Can Be Used By:

- Business loan consultants

- Student loan consultants

- Mortgage loan officers

Sample

Download: PDF, Word (.docx), OpenDocument

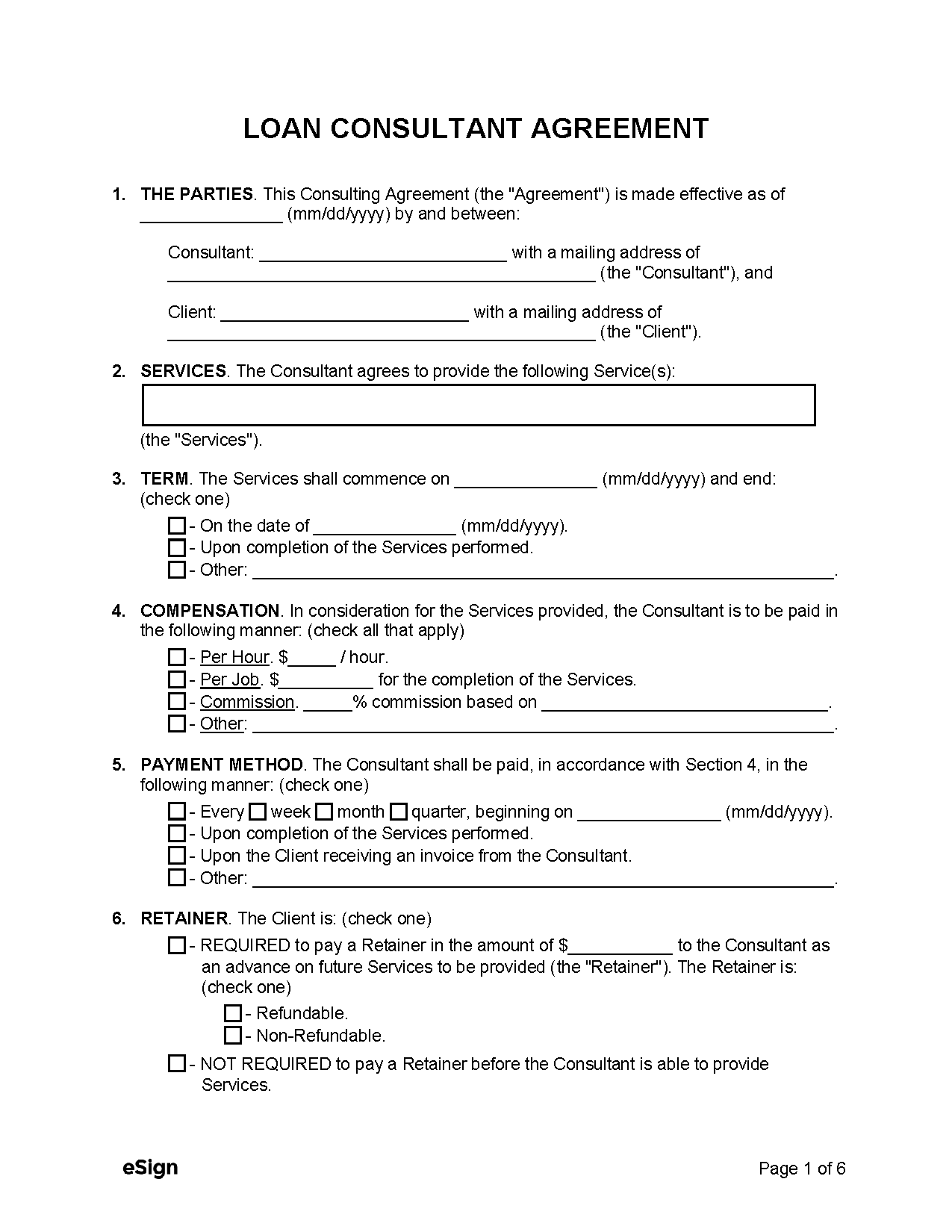

LOAN CONSULTING AGREEMENT

This Loan Consulting Agreement (“Agreement”) is made effective as of [MM/DD/YYYY] by and between [CONSULTANT’S NAME], with a mailing address of [CONSULTANT’S ADDRESS] (“Consultant”), and [CLIENT’S NAME], with a mailing address of [CLIENT’S ADDRESS] (“Client”).

1. SERVICES. The Consultant agrees to provide the following services to the Client: [DESCRIBE CONSULTING SERVICES] (“Services”).

2. COMPENSATION. In consideration for the Services to be provided, the Client agrees to pay the Consultant $[AMOUNT] per [PAYMENT BASIS (E.G., HOUR)].

3. PAYMENT METHOD. The Consultant shall be paid, in accordance with section 2, upon the Client receiving an invoice from the Consultant.

4. TERM. The Services shall commence on [MM/DD/YYYY] and end on [MM/DD/YYYY].

5. RETAINER. As an advance on future Services to be provided, the Client is required to pay the Consultant a non-refundable retainer of $[AMOUNT] every ☐ week ☐ month, beginning on [DATE].

6. NON-DISCLOSURE. The Consultant agrees not to disclose or misuse the Client’s proprietary or confidential information without prior written consent, except as needed to perform the Services, recognizing that such actions would cause irreparable harm to the Client.

7. INDEPENDENT CONTRACTOR STATUS. The Consultant is an independent contractor, and neither the Consultant nor their employees or contract personnel are or shall be deemed the Client’s employees.

8. TERMINATION. Either party may terminate this Agreement upon [#] days’ written notice.

IN WITNESS WHEREOF, the parties have executed this Agreement on the date first written above.

Consultant’s Signature: ____________________

[CONSULTANT’S PRINTED NAME]

Client’s Signature: ____________________

[CLIENT’S PRINTED NAME]