Personal Services Defined

A personal service involves a professional using their skills and knowledge to perform work for a client, as opposed to delivering a product. According to the IRS, activities in the following fields are considered personal services[1]:

- Accounting

- Actuarial science

- Architecture

- Consulting

- Engineering

- Health and veterinary services

- Law

- Performing arts

Why Use a Personal Service Contract

Written contracts (as opposed to verbal) help define a working relationship and ensure both parties understand their roles before work begins.

1. Communication

Personal service contracts help prevent miscommunication and ensure the arrangement meets each party’s needs and expectations.

2. Independent Contractor Status

The contract establishes the service provider as an independent contractor and clarifies the parties aren’t entering into an employee-employer relationship.

3. Liability

As a legally binding document, if either party fails to perform duties or uphold the agreement terms, the document can hold the violating party liable and help the injured party prove their case.

Sample

Download: PDF, Word (.docx), OpenDocument

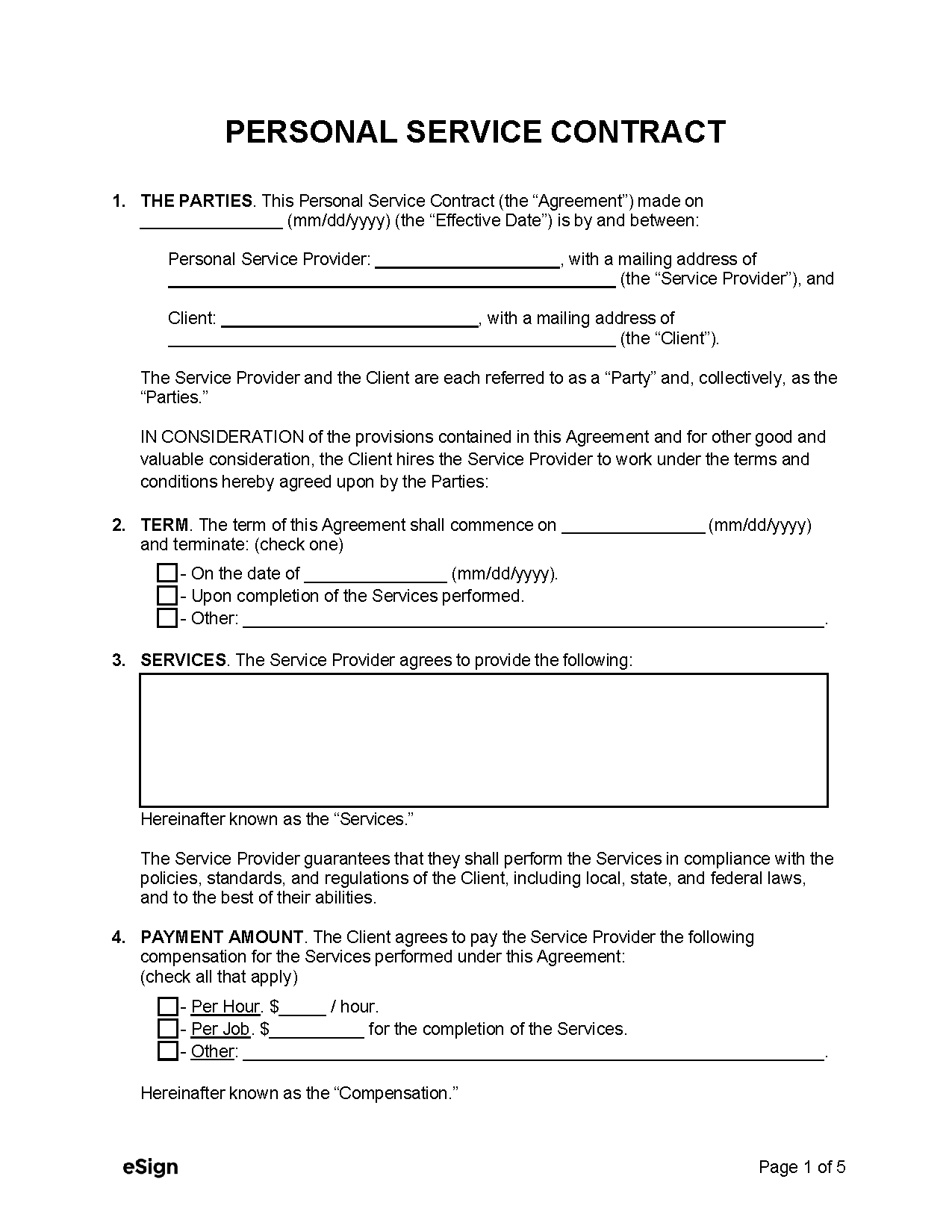

PERSONAL SERVICE CONTRACT

1. THE PARTIES. This Service Contract (the “Agreement”) made on [MM/DD/YYYY] (the “Effective Date”) is by and between [SERVICE PROVIDER NAME], with a mailing address of [SERVICE PROVIDER ADDRESS] (the “Service Provider”), and [CLIENT NAMES], with a mailing address of [CLIENT ADDRESS] (the “Client”).

2. TERM. The term of this Agreement shall commence on [MM/DD/YYYY] and terminate on the date of [MM/DD/YYYY].

3. SERVICES. The Service Provider agrees to provide the following: [DESCRIBE SERVICES TO BE PERFORMED]. Hereinafter known as the “Services.”

4. PAYMENT AMOUNT. The Client agrees to pay the Contractor $[RATE]/Hour for the Services. Hereinafter known as the “Compensation.”

5. PAYMENT METHOD. The Client shall pay the Compensation every week, beginning on [MM/DD/YYYY].

6. INDEPENDENT CONTRACTOR STATUS. The Service Provider, under the code of the Internal Revenue Service (IRS), is an independent contractor and neither the Service Provider or their employees or contract personnel are, or shall be deemed, the Client’s employees.

7. ADDITIONAL TERMS AND CONDITIONS. [ADD ADDITIONAL INSTRUCTIONS, TERMS, CONDITIONS].

IN WITNESS WHEREOF, the Parties hereto agree to the above terms and have caused this Agreement to be executed in their names.

Client’s Signature: _________________________ Date: _______________

Printed Name: _________________________

Service Provider’s Signature: _________________________ Date: _______________

Printed Name: _________________________