Formatting Requirements

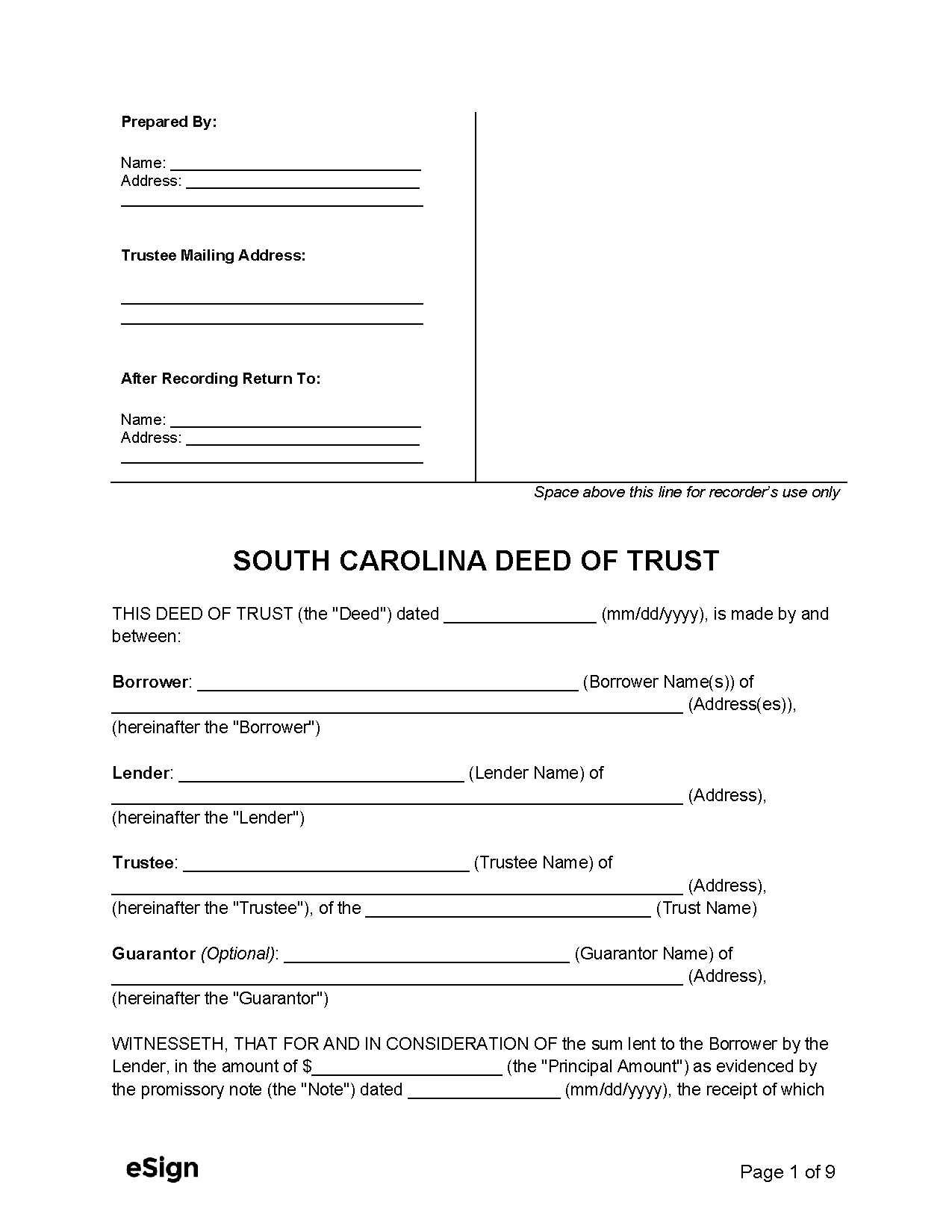

Trust deeds will be filed with the Register of Deeds or Clerk of Court in the county where the property is located.[1] Formatting requirements are set at the county level. Deeds of trust in South Carolina must be witnessed and notarized; the notary may act as a witness.[2]