State Laws

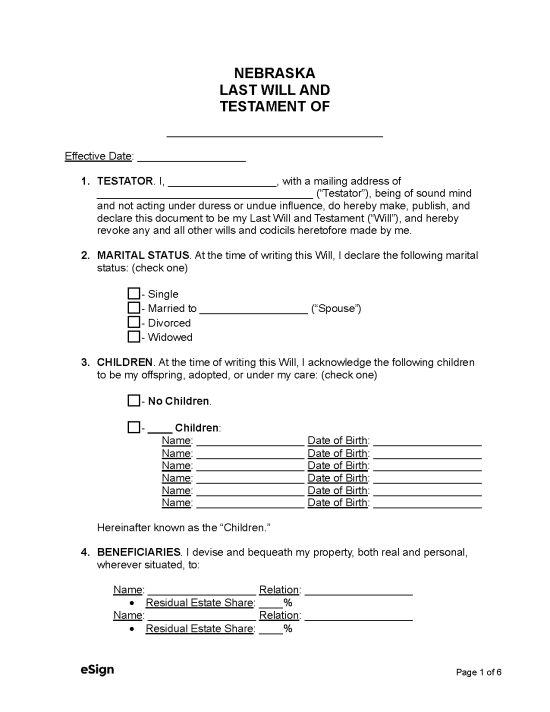

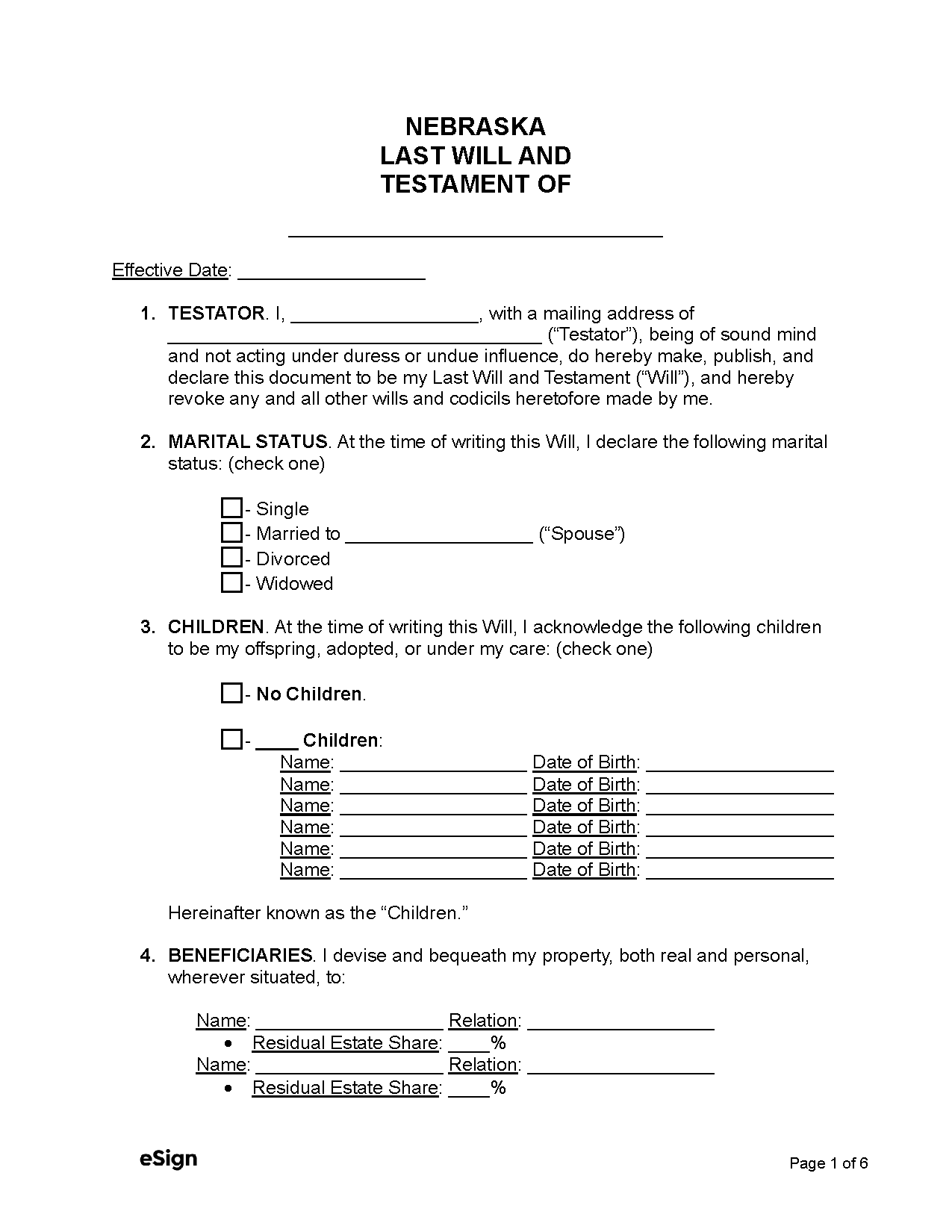

A testator must be 18 years or older and of sound mind.[1]

Holographic Wills – A handwritten will must be signed and dated by the testator and in their handwriting. Witnesses are not required for handwritten wills.[2]

Revocation – A will may be revoked if it is destroyed or if a new will is created that expressly revokes, or is inconsistent with, the original.[3] Additionally, the divorce or annulment of a testator’s marriage revokes any provisions affecting the former spouse (or their relatives).[4]

Signing Requirements – A will is only valid if signed by the testator and two witnesses (whether disinterested or not).[5] However, without at least one disinterested witness, an interested witness can only receive as much as they would by law if the decedent left no will.[6]

Probate Process in Nebraska (8 steps)

An estate must be entered into probate within three years of the decedent’s death.[7] It should be noted that this guide is for informal probate, the simpler and more common procedure; formal probate will require additional documents and steps not included here.

- File Application

- Mail Notices

- Accept Appointment

- Open Estate Account

- Create Inventory

- Pay Inheritance Taxes (If Applicable)

- Close Estate

- Petition for Order of Settlement (Optional)

The following is meant to be a general overview of the probate process. It is recommended that executors/personal representatives consult with an attorney if they’re unsure of any step.

1. File Application

Probate may be avoided if the estate’s total value is not greater than $100,000. If eligible, the Affidavit for Transfer of Personal Property without Probate, commonly referred to as a “small estate affidavit,” may be used to collect and distribute the decedent’s estate.[8]

Probate is typically initiated by the personal representative named in the will. To begin, the personal representative must file the will and supporting documents listed below with the court registrar of the county where the decedent passed[9]:

- Application for Informal Probate and Appointment of Personal Representative – This document must include information regarding the decedent, the personal representative, and the will.[10] It should be filed at least 120 hours after the decedent’s passing.[11]

- Original Last Will & Testament – The original or authenticated will must be delivered to the court within ten days of the Application for Informal Probate’s filing.

- Filing Fee – A $22 filing fee must be paid when opening an informal probate.[12]

2. Mail Notices

Upon approval of the Application for Informal Probate, the court will issue a Registrar Statement and publish a Notice of Appointment & Notice to Creditors in a newspaper circulating in their county.[13] The notices inform any claimants that claims must be submitted within two months of first publication, after which they will be invalid.

Both notices will be provided to the personal representative, who must mail them to interested persons within five days of publication.[14],[15] An Affidavit of Mailing Notice for each notice must be filed with the court afterward.

If the decedent is 55 years or older or stayed in a medical institution, the Notice to Creditors should be delivered along with the decedent’s social security number (and that of any surviving spouse) to the Department of Health and Human Services via e-mail or mail.

3. Accept Appointment

An Acceptance of Appointment must be filed with the court before the personal representative is authorized to administer the estate.[16],[17] The personal representative must also post bond, unless waived by the will or all of the will’s beneficiaries.[18] A surety for a bond can be obtained via the following providers:

Once the Acceptance of Appointment is filed and a bond is provided (if applicable), the court will issue the Letters of Personal Representative, and the personal representative may begin their duties.

4. Open Estate Account

The personal representative should begin administration by opening an estate bank account for depositing estate funds and paying any debts or taxes. A Tax Identification Number will need to be obtained, which may be done online or by mailing the Form SS-4 to:

Internal Revenue Service

Attn: EIN Operation

Cincinnati, OH 45999

The Notice of Fiduciary Relationship Form 56 will also need to be mailed to notify the IRS of the personal representative’s authority over the estate.

5. Create Inventory

Within three months of being appointed, the personal representative must create an Inventory of the estate and file it with the court.[19] If necessary, they may employ appraisers to ascertain the fair market value of any of the decedent’s assets or property.[20] Copies of the Inventory should be sent to any interested persons upon request.

6. Pay Inheritance Tax (If Applicable)

Nebraska is one of six states that charge an inheritance tax. This tax is due within 12 months.[21] The court will issue an order determining the inheritance tax owed, calculated as follows[22]:

- Immediate relatives – Transfers to immediate relatives (and their spouses and descendants) are subject to a 1% tax on anything over $100,000.[23]

- Remote relatives – Transfers to remote relatives (e.g., aunts, uncles, nephews, and their spouses/descendants) are subject to an 11% tax on anything over $40,000.[24]

- Other heirs – Transfers to all other heirs are subject to a 15% tax on anything over $25,000.[25]

All amounts under the taxable amount are exempt; for example, if the decedent’s child receives $101,000, they would be taxed 1% of $1,000. No inheritance tax is levied on transfers to a decedent’s spouse, relatives under 22, or to non-profit organizations.[26]

Before the estate’s distribution, the personal representative must deduct any applicable taxes, and within 30 days, pay them to the county treasurer.[27],[28] The Estate County Inheritance Tax Report must also be provided to the county treasurer after the estate’s distribution.[29]

7. Close Estate

After an estate’s distribution, a Verified Statement may be filed if at least five months after the personal representative’s appointment and four months after the Notice to Creditors‘ publication has passed.[31] Creditors and beneficiaries must receive a copy of the Verified Statement, and beneficiaries must receive a copy of an Account that lists all estate-related transactions. The personal representative is discharged if the Verified Statement is uncontested after one year of filing.

8. Petition for Order of Settlement (Optional)

Instead of filing a Verified Statement, the personal representative may petition for a court hearing and Order of Settlement, which will allow them to be discharged of their duties right away. The petition must be made one year after their appointment and after the period for creditors to submit claims has passed.[32]

The petition can be submitted with an Account of the administration, or a distribution proposal, and beneficiaries must be given a notice of the petition and hearing. If approved, the estate can be distributed and the personal representative will be discharged from their duty.

The personal representative may also file a verified application demonstrating that the estate is uncontested after they have been discharged. If filed, the registrar will provide a certificate to show that the estate’s administration is completed.[33]

Sources

- § 30-2326

- § 30-2328

- § 30-2332

- § 30-2333

- § 30-2327

- § 30-2330

- § 30-2408

- § 30-24,125

- § 30-2410

- § 30-2414

- § 30-2420

- § 33-125

- § 30-2483

- § 30-2415

- § 25.520.01

- § 30-2444

- § 30-2403

- § 30-2446

- § 30-2467

- § 30-2468

- § 77-2010

- § 77-2018.01

- § 77-2004

- § 77-2005

- § 77-2006

- § 77-2007.04

- § 77-2011

- § 77-2014

- § 77-2015

- § 77-2018.02

- § 30-24,117

- § 30-26,116

- § 30-24,121