Financial Advisor vs. Financial Consultant

“Financial advisor” and “financial consultant” refer to professionals who assist others in making informed decisions about their money. While there is no official difference between the two titles, some consulting firms distinguish one from the other based on the worker’s duties and length of time spent with clients.

- Financial advisors typically strategize methods to help companies achieve long-term financial goals.

- Financial consultants focus more on personalized, short-term solutions to build wealth.

Licensed Consultants

Financial consultants without proper certification can still help clients organize their finances and build wealth. However, they are not qualified to sell stocks, bonds, mutual funds, or other investment products. Only those consultants who have taken a qualification exam from the Financial Industry Regulatory Authority and have obtained a license (such as a Series 7) are able to sell investment products.[1]

Other higher-level consultants may hold a Chartered Financial Consultant (ChFC) or Certified Financial Planner (CFP) designation offered by other institutions.[2]

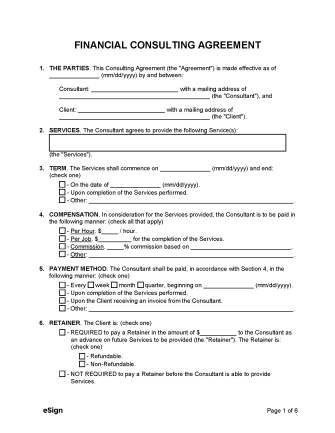

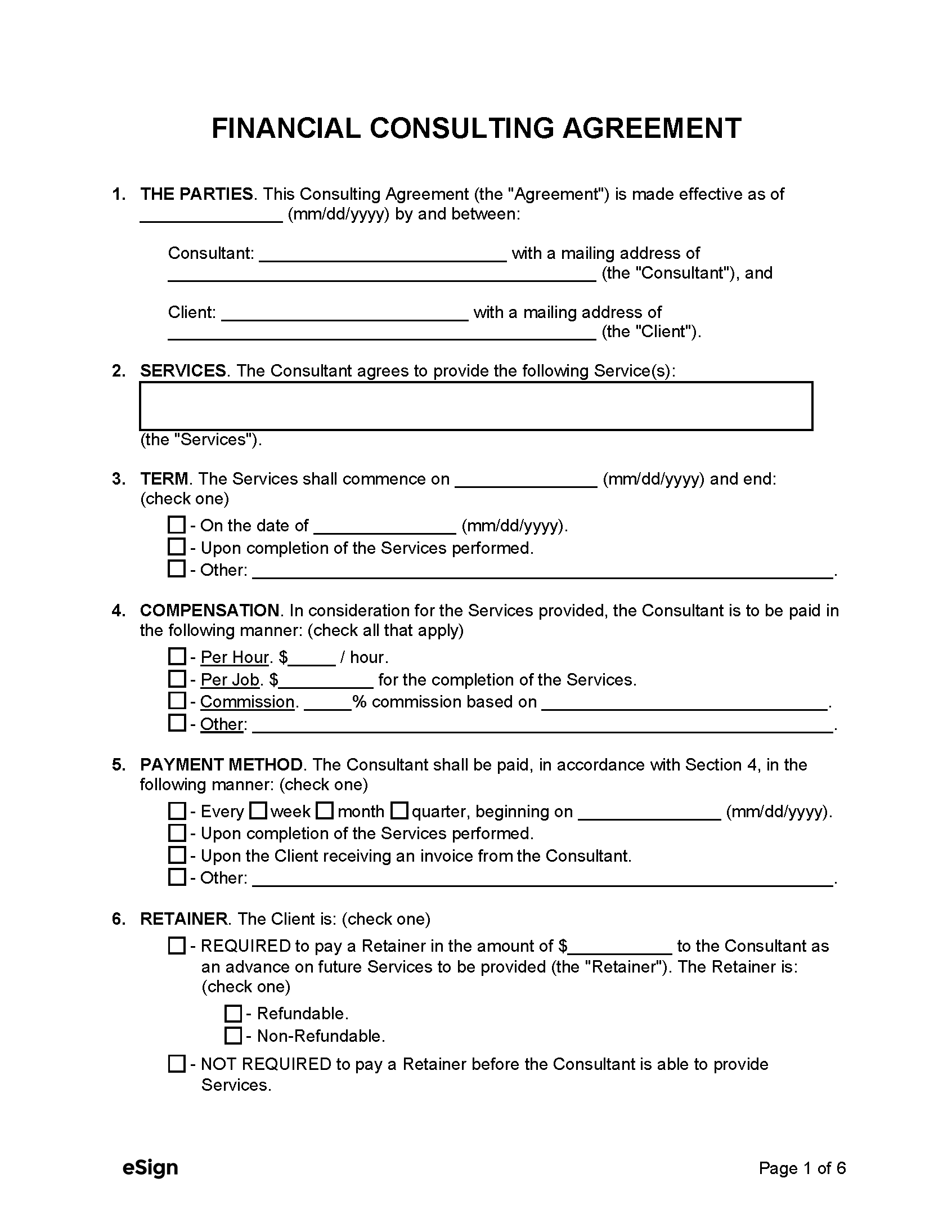

Sample

Download: PDF, Word (.docx), OpenDocument

FINANCIAL CONSULTANT AGREEMENT

1. THE PARTIES. This Financial Consultant Agreement (“Agreement”) is made on [MM/DD/YYYY] by and between:

Consultant: [CONSULTANT’S NAME], with a mailing address of [CONSULTANT’S ADDRESS] (“Consultant”), and

Client: [CLIENT’S NAME], with a mailing address of [CLIENT’S ADDRESS] (“Client”).

2. SERVICES. The Consultant agrees to provide the Client with the following services: [HR SERVICES TO BE PROVIDED] (“Services”).

3. TERM. The Services shall commence on [MM/DD/YYYY] and end upon [END DATE OR OTHER TERMINATION EVENT].

4. PAYMENT. The Client agrees to pay the Consultant $[AMOUNT] per [PAYMENT BASIS (E.G., HOUR)] for the Services provided. Payment shall be made by [PAYMENT METHOD].

5. EXPENSES. The Client shall be responsible for all expenses related to the Services, except for the following: [EXPENSES TO BE PAID BY CONSULTANT].

6. INDEPENDENT CONTRACTOR STATUS. The Consultant is an independent contractor, and neither the Consultant nor their employees or contract personnel are or shall be deemed the Client’s employees.

7. NON-DISCLOSURE. The Consultant agrees not to disclose or misuse the Client’s proprietary or confidential information without prior written consent, except as needed to perform the Services, recognizing that such actions would cause irreparable harm to the Client.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first written above.

Consultant’s Signature: _____________________

Print Name: [CONSULTANT’S NAME]

Client’s Signature: _____________________

Print Name: [CLIENT’S NAME]