Formatting Requirements

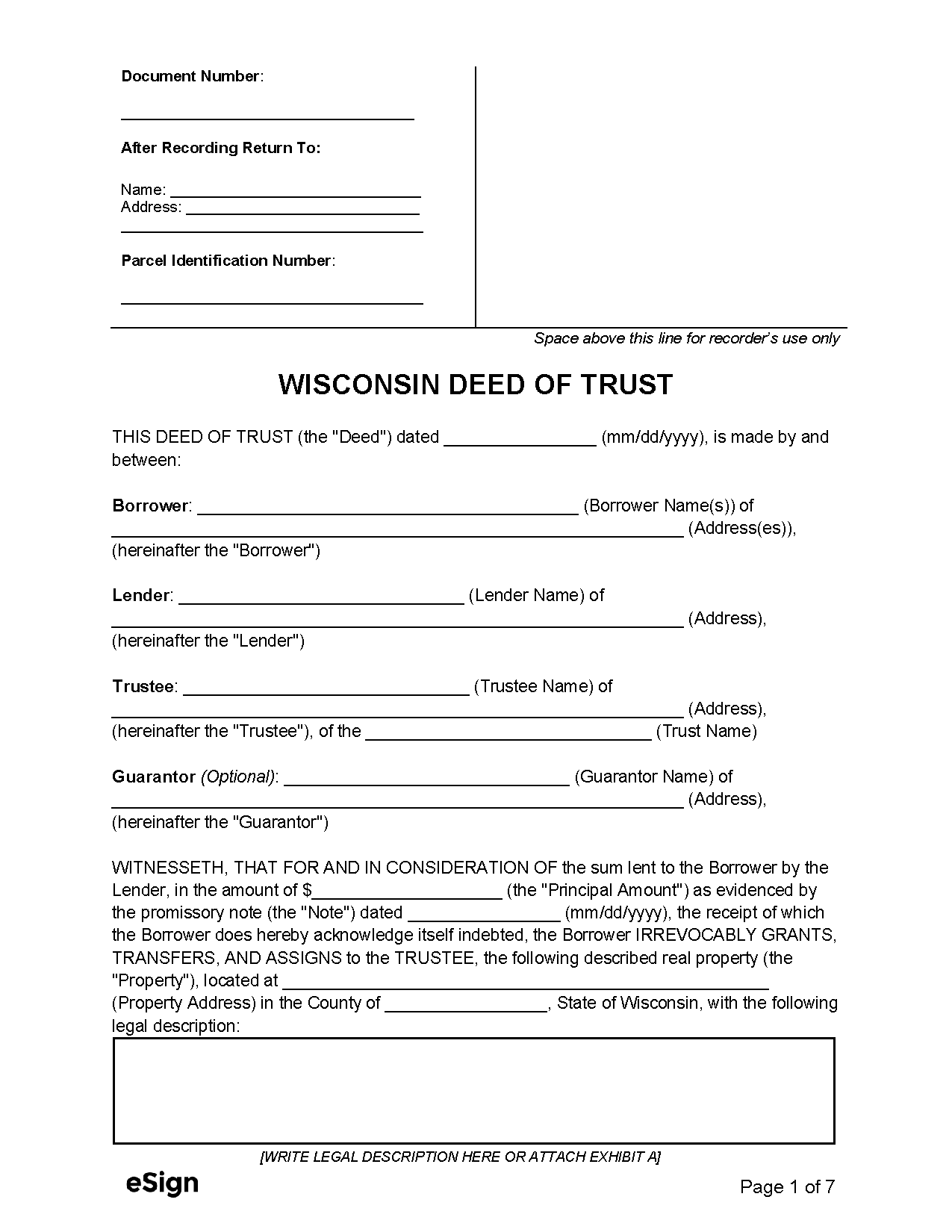

Trust deeds must be filed with the local Register of Deeds.[1] A notary public must sign the document, which must adhere to the following formatting standards[2]:

- 20lb white paper, 8.5″ x 11″ or 8.5″ x 14″

- Black, blue, or red ink

- 0.5″ top margin, 0.25″ on the sides, and bottom margin

- Have the required spaces left blank for recording information

Mortgage vs Deed of Trust

A deed of trust is comparable to a mortgage in that both secure the repayment of a home loan.

A deed of trust is made between a borrower, a lender, and a trustee, who holds the title. If a default occurs, the trustee can foreclose on the property to repay the lender.

A mortgage only involves the borrower and lender, and the lender is granted an interest in the property. In the event of a mortgage default, the borrower or sheriff would convey the property to a successful bidder or the lender.