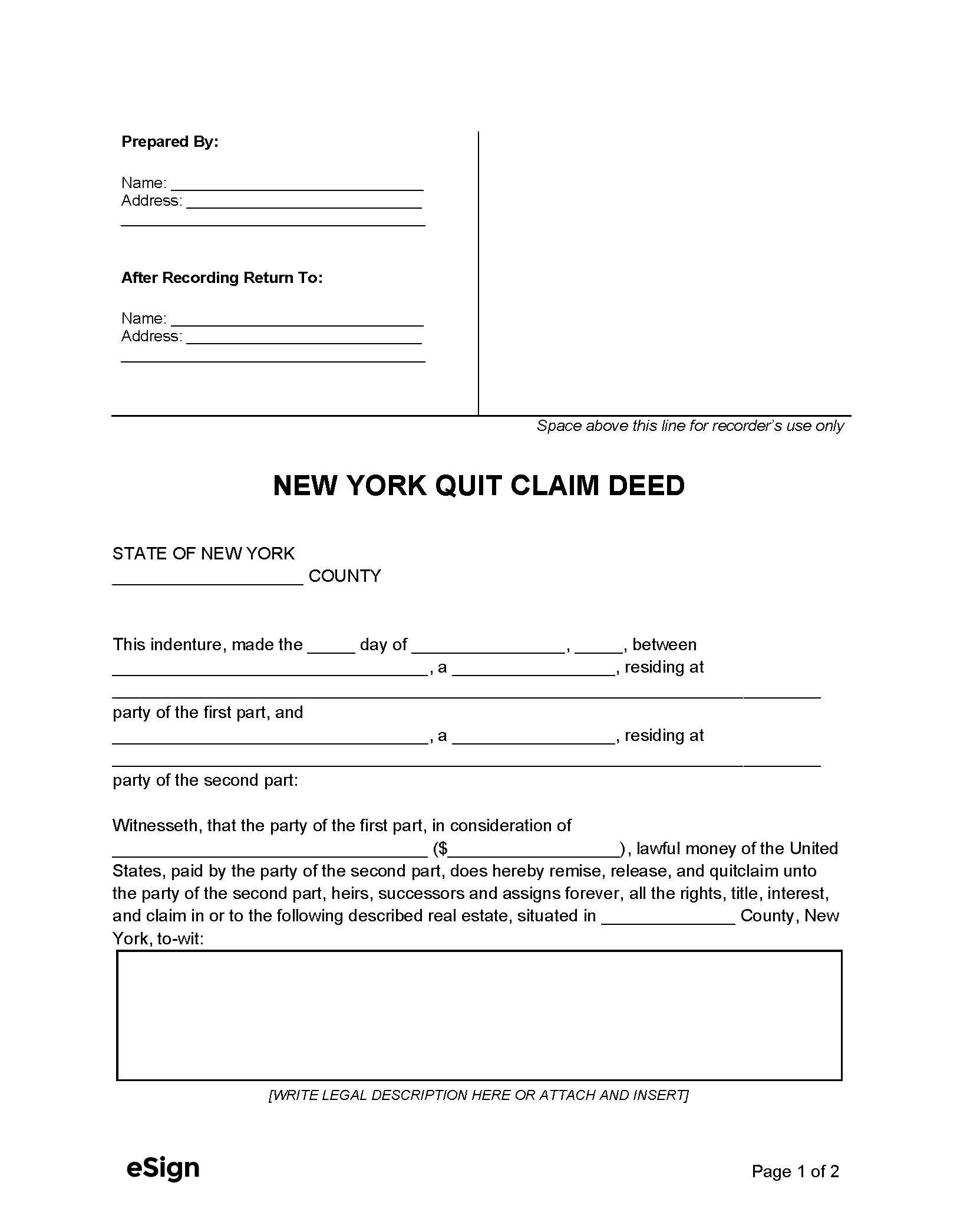

Recording Details

- Signing Requirements – The grantor must sign the document and have their signature notarized.[1]

- Where to Record – County Clerk or City Register (Outside NYC – Inside NYC)[2]

- Deeds may be filed online in Staten Island and the other NYC boroughs.

- Residents of Staten Island who wish to file in person must go to the Richmond County Clerk’s office.

- Recording Fees: Recording fees vary by county.

Formatting Requirements

There is no state-wide standardized formatting. Individuals can contact their County Clerk or City Register for specific formatting requirements.

Required Forms

Inside New York City:

- Form TP-584-NYC – A transfer tax return that must be filed with the deed.

- RP-5217NYC – Used to document real property transfers in NYC (see instructions).

Outside New York City:

- Form TP-584 – A form required to submit a property transfer tax return.

- RP-5217-PDF – Records the real estate transfer between individuals (see instructions).

- Form IT-2663 – Must be completed by grantors who reside outside of New York State to report personal income tax on the gain from the sale of property.

Before filing, individuals should check with their local office to see if additional forms are required.