Recording Details

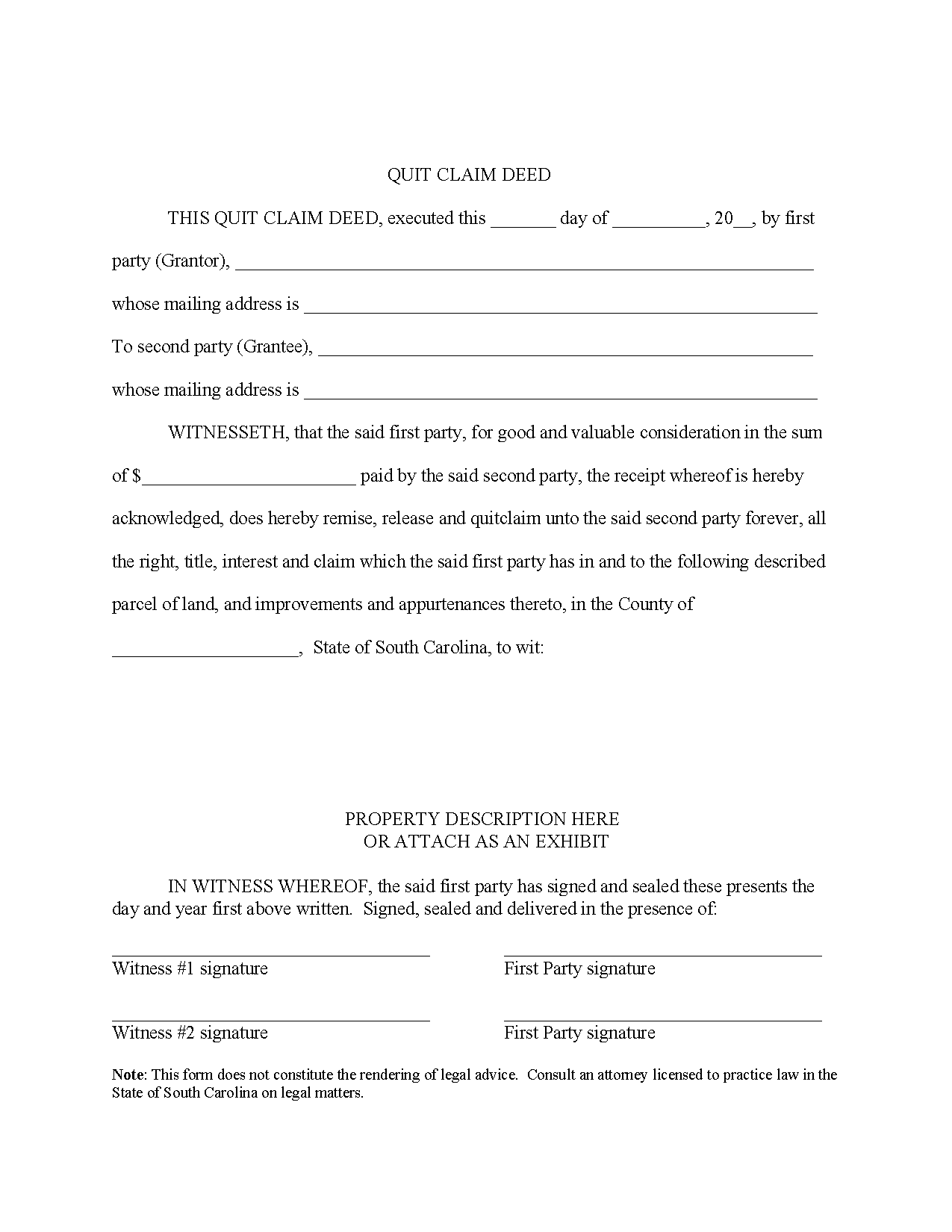

- Signing Requirements – Signatures must be acknowledged before a notary public in the presence of two witnesses, one of which can be the notary.[1]

- Where to Record – Register of Deeds/Clerk of Court[2]

- Recording fees – $15 (as of this writing)[3]

Formatting Requirements

The South Carolina Code of Laws does not establish formatting requirements for recording deeds, but each county’s register of deeds sets its own guidelines, often requiring specific paper size, font, margins, etc.

Affidavit for Taxable or Exempt Transfers – This affidavit must be filed with the register of deeds or court clerk when recording a deed to confirm the value of the property.[4]