By Type (10)

How Retainer Fees Work

A retainer fee is a down payment clients make to guarantee the services of a professional. Retainer fees are often charged on a recurring basis and cover a fixed number of working hours or tasks over a given period. If the retainer runs out, the service provider can request another deposit or later invoice the client for any additional work performed.

Retainer fees are commonly held in a separate bank account and drawn upon as services are provided. Depending on the agreed terms, any unused funds may be refunded to the client after the work is completed.

What Should Be Included

Services – The service provider should include the tasks or other actions they’ll perform for the client. This also enables the contractor to relay what is not included to set clear work expectations.

Term – Although a retainer contract is an ongoing agreement, it should still specify the start date and outline procedures for ending the arrangement.

Fees – The agreement must specify the retainer fee amount and explain whether it’s refundable. The service provider should also outline their usual rates, which might be an hourly wage, flat fee, or commission.

Independent Contractor Status – Retainer agreements should indicate that the service provider, as an independent contractor, is not entitled to employee benefits and is responsible for their own taxes, insurance, and related obligations.

Confidential Information – A non-disclosure clause is often included in retainer agreements to prevent the unauthorized use or sharing of the client’s proprietary information.

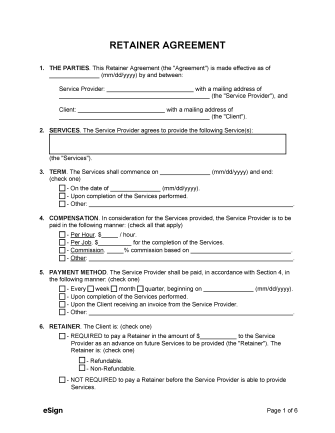

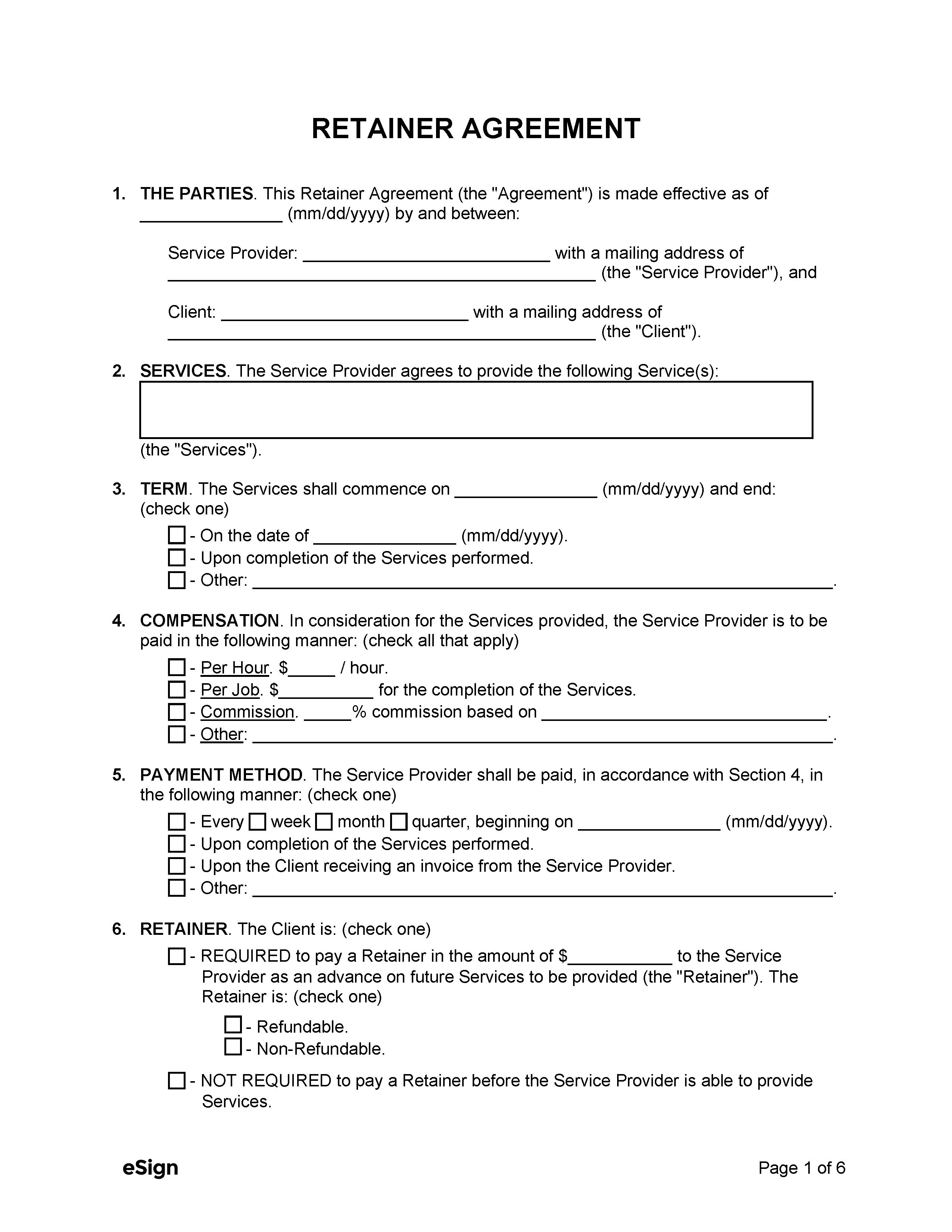

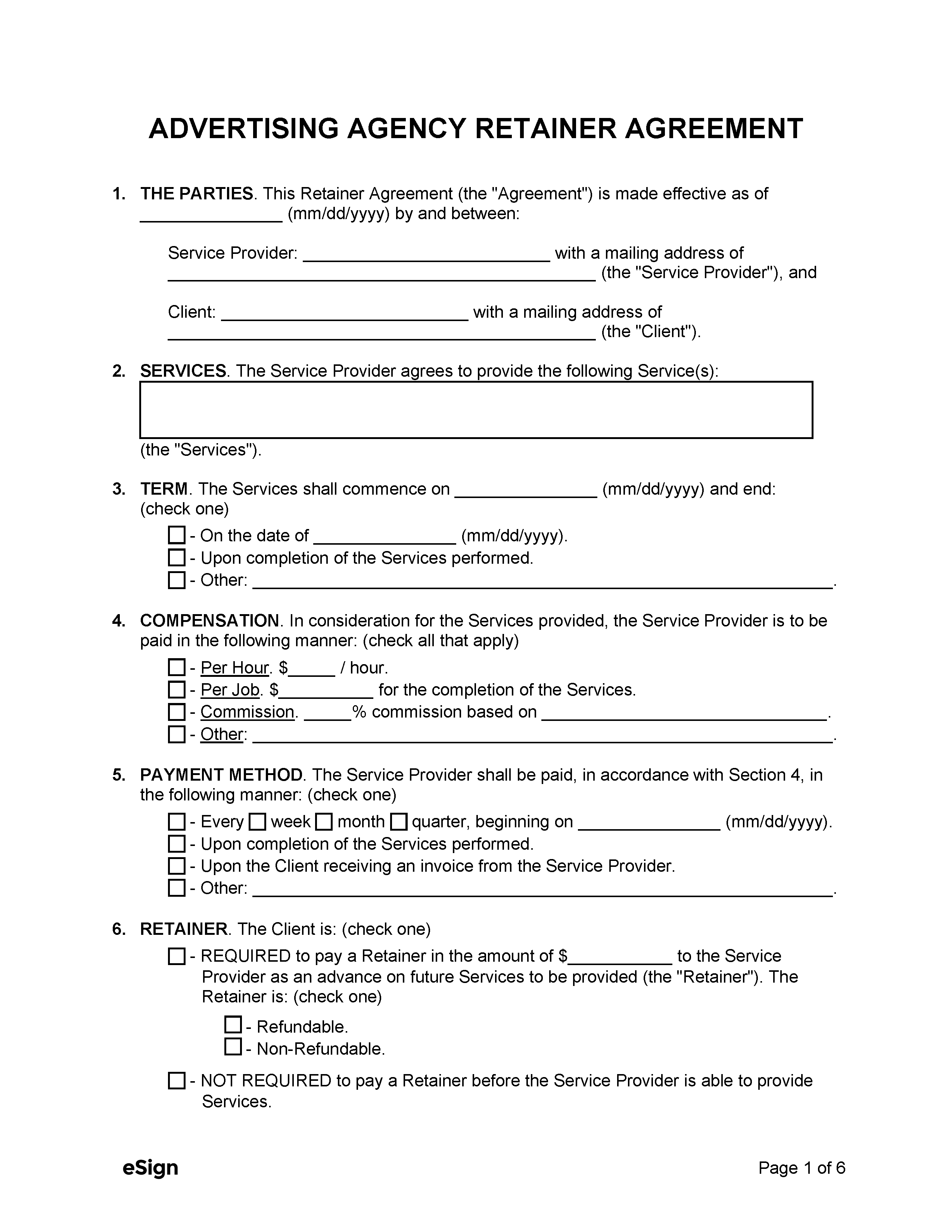

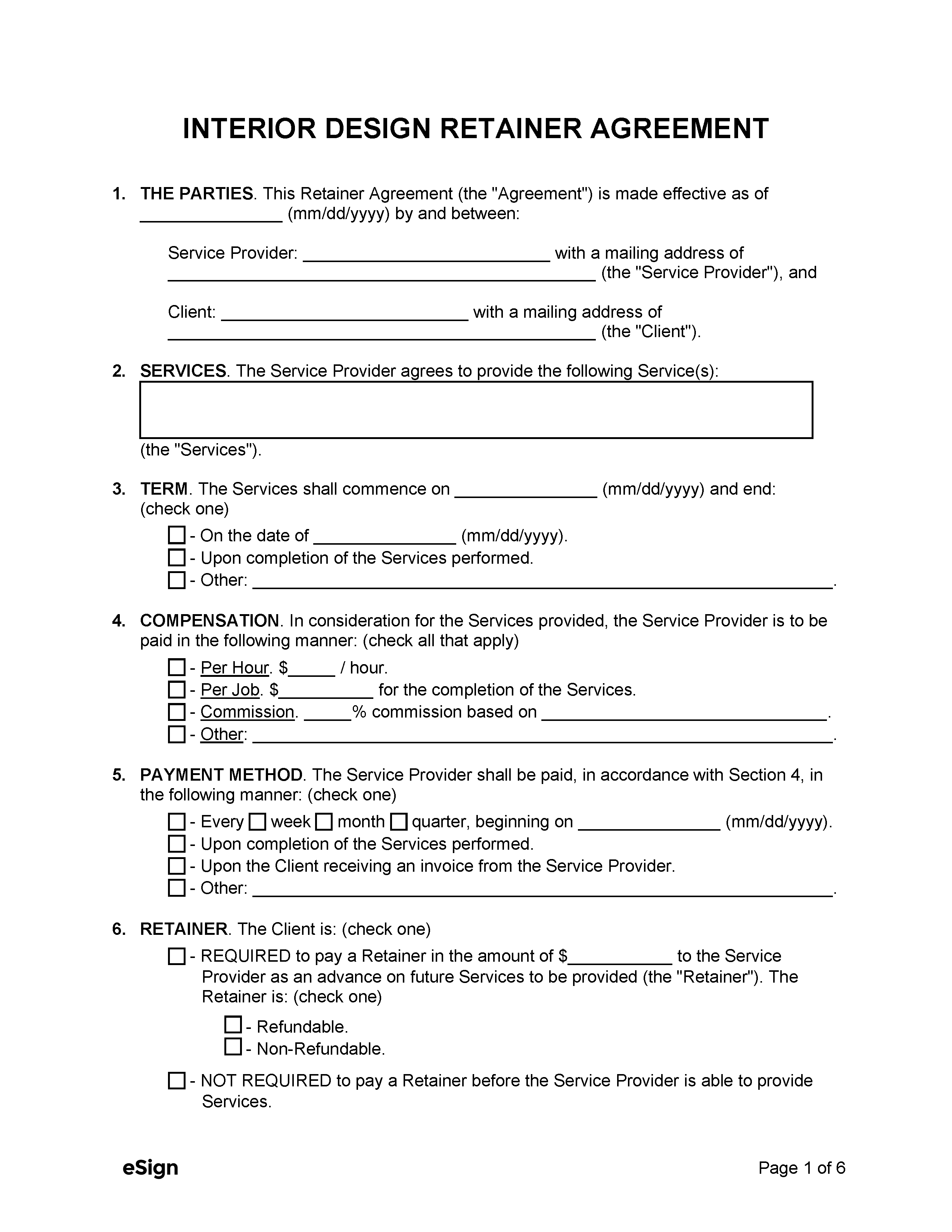

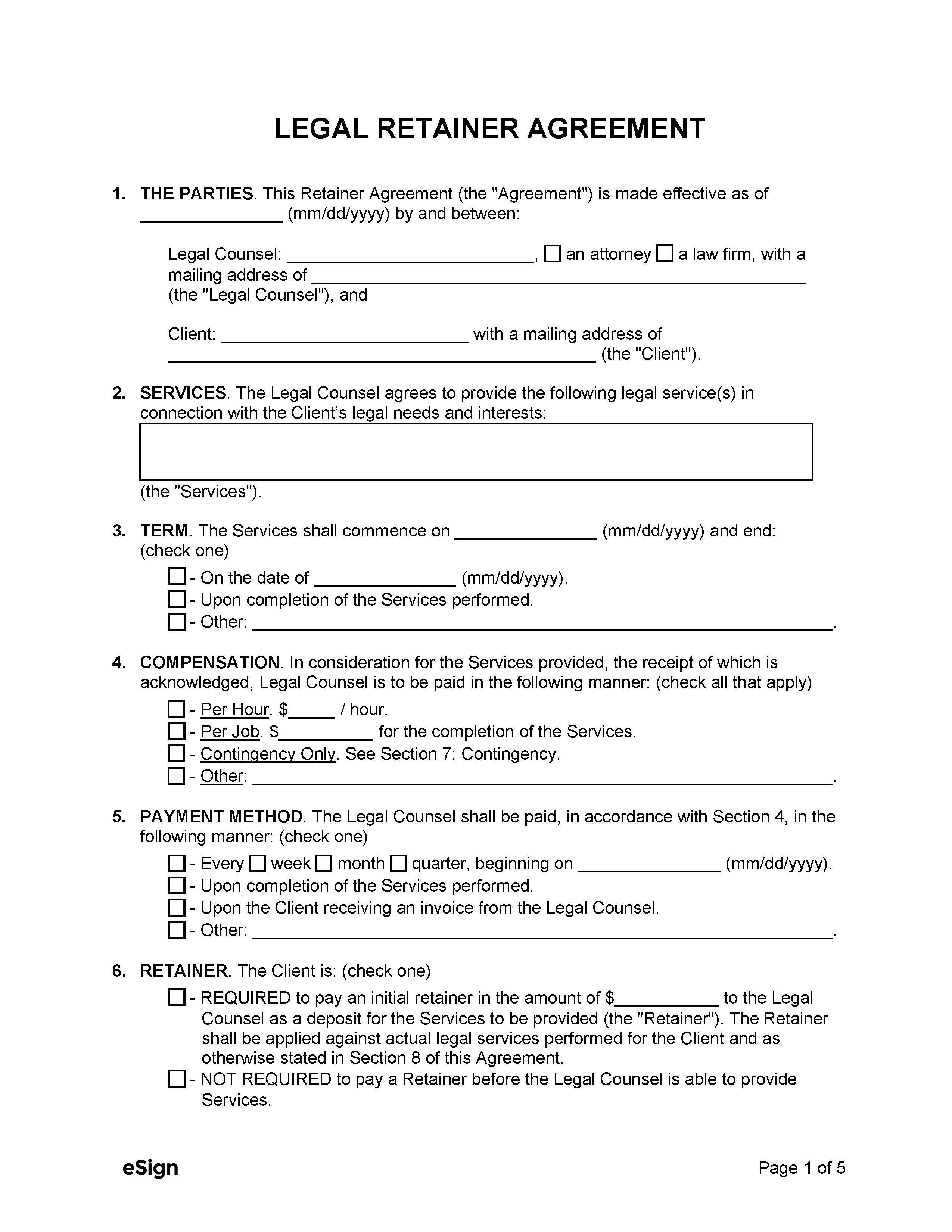

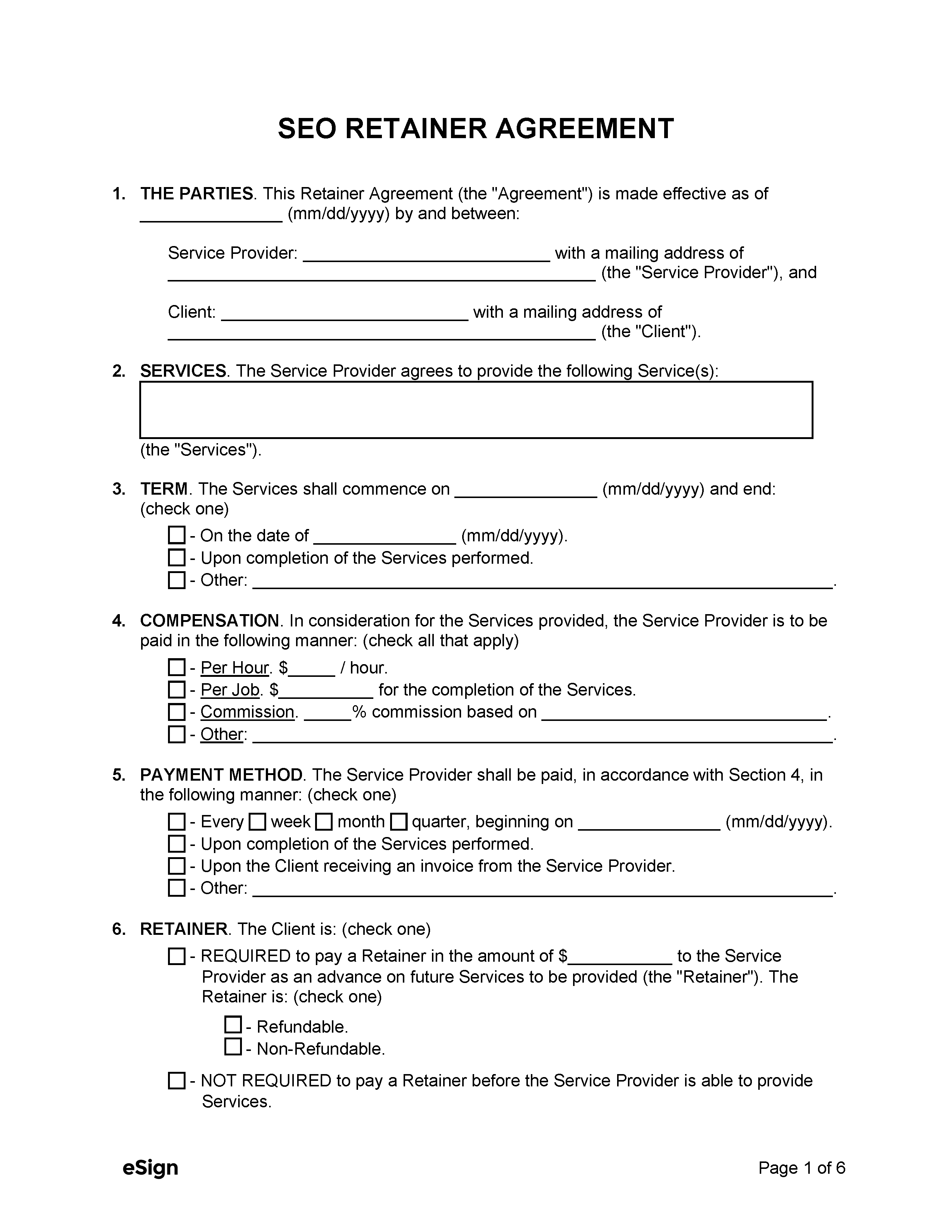

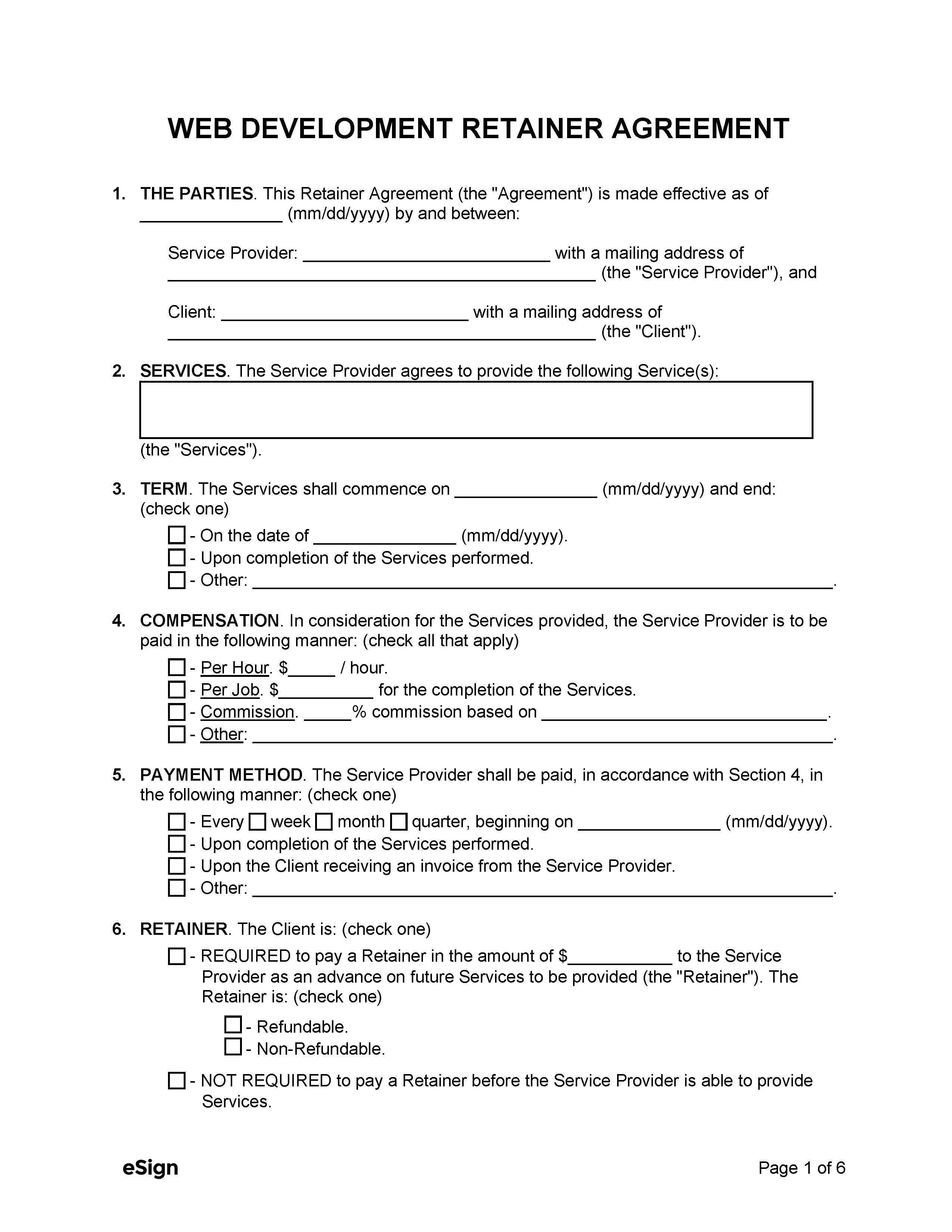

Sample

Download: PDF, Word (.docx), OpenDocument

RETAINER AGREEMENT

1. THE PARTIES. This Retainer Agreement (the “Agreement”) is made effective as of [MM/DD/YYYY] by and between:

Service Provider: [SERVICE PROVIDER NAME], with a mailing address of

[SERVICE PROVIDER ADDRESS] (the “Service Provider”), and

Client: [CLIENT NAME], with a mailing address of

[CLIENT ADDRESS] (the “Client”).

2. SERVICES. The Service Provider agrees to provide the following Service(s): [DESCRIBE SERVICE(S)]. (hereinafter the “Services”).

3. TERM. The Services shall commence on [MM/DD/YYYY] and end upon either party providing [#] days’ notice.

4. COMPENSATION. In consideration for the Services provided, the Service Provider is to be paid the following compensation: [DESCRIBE COMPENSATION].

5. PAYMENT METHOD. The Service Provider shall be paid, in accordance with section 4, within [#] days upon the Client receiving an invoice from the Service Provider.

6. RETAINER. The Client is required to pay a retainer of $[AMOUNT].

7. DISPUTES. If any dispute arises under this Agreement, the parties shall negotiate in good faith to settle such dispute. If the parties cannot resolve such disputes themselves, then either party may submit the dispute to mediation by a mediator approved by both parties.

8. INDEPENDENT CONTRACTOR STATUS. The Service Provider is an independent contractor, and neither the Service Provider’s employees nor contract personnel are or shall be deemed the Client’s employees.

9. NON-DISCLOSURE. The Service Provider agrees not to disclose or use the Client’s proprietary or confidential information without prior written consent, except as needed to perform the Services, recognizing that such actions would cause irreparable harm to the Client.

10. INDEMNIFICATION. The Service Provider shall indemnify and hold the Client harmless from any loss or liability from performing the Services under this Agreement.

11. GOVERNING LAW. This Agreement shall be governed by the laws of the State of [STATE NAME].

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on the dates written hereunder.

Service Provider’s Signature: ______________________ Date: [MM/DD/YYYY]

Print Name: [SERVICE PROVIDER NAME]

Client’s Signature: ______________________ Date: [MM/DD/YYYY]

Print Name [CLIENT NAME]