By Profession (21)

By Type (3)

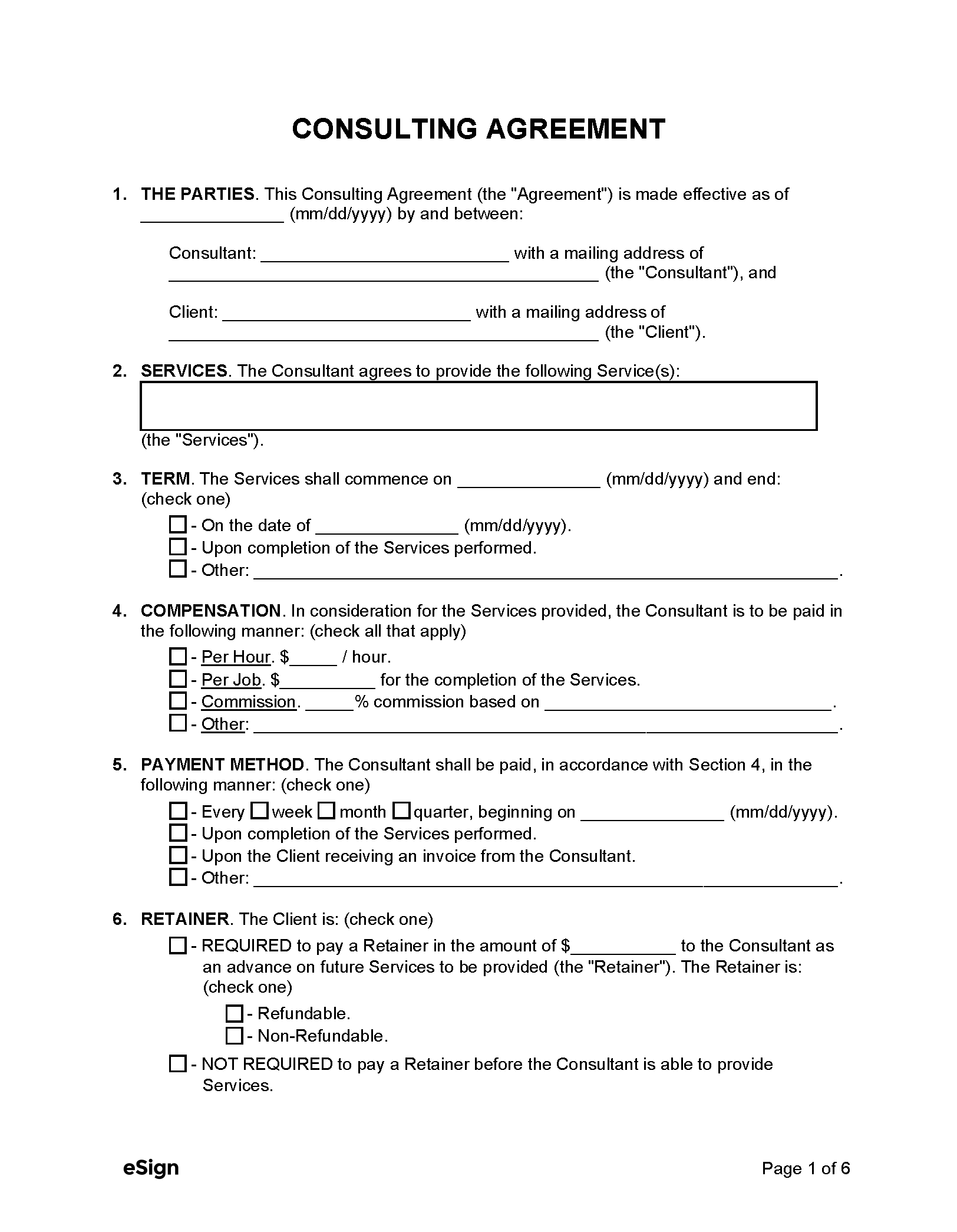

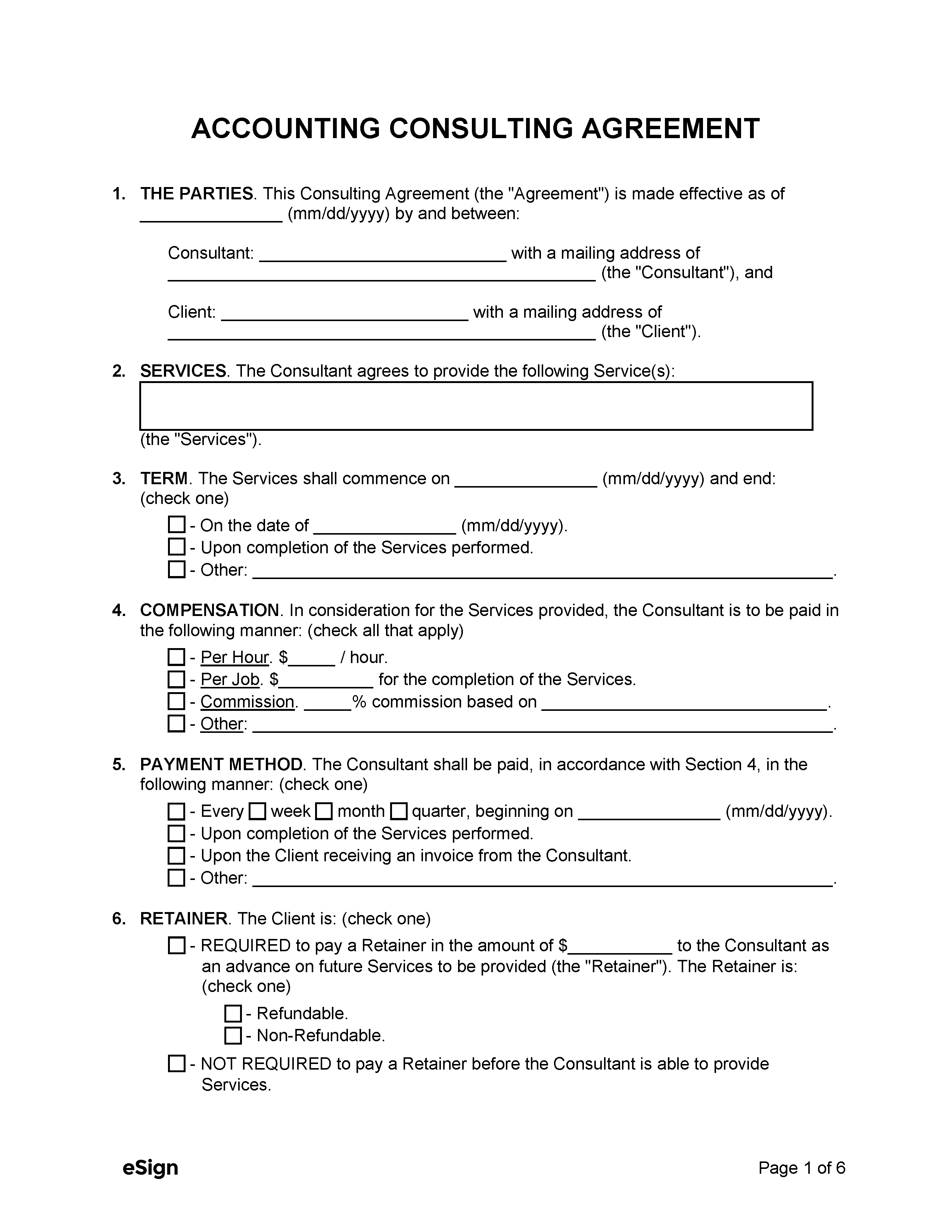

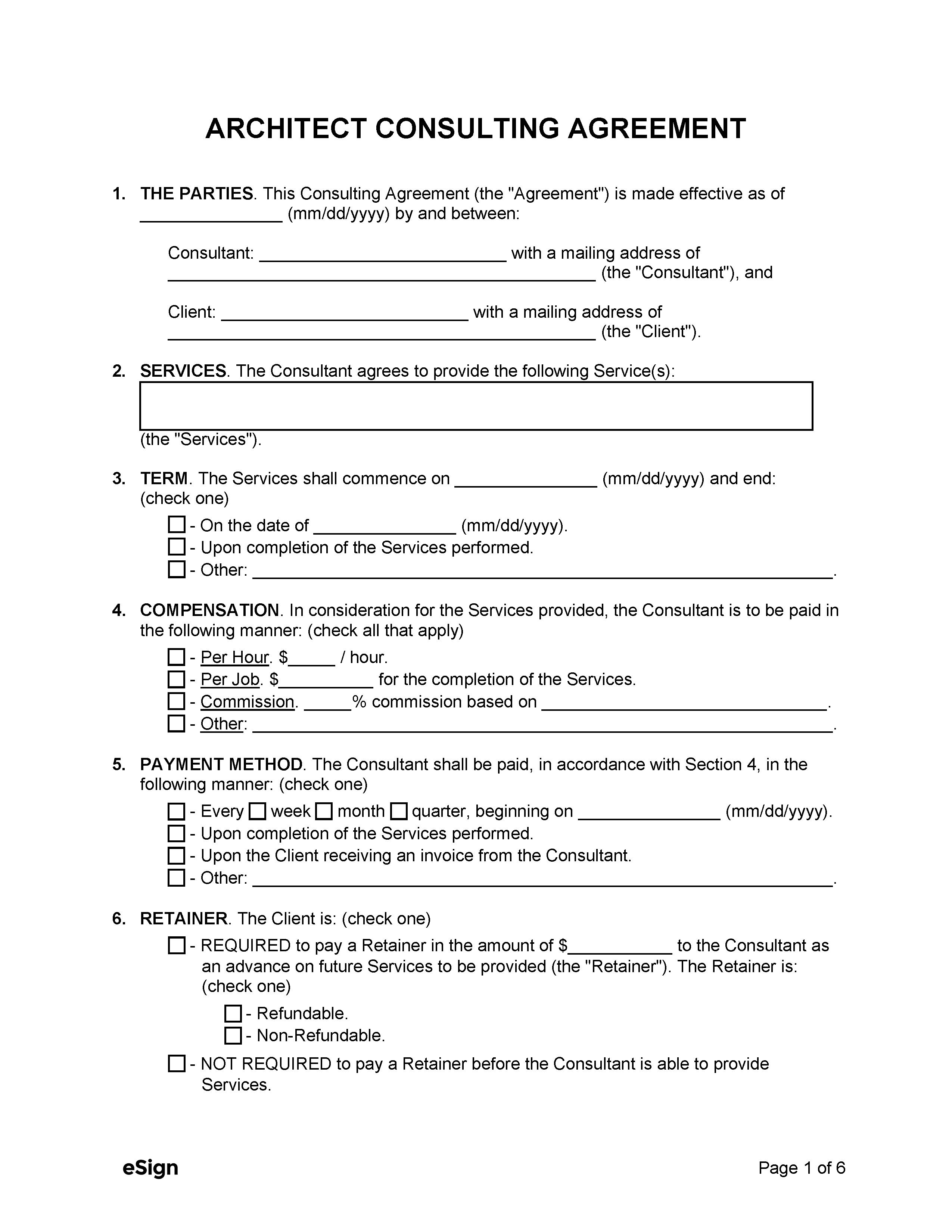

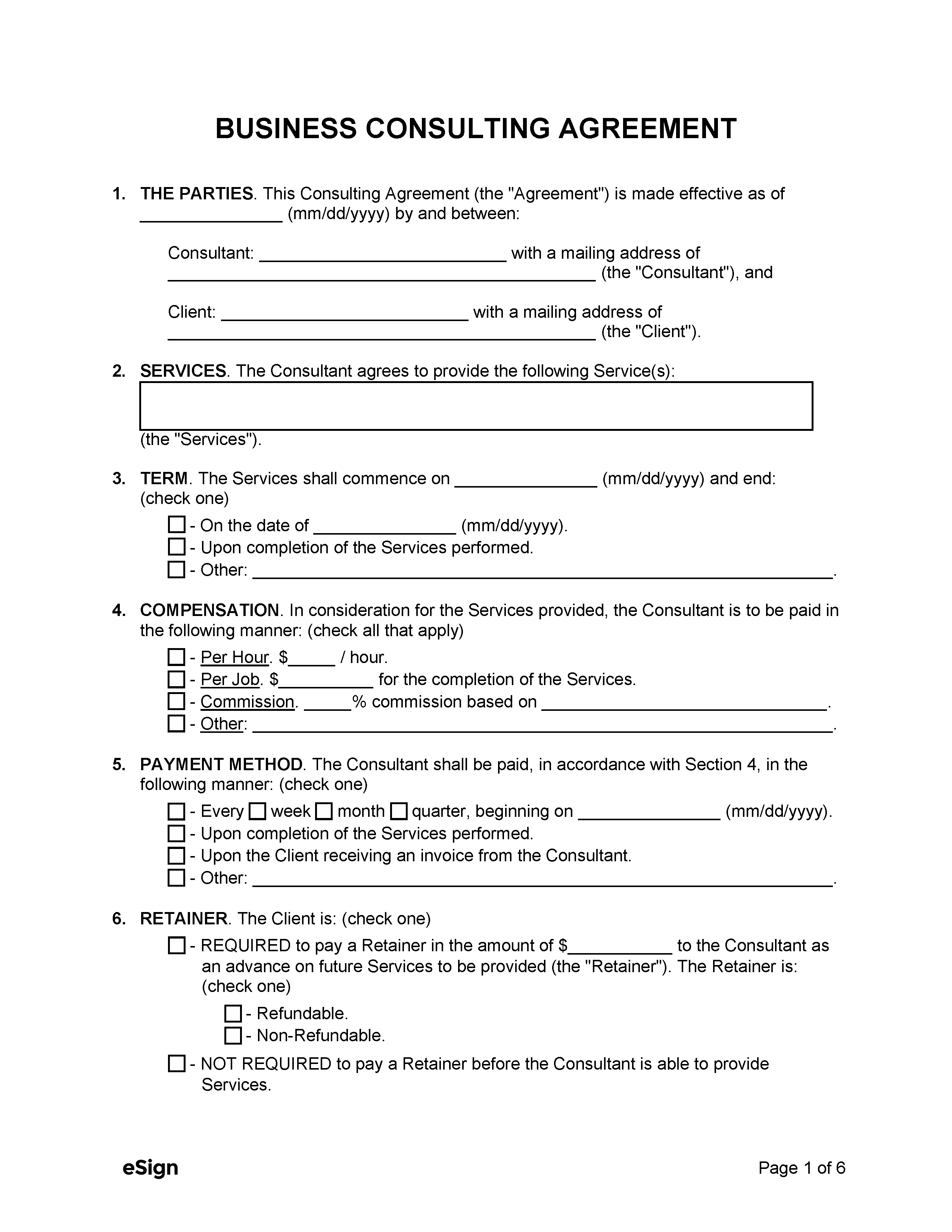

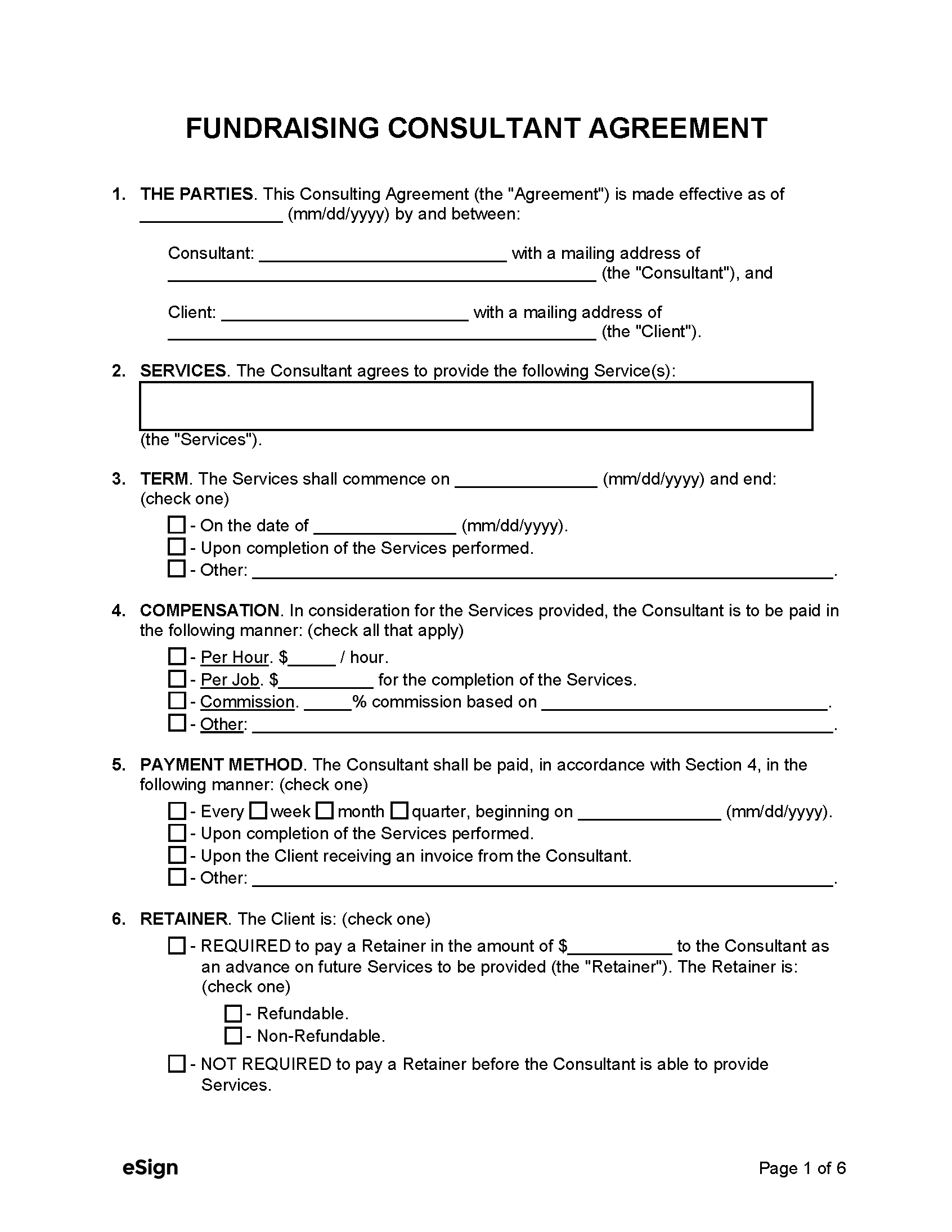

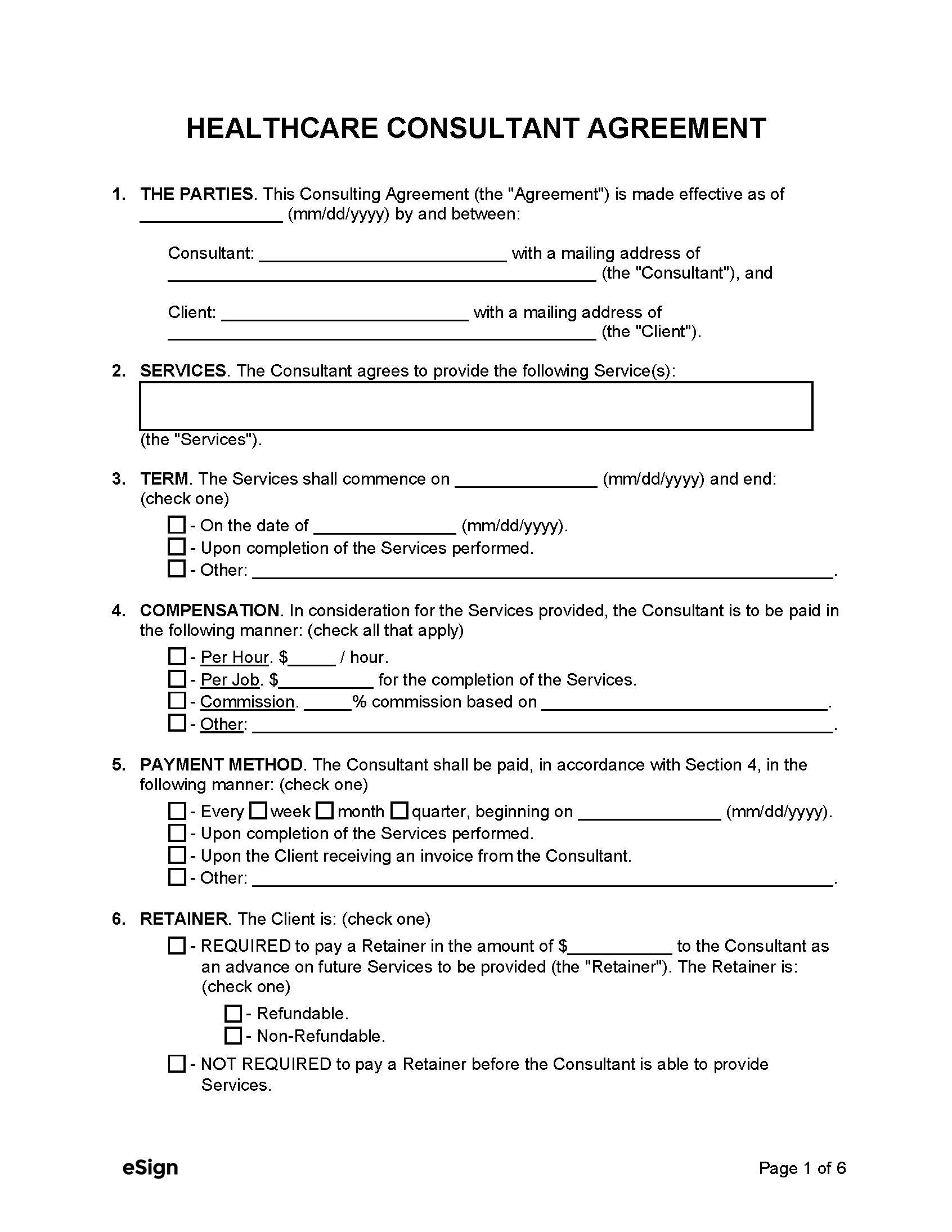

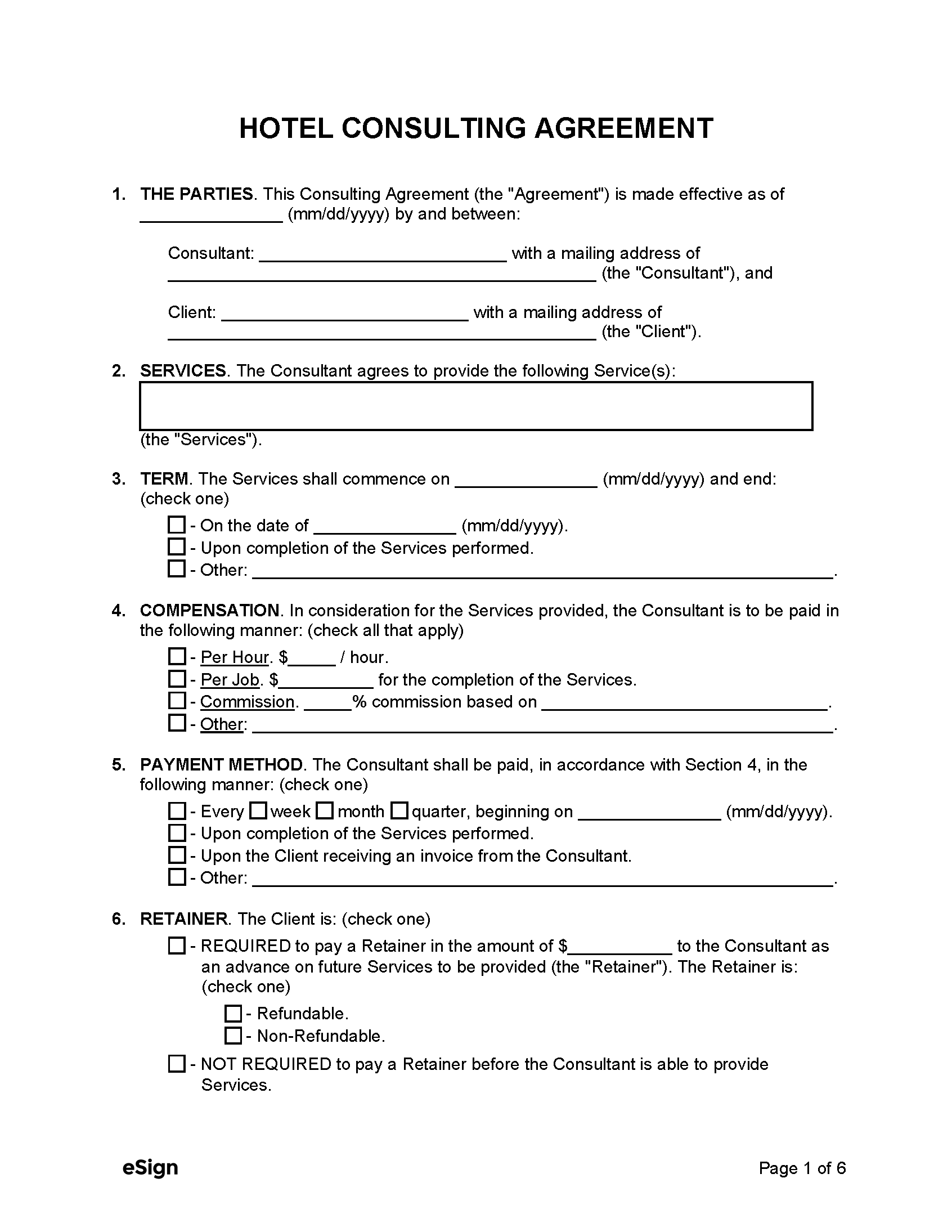

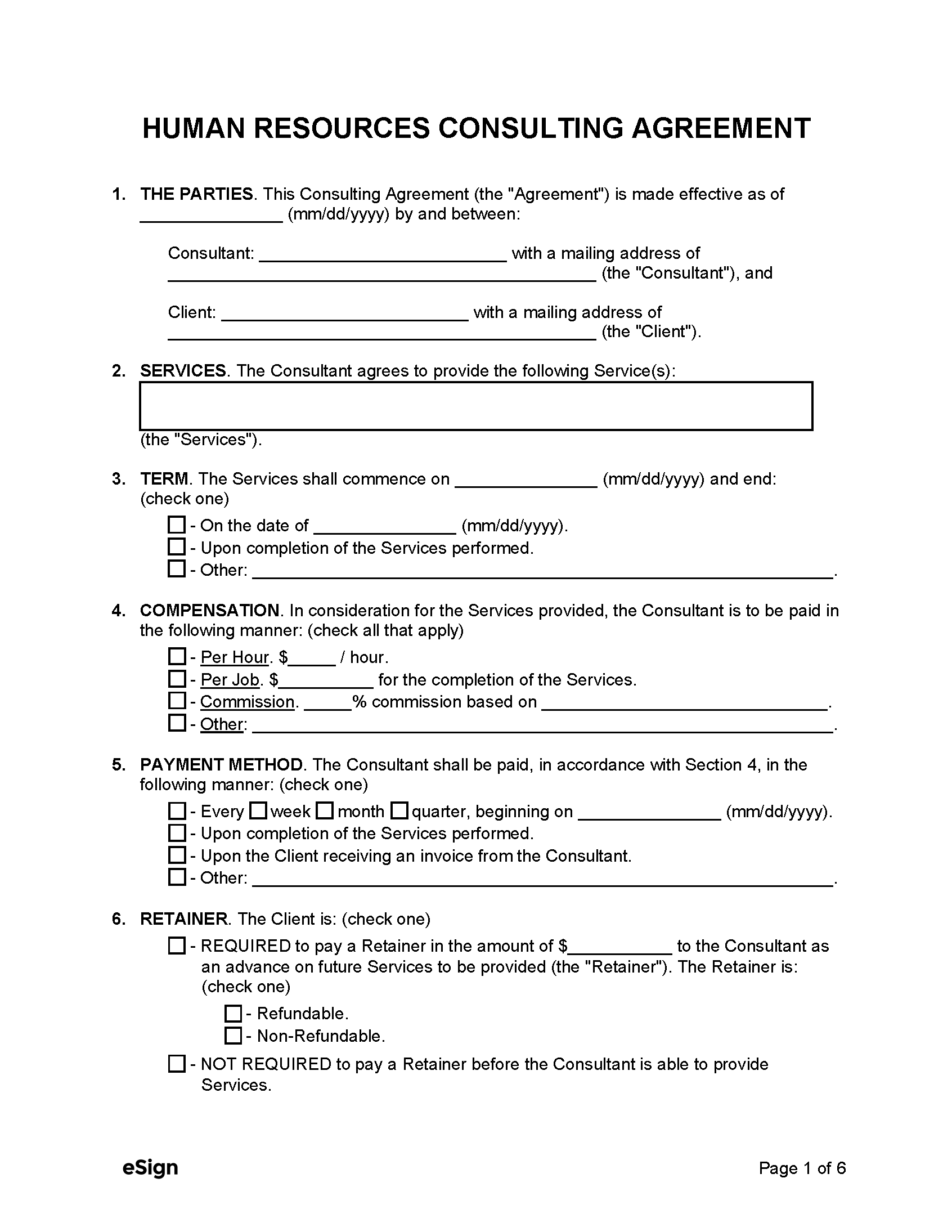

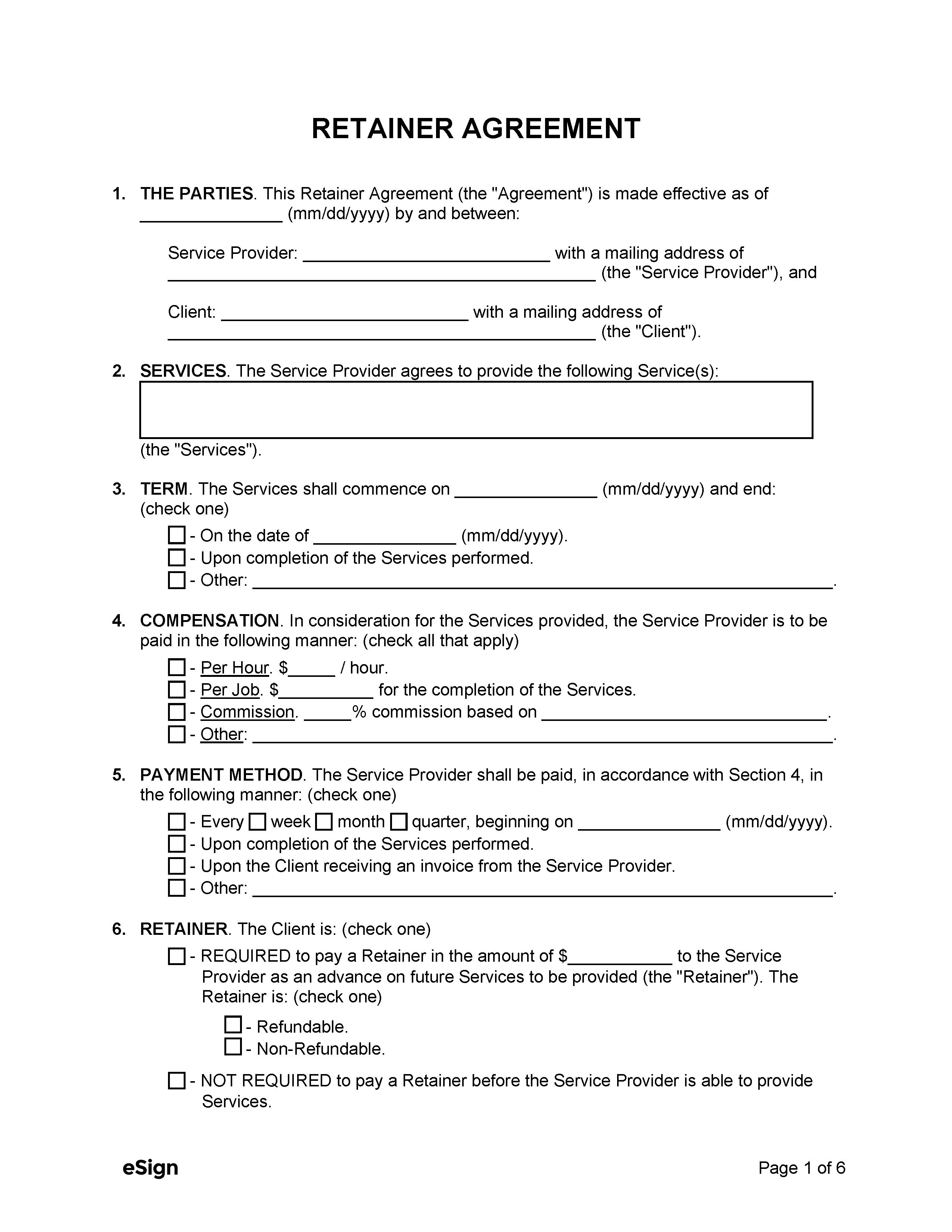

What’s Included

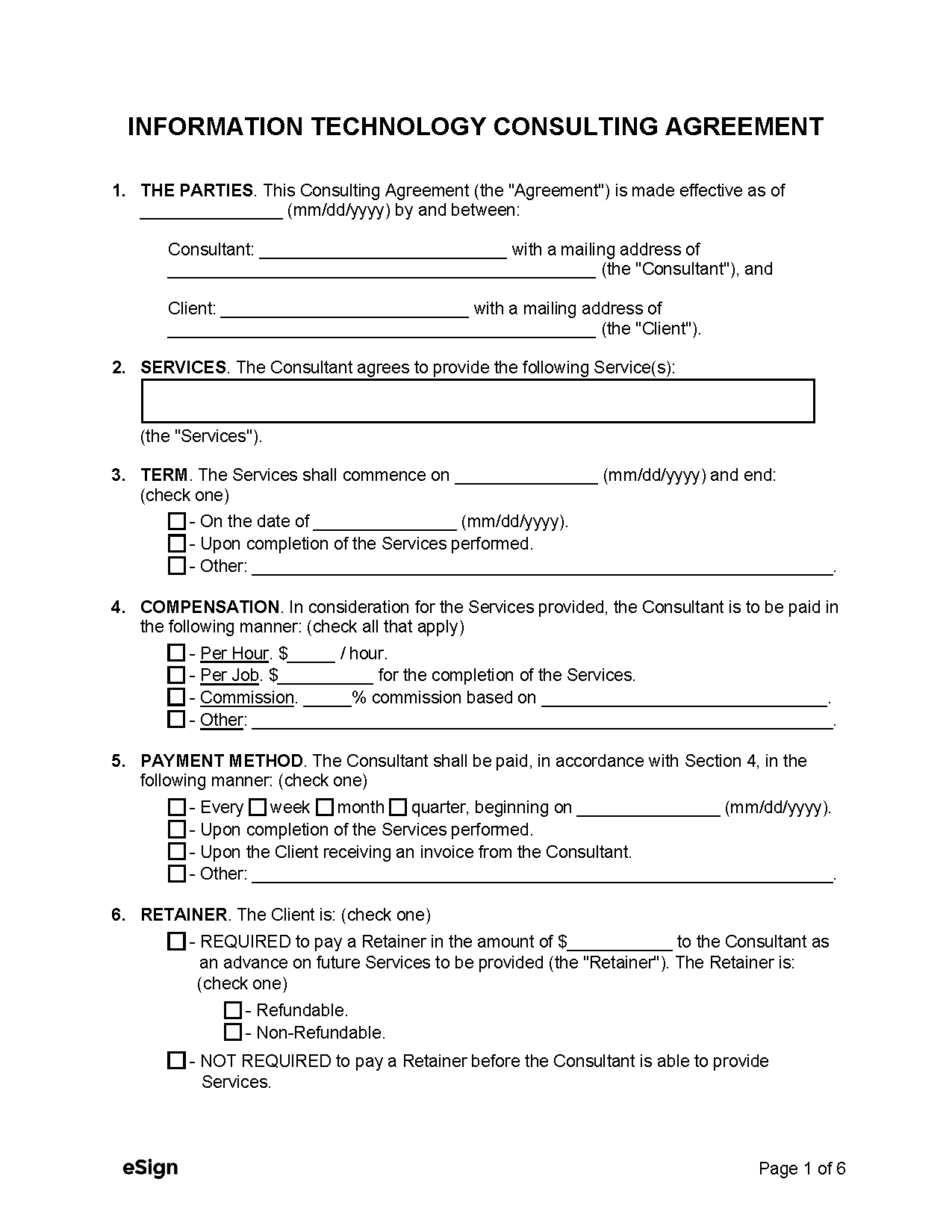

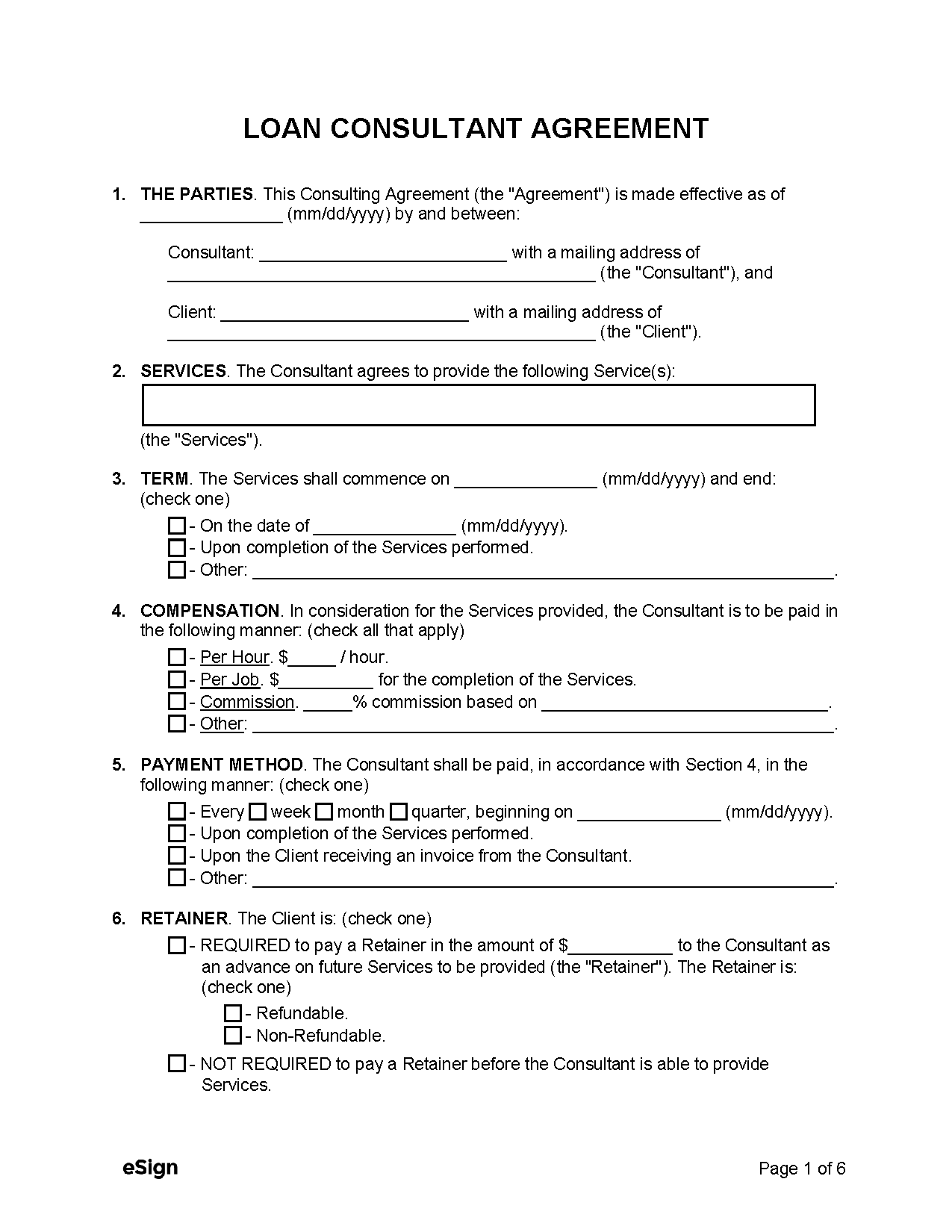

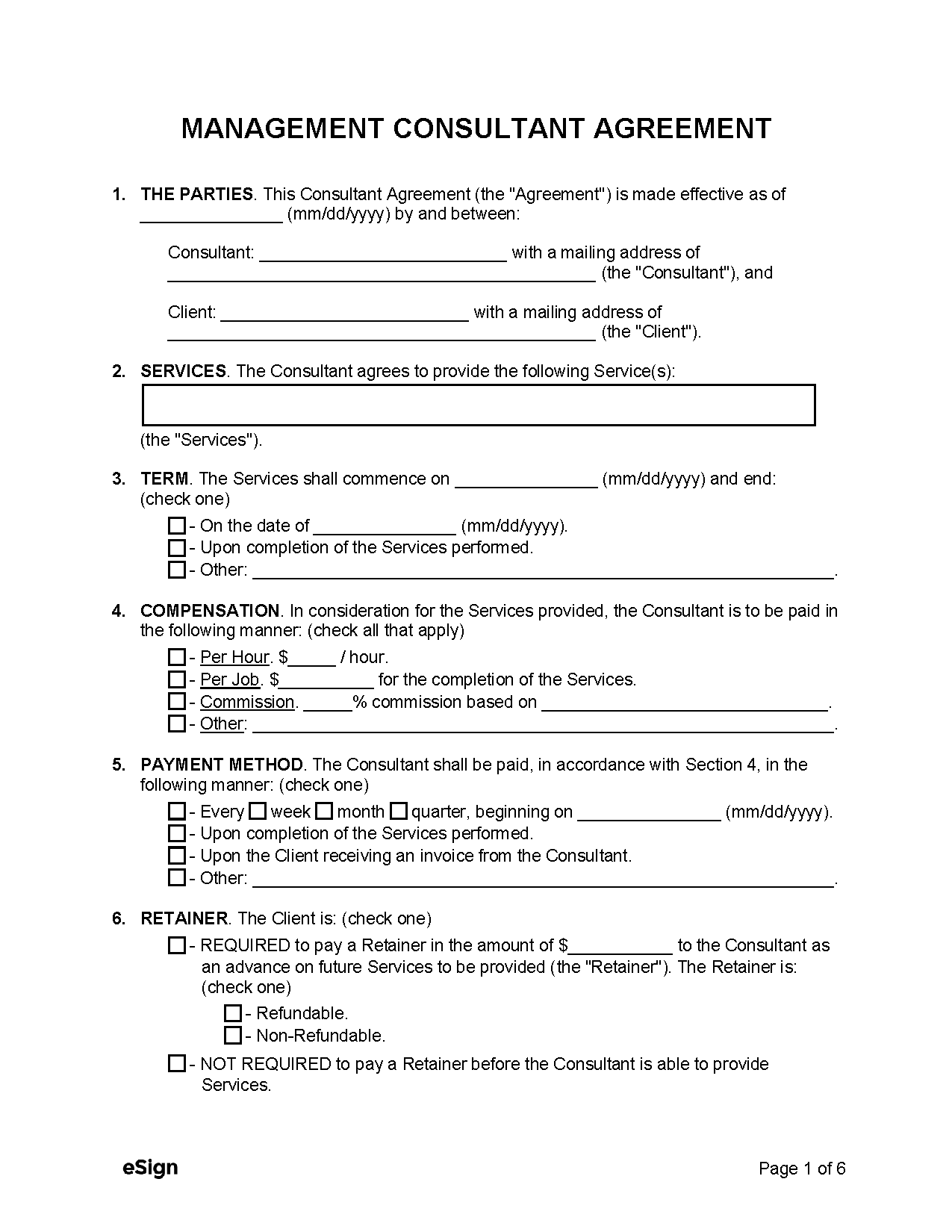

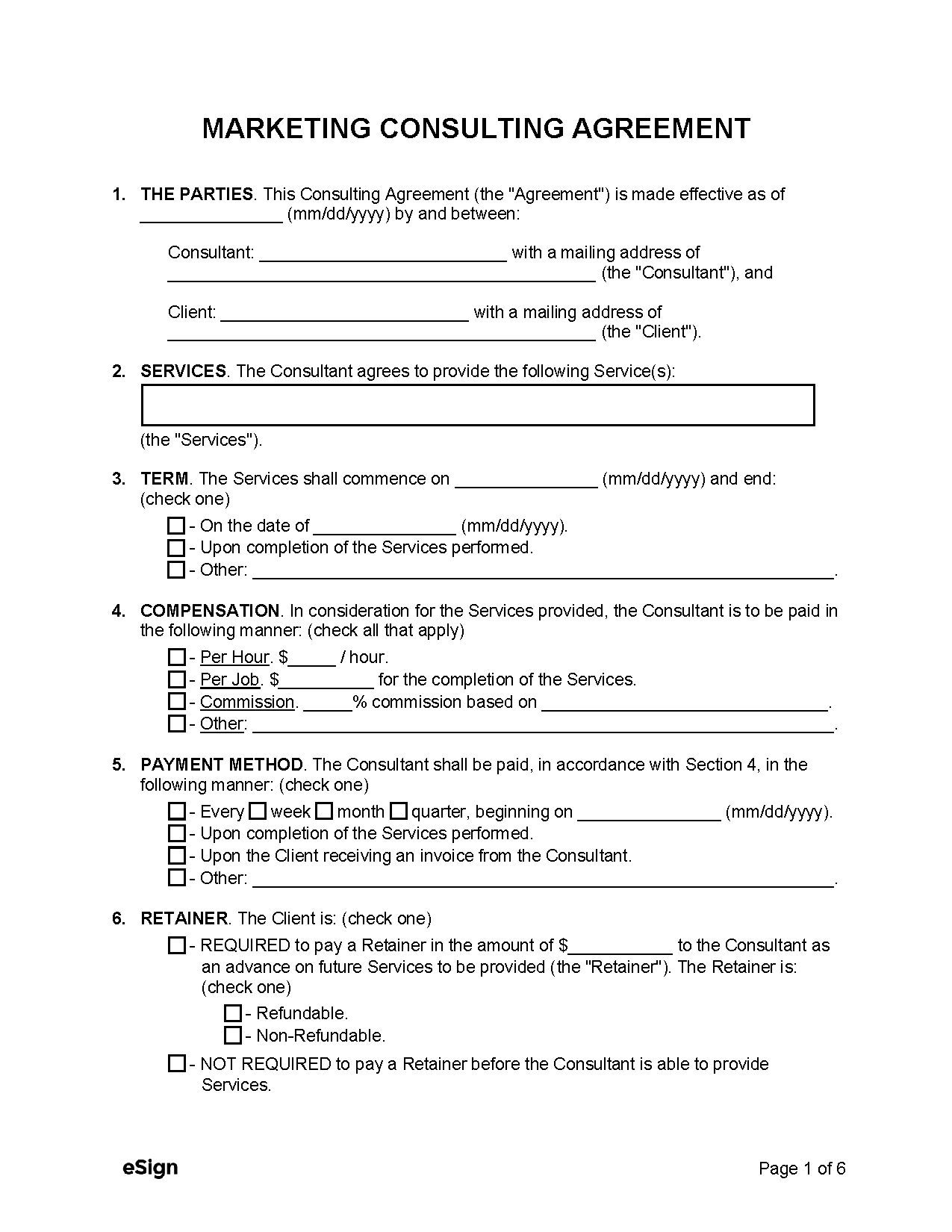

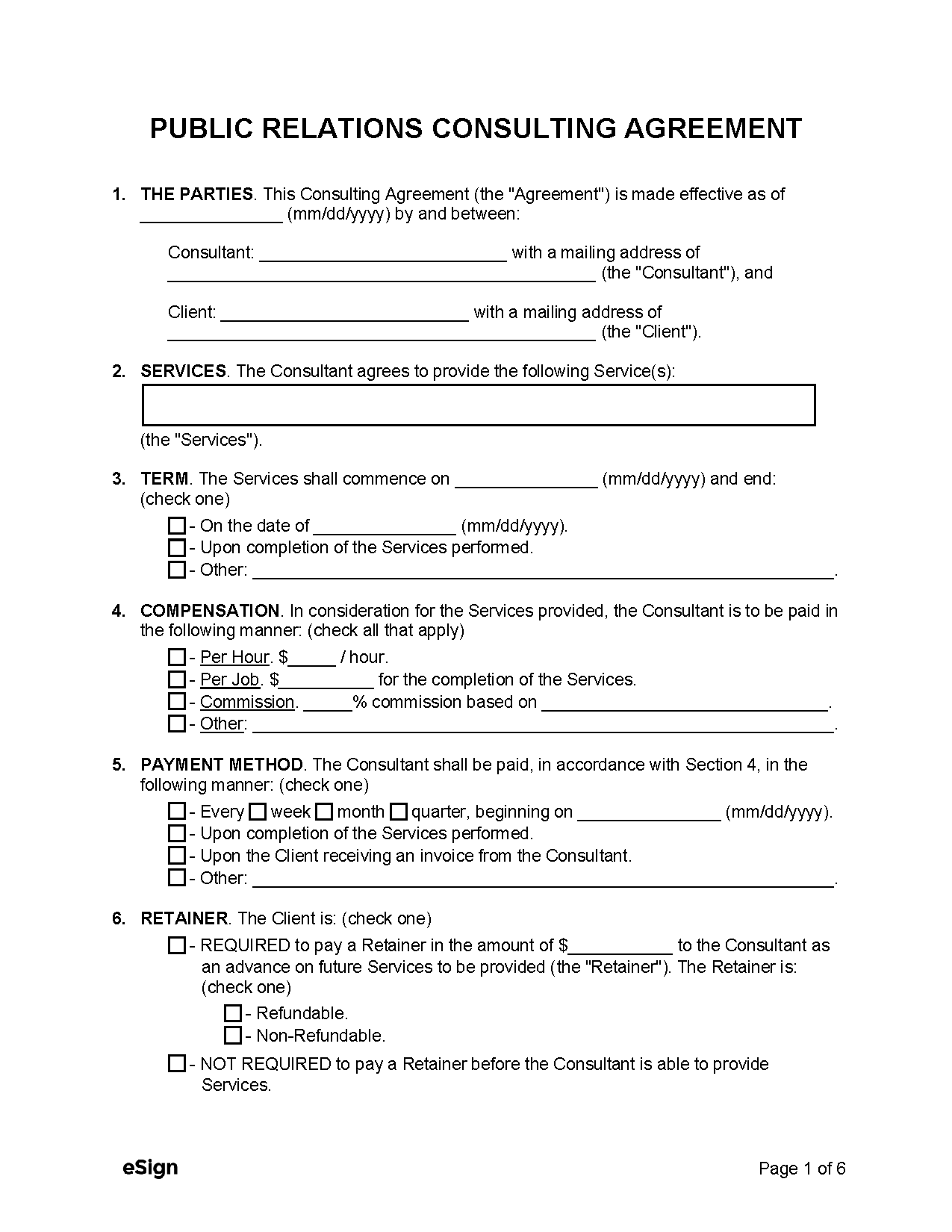

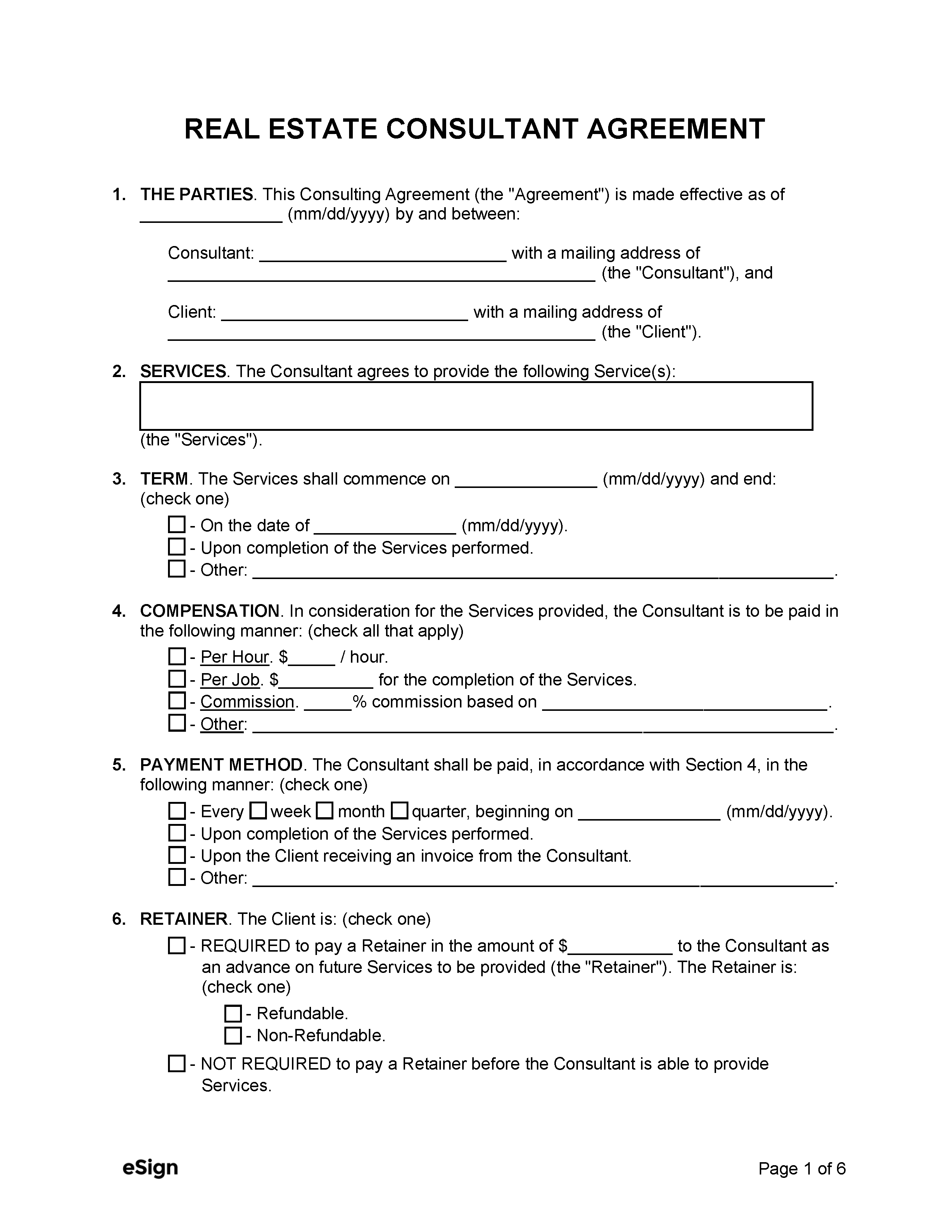

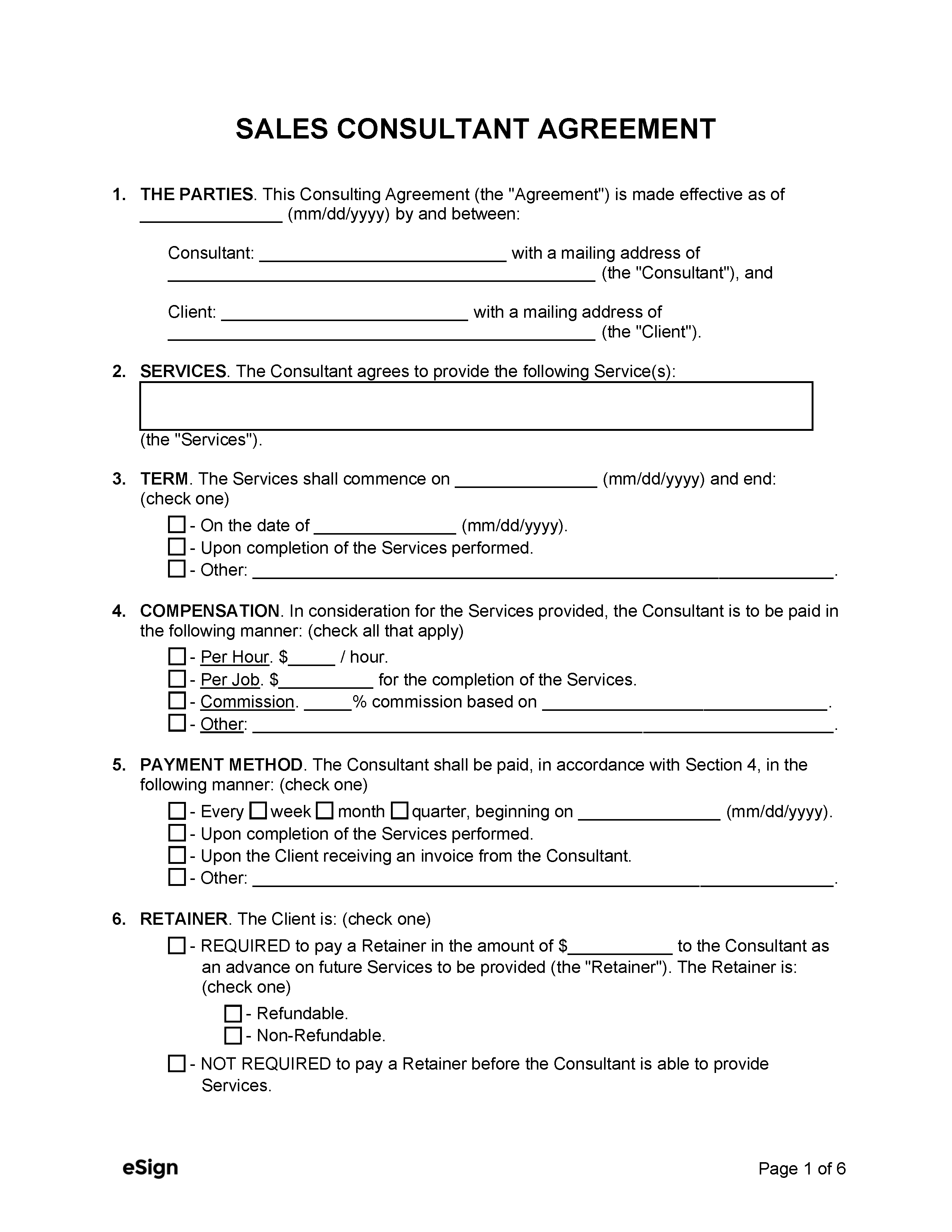

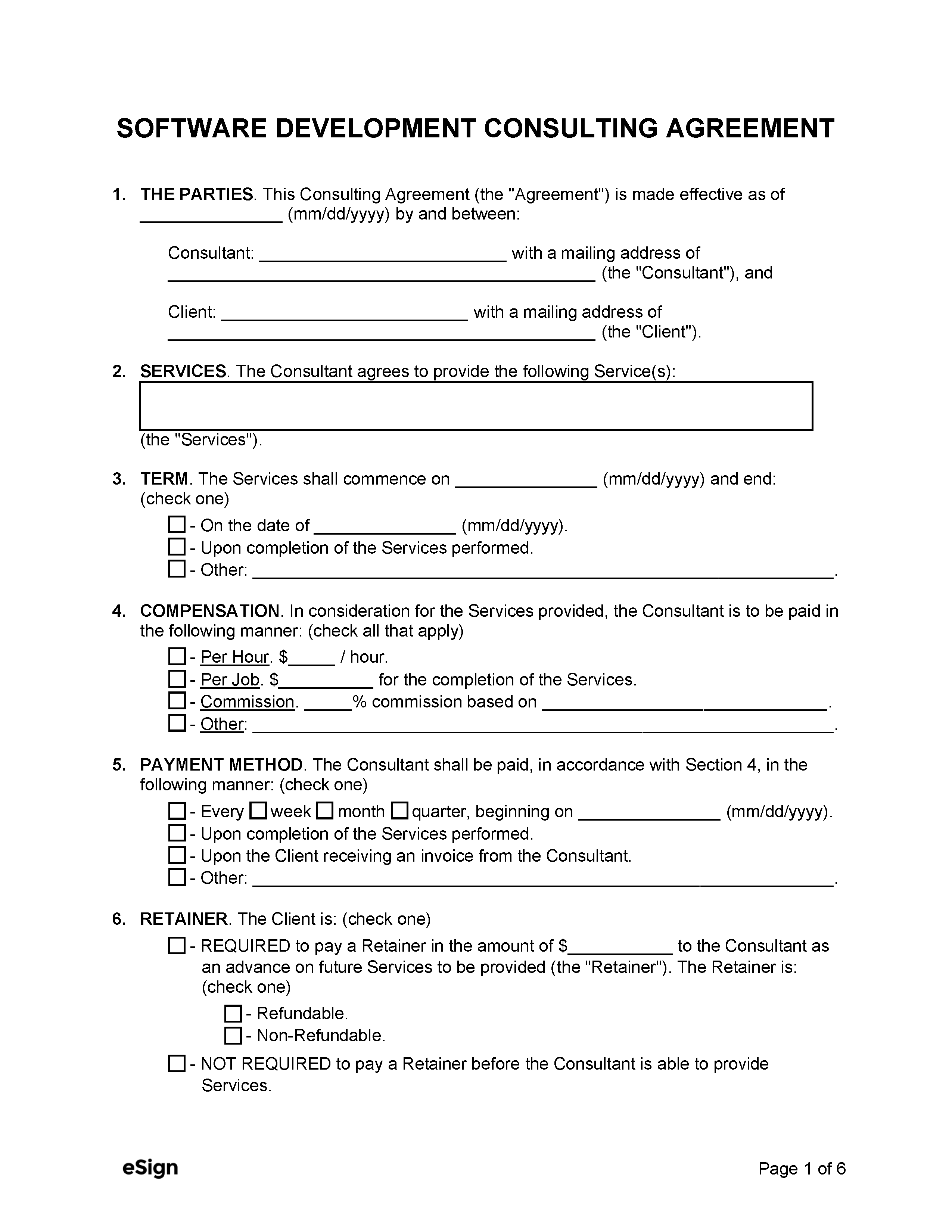

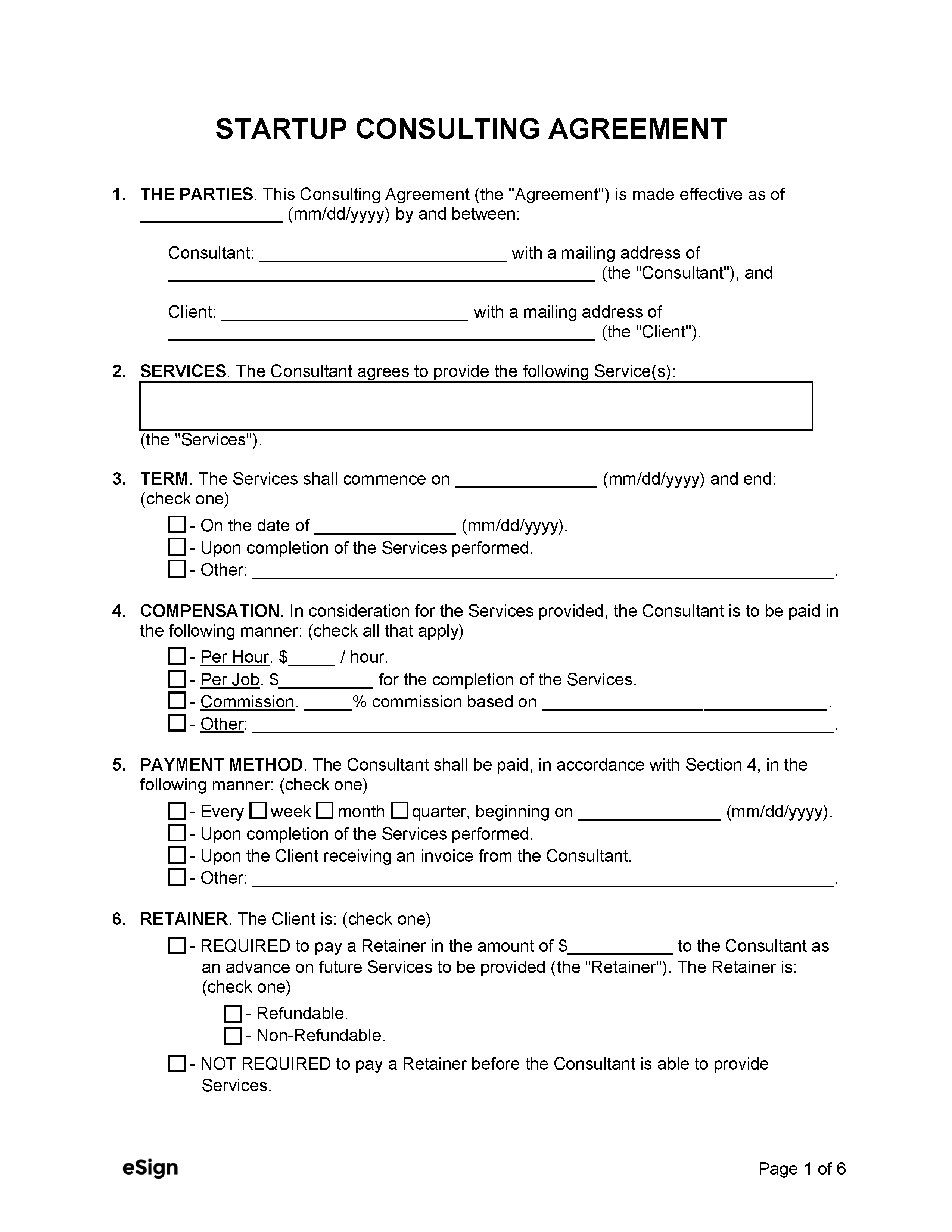

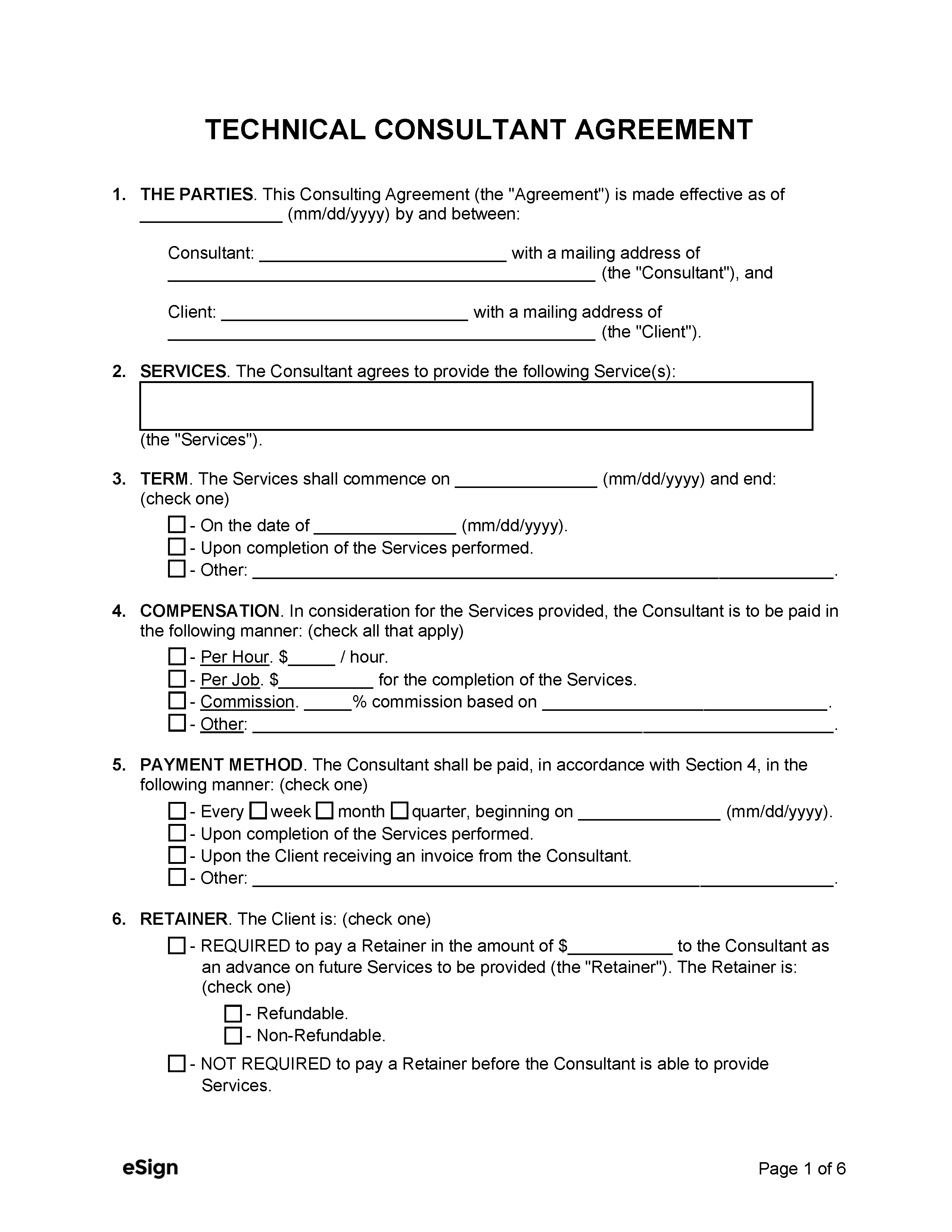

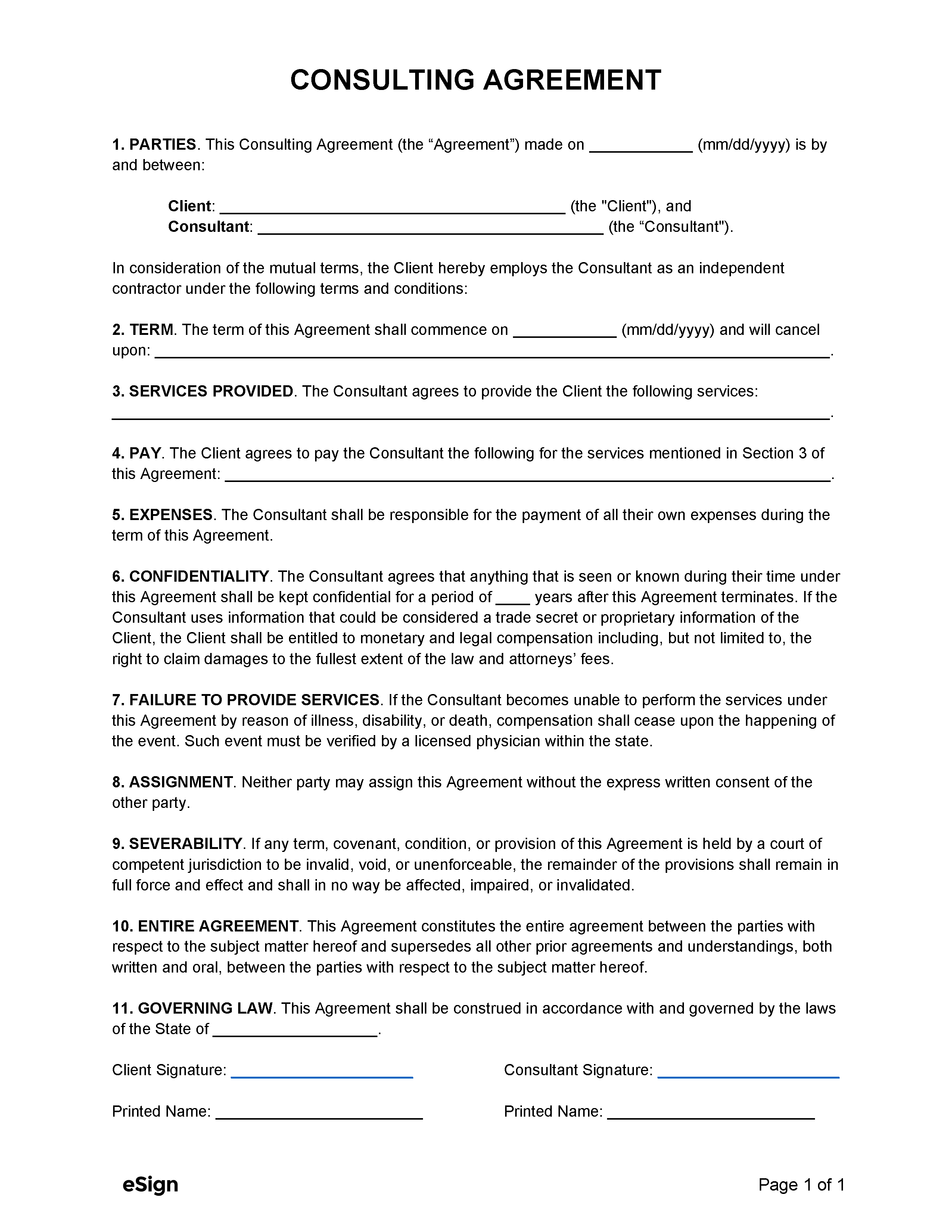

- Parties (identification) – The names and addresses of the consultant and client.

- Services – A description of the services that the consultant must provide to fulfill the contract.

- Term (contract length) – The start and end date of the contract or event that renders the contract complete.

- Compensation – The rate, fee, commission, or other payment that the consultant will receive for their services and the timing of those payments.

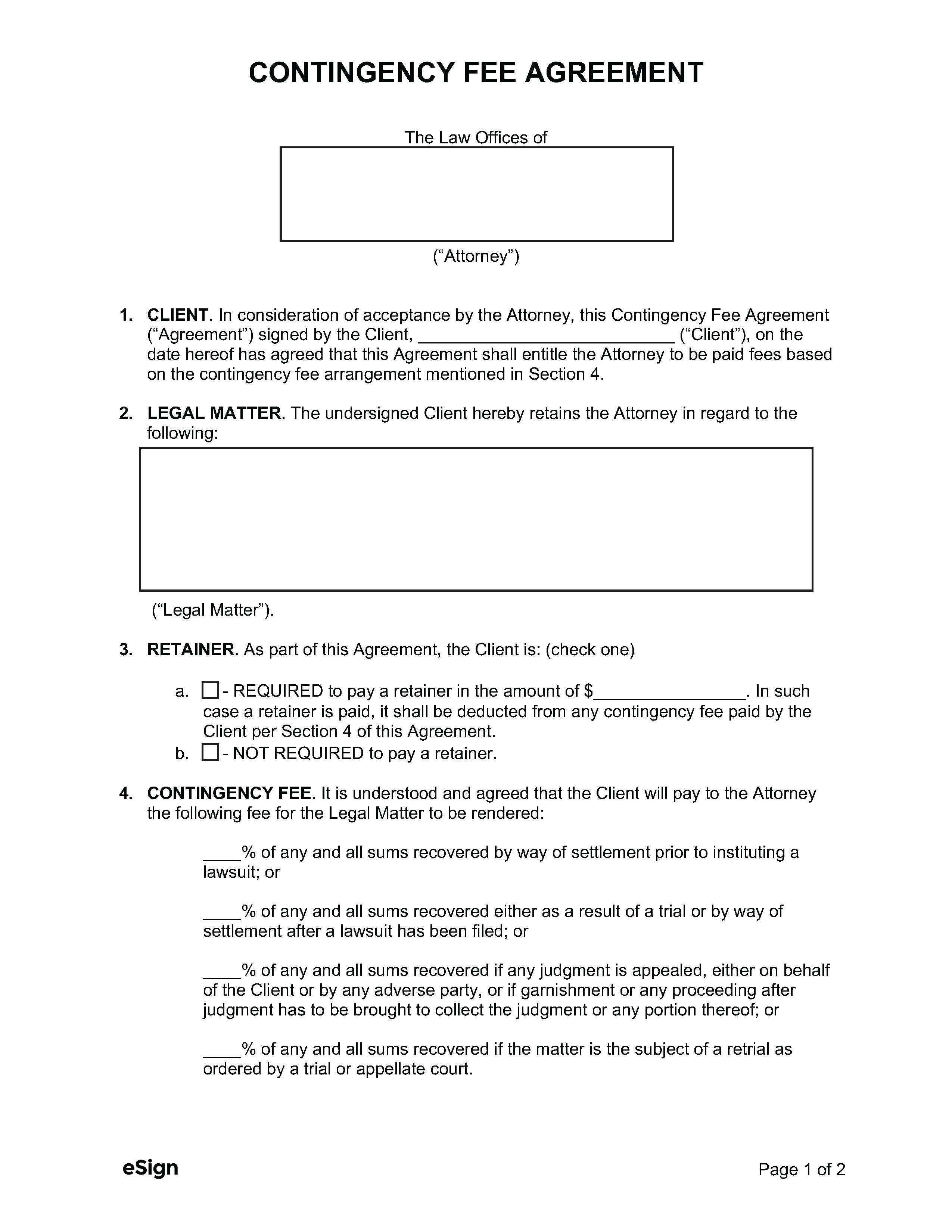

- Retainer – The deposit or minimum amount that must be paid to secure the consultant’s services.

- Contingency – Whether the consultant will earn a fee contingent on certain results and the amount of that fee.

- Expenses – Any costs that will be covered by the client.

- Signatures – The signature of both parties to render the contract legally binding.

How to Charge for Consulting

Pricing Factors

The rate a consultant charges will vary depending on their experience level, training, market demand, and the type of services for which they are being hired.

Fee Structures

Consultants can charge clients using any of the following methods:

- Hourly – The consultant charges a flat rate for each hour that they work for the client. In most cases, the contractor tracks their own hours and bills the client when the job is complete.

- Per Project – The client pays a flat fee for each assigned project that the consultant finishes.

- Results-Based (Performance) – The consultant is paid a commission on profits or sales, usually in addition to other compensation.

- Combination – The client pays the consultant using a combination of the above metrics based on the tasks that the consultant completes, the services they provide, and the amount of time that they work.

Using Retainers

A retainer is a fixed sum of money paid to a consultant before their work on a contract begins. The deposit provides the consultant with a guaranteed amount of work and payment, even if the client backs out of the agreement. In turn, the consultant guarantees that the client will have access to their services in the near to medium term.

When to Use

A retainer is often used in the following circumstances:

- The consultant has significant experience.

- The industry is highly competitive.

- The client needs assistance with a long-term project.

Sample

Download: PDF, Word (.docx), OpenDocument

CONSULTANT AGREEMENT

1. THE PARTIES. This Consultant Agreement (“Agreement”) is made effective as of [DATE] by and between:

Consultant: [CONSULTANT’S NAME], with a mailing address of [CONSULTANT’S ADDRESS] (“Consultant”), and

Client: [CLIENT’S NAME], with a mailing address of [CLIENT’S ADDRESS] (“Client”).

2. SERVICES. The Consultant agrees to provide the following services to the Client: [DESCRIBE DEVELOPER’S SERVICES] (“Services”).

3. COMPENSATION. In consideration for the Services to be provided, the Client agrees to pay the Consultant $[AMOUNT] per hour.

4. PAYMENT METHOD. The Consultant shall be paid, in accordance with section 2, upon the Client receiving an invoice from the Consultant.

5. TERM. The Services shall commence on [MM/DD/YYYY] and end on [MM/DD/YYYY].

6. RETAINER. As an advance on future Services to be provided, the Client is required to pay the Consultant a retainer in the amount of $[AMOUNT] every ☐ week ☐ month ☐ quarter, beginning on [DATE] (“Retainer”). The Retainer is non-refundable.

7. NON-DISCLOSURE. The Consultant agrees not to disclose or misuse the Client’s proprietary or confidential information without prior written consent, except as needed to perform the Services, recognizing that such actions would cause irreparable harm to the Client.

8. EXPENSES. The Client shall only be responsible for the following expenses: [LIST EXPENSES TO BE PAID BY CLIENT].

9. INDEPENDENT CONTRACTOR STATUS. The Consultant is an independent contractor, and neither the Consultant nor their employees or contract personnel are or shall be deemed the Client’s employees.

10. TERMINATION. Either party may terminate this Agreement upon [#] days’ written notice.

IN WITNESS WHEREOF, the parties have executed this Agreement on [MM/DD/YYYY].

Consultant’s Signature: ____________________

[CONSULTANT PRINTED NAME]

Client’s Signature: ____________________

[CLIENT PRINTED NAME]