An accountant/bookkeeping engagement letter is a legal document between a client and a person hired to provide tax preparation and financial services on their behalf. It commonly includes the hourly pay, retainer amount, and the scope of work to be performed.

Once signed, both parties will be legally bound to the engagement letter. It is commonly required before an accountant or bookkeeper devotes time to a client’s request.

Contents |

When to Use an Accountant Engagement Letter

After receiving a client’s details through an intake form, an accountant can write a contractual agreement using an engagement letter. The letter must be signed in advance so that the accountant is protected against the client demanding services that go beyond the original agreement or simply not paying the amount owed. Even if the accountant has previously worked for the client, they will generally send an engagement letter before any new work is begun.

Auditing and Financial Statements

There are three ways that accountants will prepare financial statements for companies:

- Audited Statement – An independent report of a company’s accounts, contracts, procedures, and potential legal concerns (e.g., fraud, tax evasion). The accountant will be required to confirm the company’s financial records by requesting information from clients, associated businesses, institutions, and other third parties. Public companies are legally required to have their financial statements audited in this manner.

- Reviewed Statement – A statement given after the company’s financial statements are reviewed to determine whether they require any modification. No third-party verification is required; however, the company’s contracts, board minutes, legal records, and other documentation may be analyzed.

- Compiled Statement – A company’s financial records are delivered to an accountant who correctly formats them to current standards. This compilation is a basic summary that requires no verification and is usually used to disclose financial information to investors.

Only certified public accountants (CPAs) can prepare financial statements for submission to Securities and Exchange Commission (SEC).

What’s Included

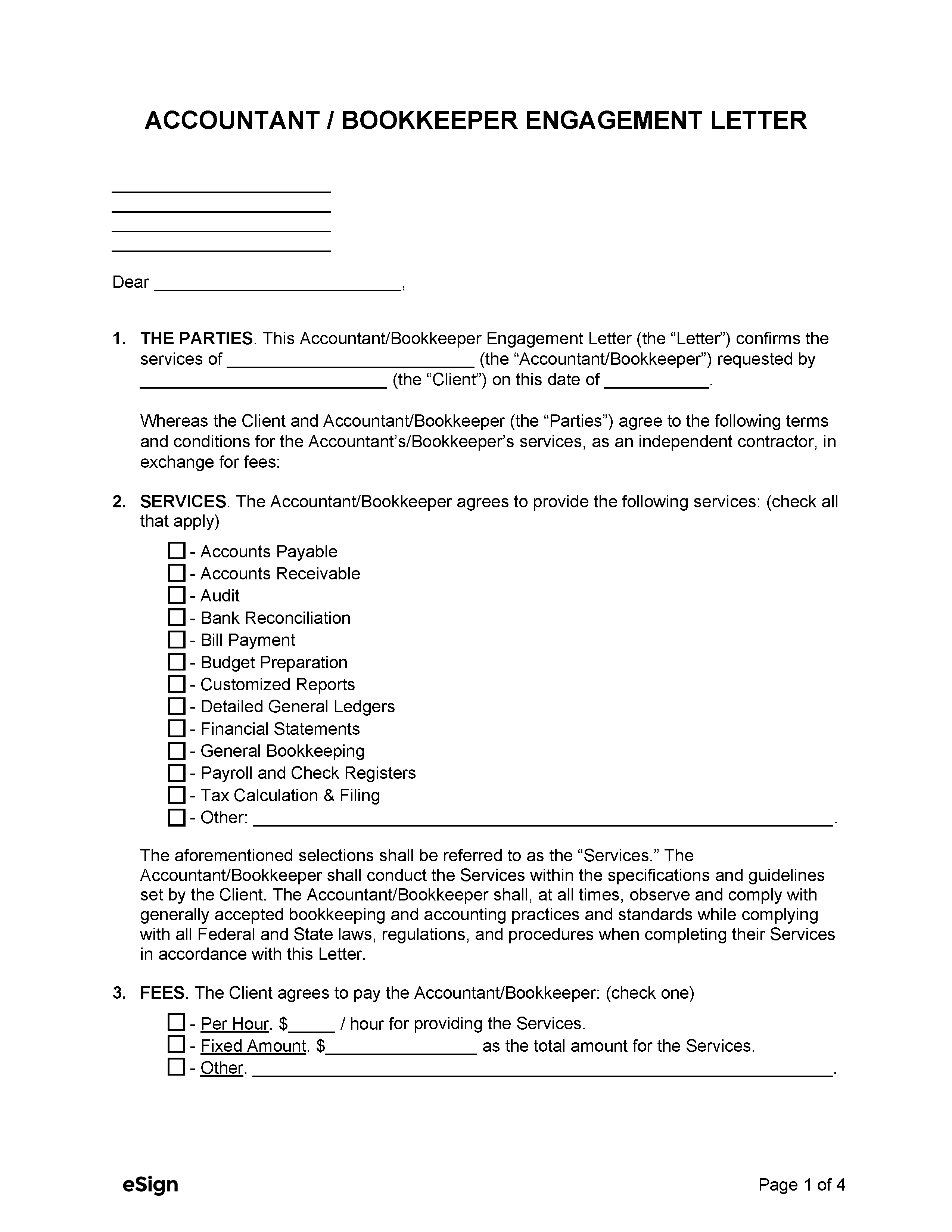

An accountant/bookkeeper engagement letter is an official document that needs to include specific information to be legally binding and valid. The below terms, information, and authorization will generally be required.

Contact Information

The names and addresses of the accountant/bookkeeper and the client will be listed in the letter. If the hired party is an accountancy firm, the name of the accountant or bookkeeper working on the contract will also be provided.

Duration

An engagement letter will indicate the duration of the agreement, which may be for a defined period, on an ongoing basis, or another arrangement by which it ends or is renewed. The signing date of the letter must be earlier than the agreement start date.

Services

By clearly stating each service provided under the contract in as much detail as possible, the accountant cannot be expected to provide any additional services outside the scope of the agreement.

Compensation

The letter will need to specify how much the accountant will be paid and when. Compensation may be an hourly rate, flat fee, or a combination of the two. Payment may be scheduled on a particular date, upon the completion of the services, or on a recurring basis.

Client Obligations

In addition to the accountant’s services and responsibilities, the contract will also detail the client’s responsibilities, which include providing financial information and taking responsibility for said information’s accuracy.

Signatures

An engagement letter is a legal document and requires both parties’ signatures and signing dates to be valid.

Why It’s Important

The drafting and delivery of an engagement letter is necessary to accomplish the following:

- Avoid scope creep – By clearly defining the scope of their services, the accountant can negotiate additional fees for any work beyond the limits of the contract.

- Limit risk and liability – Having clients sign a legally binding document reduces the risk of bad business relationships and avoids certain liabilities if there is a conflict.

- Present a professional front – Sending an engagement letter to clients shows the service provider’s professionalism and expectations regarding their work and compensation.

- Predict income and schedule – With committed contracts, an accountant can reliably plan their schedule and budget in advance.

- Reduce misunderstandings – The accountant minimizes any misunderstandings by clearly providing all relevant details regarding their services and payment.

Accountant/Bookkeeper Certification

An accountant/bookkeeper license isn’t required to provide bookkeeping services or prepare a compiled financial statement. However, only licensed CPAs are permitted to prepare audited and reviewed statements and file reports with the SEC. Accountant certification also isn’t required to prepare taxes, except in the following states:

- California

- Connecticut

- Illinois

- Maryland

- Nevada

- New York

- Oregon

To act as a taxpayer’s representative, the accountant must be a CPA, registered tax agent, or attorney.

Certification requirements vary depending on the jurisdiction, and generally include work experience, training, and a bachelor’s degree. Although a license isn’t required to work as a professional bookkeeper, there are nationally-recognized certifications that may help improve employment opportunities.

The most common accountant and bookkeeper licenses are listed below.

Accountant Licenses

- Certified Public Accountant (CPA)

- Certified Management Accountant (CMA)

- Certified Internal Auditor (CIA)

- Certified Information Systems Auditor (CISA)

Bookkeeper Licenses

- Certified Public Bookkeeper (CPB)

- Certified Bookkeeper (CB)

- Certified Payroll Specialist (CPS)

- Certified Quickbooks Advisor (CQA)