By Type (3)

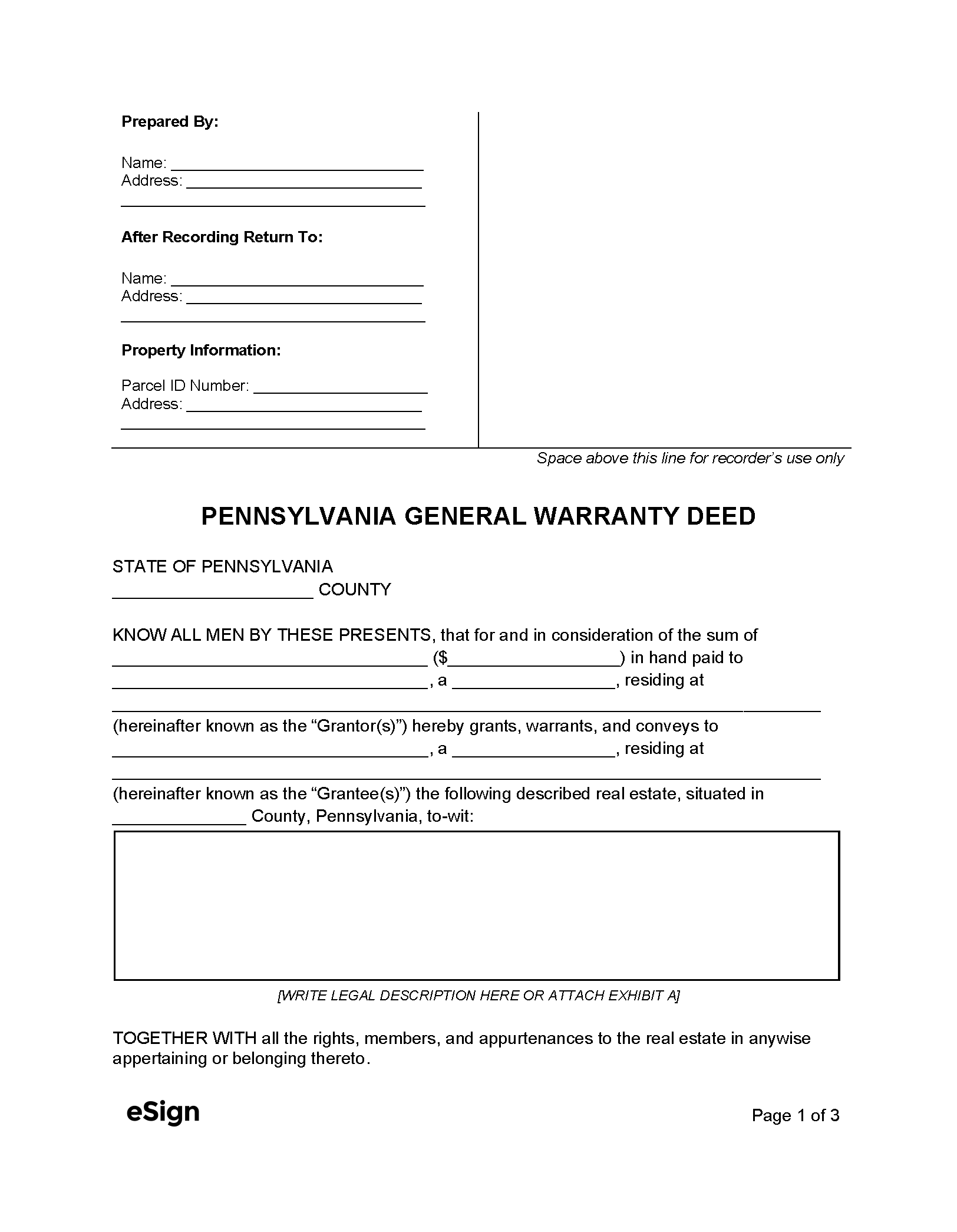

General Warranty Deed – Conveys ownership while providing the grantee full protection against title defects. General Warranty Deed – Conveys ownership while providing the grantee full protection against title defects.

|

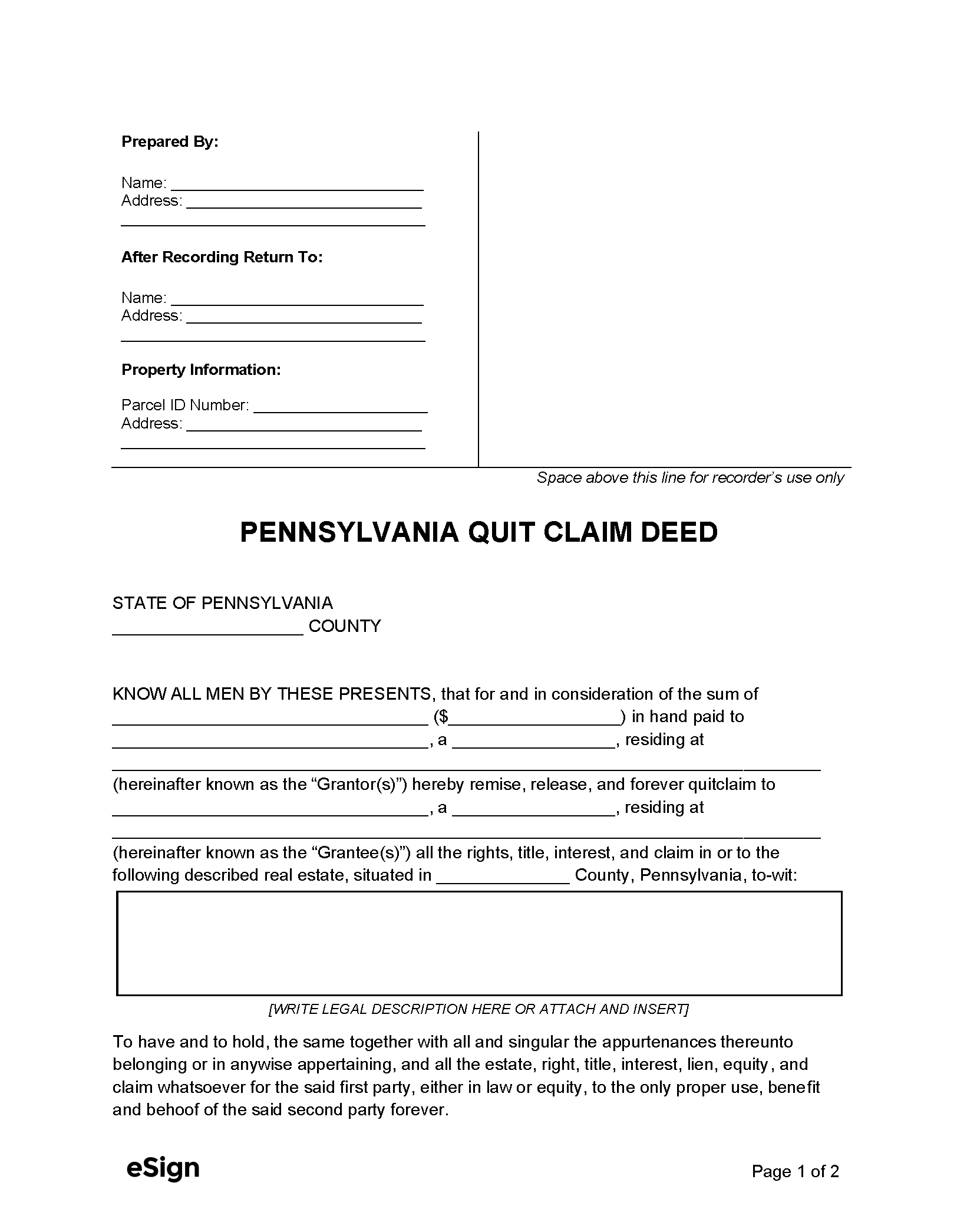

Quit Claim Deed – Transfers a property title without guaranteeing its quality (no title warranties provided). Quit Claim Deed – Transfers a property title without guaranteeing its quality (no title warranties provided).

|

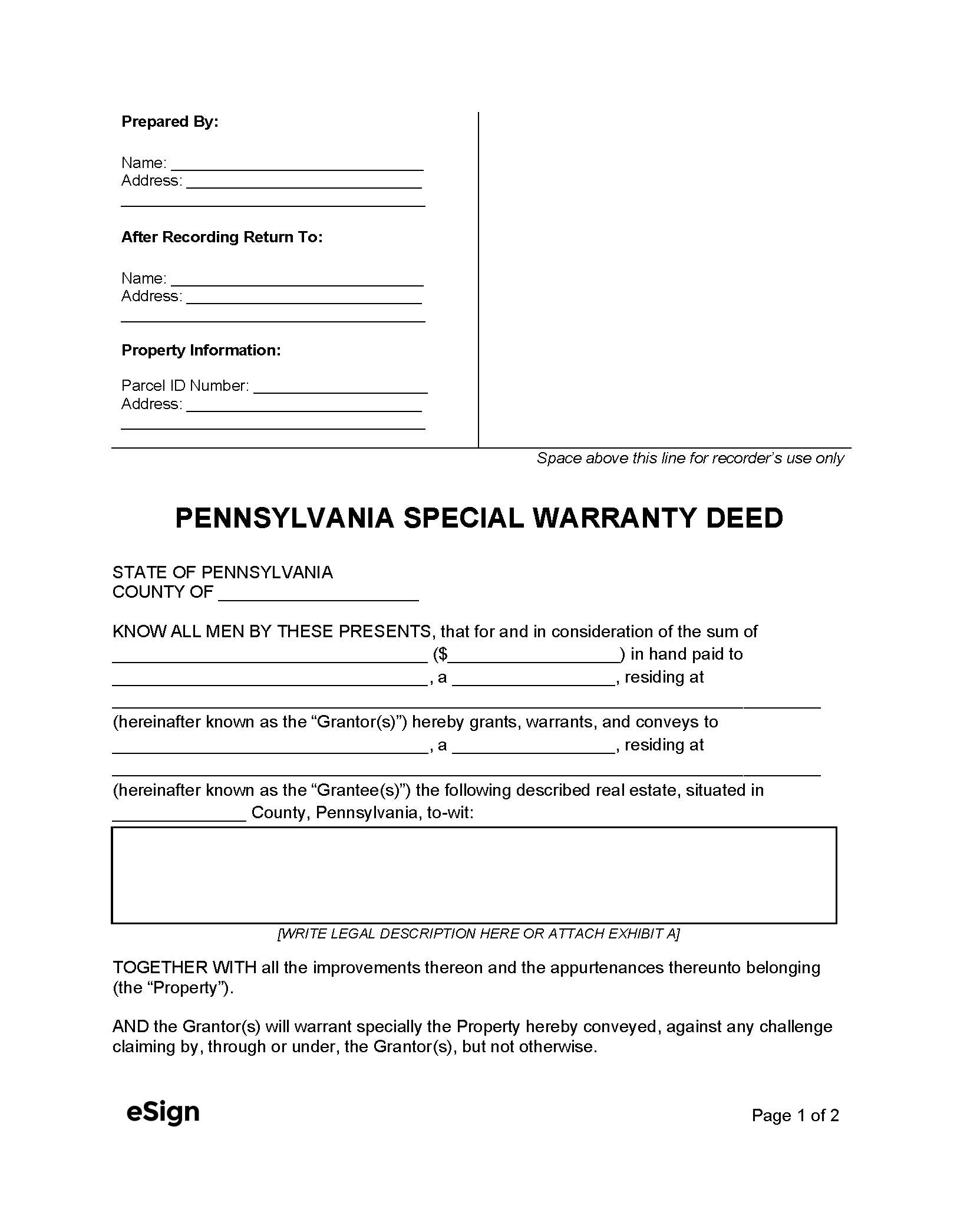

Special Warranty Deed – Offers limited protection, only covering title defects that occurred during the current grantor’s possession. Special Warranty Deed – Offers limited protection, only covering title defects that occurred during the current grantor’s possession.

|

Formatting

Pennsylvania law doesn’t outline deed formatting requirements, but counties typically follow these PRIA standards[1]:

Paper – White, sized 8.5″ by 11″ (8.5″ by 14″ is permitted)

Margins – 3″ top-right margin on the first page, 1″ margins elsewhere

Font – Black text, at least 10-point font

Note: Different formatting requirements may be imposed locally by the County Recorder.

Recording

Signing Requirements – State law requires each deed to be signed by the grantor and include a notarial acknowledgment.[2]

Where to Record – The office of the Recorder of Deeds is responsible for recording deeds.[3]

Cost – The statutory recording fee is $11.50, although charges vary by county.[4] Filers can use a fee calculator to determine the exact fees.

Additional Forms

Form REV-183 (Realty Transfer Tax Statement of Value) – Must be recorded with the deed when the full consideration is not specified or a transfer tax exemption is claimed.[5]

Coal Severance Notice – The grantor must include this notice in the deed if there was a coal severance below the premises.[6]

Bituminous Coal Notice – Must be included in the deed and signed by each grantee if all of the following are true[7]:

- The premises contains bituminous coal

- The bituminous coal will be taxed separately

- The deed doesn’t certify whether the structure is being supported by bituminous coal