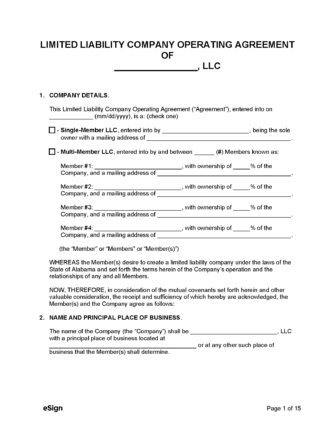

An Alabama LLC operating agreement is a document that records the agreed-upon policies, regulations, and structure of a newly-created limited liability company. An operating agreement outlines major aspects of the company’s internal affairs and aids in separating the entity from its owners. It also clarifies the company’s policies from the scheduling of annual meetings and member voting to the distribution of company assets.

Once completed, the form answers the questions to many “what-if” scenarios, such as adding additional members, the death of a member, and the sale or transfer of a member’s ownership. Without such an agreement in place, obtaining outside investments or loans can be markedly difficult, if not impossible.

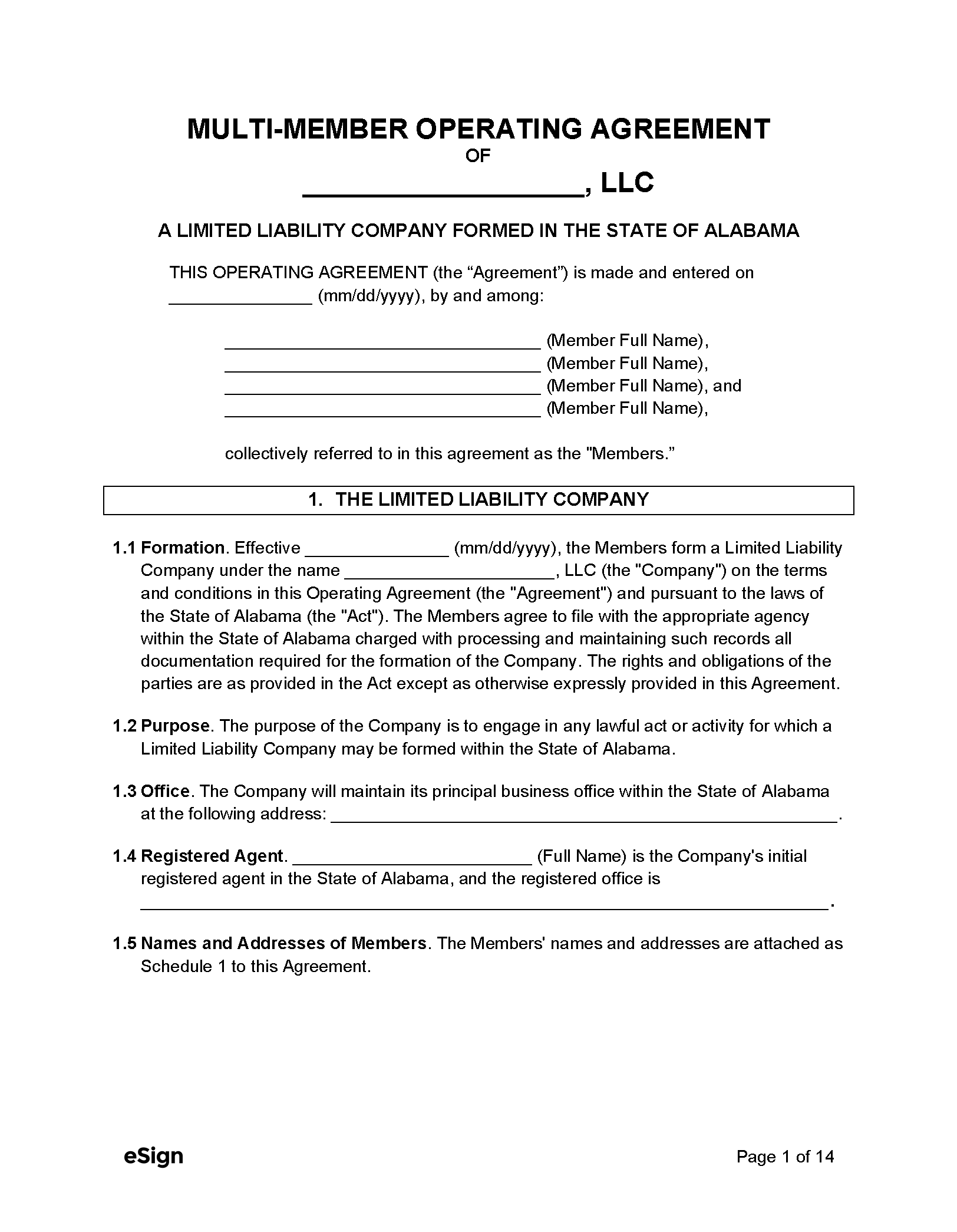

Is an Operating Agreement Required?

No, in Alabama an operating agreement is not legally required to be completed. Although, it is recommended to have this agreement to protect the ownership interest of members.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 10A, Chapter 5A

- Definitions: § 10A-5A-1.02

- Formation: § 10A-5A-2.01

- Naming of LLCs: § 10A-1-5.06

How to File (5 Steps)

- Step 1 – Reserve the Entity’s Name

- Step 2 – File the Certificate of Formation

- Step 3 – Create an Operating Agreement

- Step 4 – Obtain an EIN

- Step 5 – File Business Privilege Tax Return

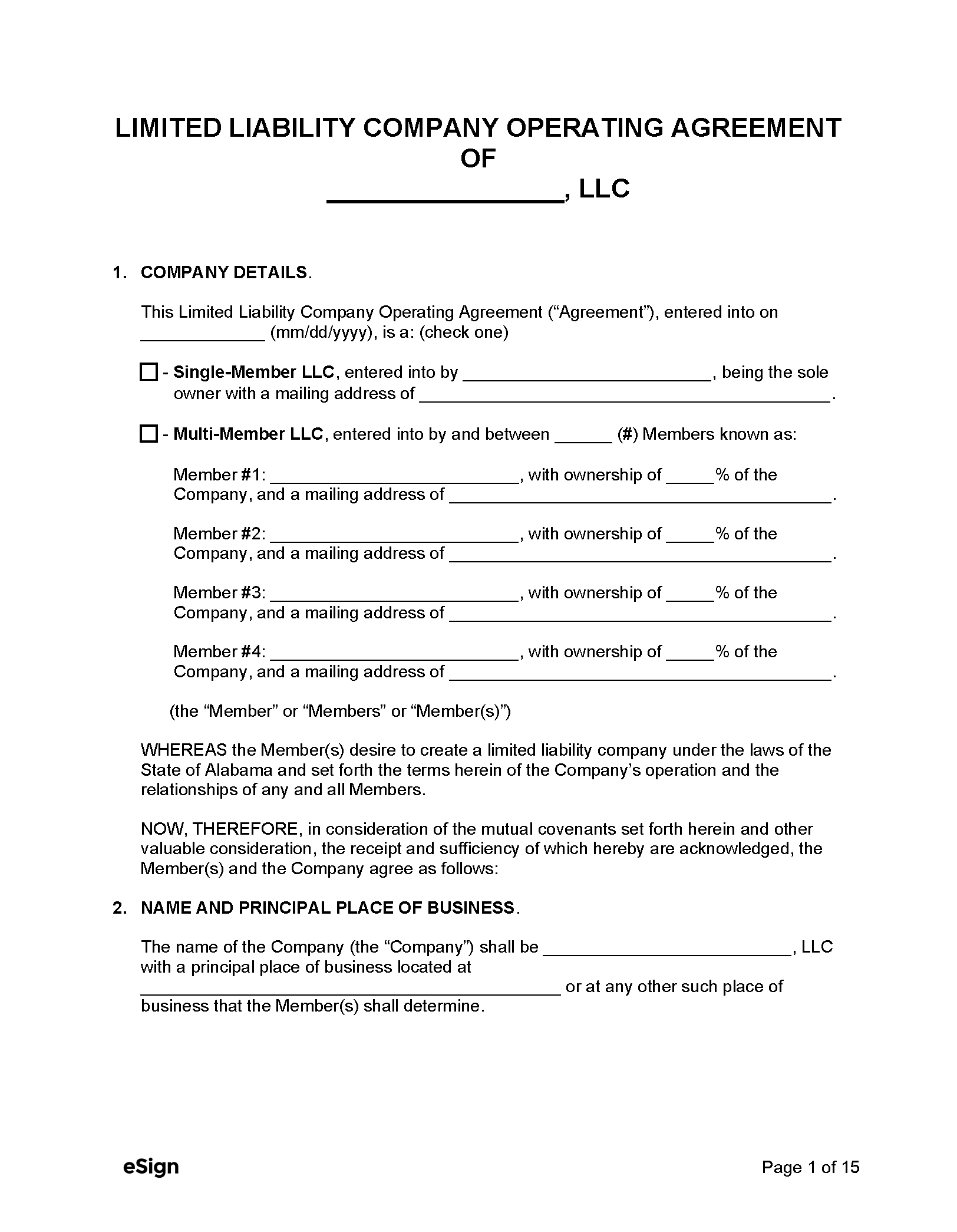

Step 1 – Reserve the Entity’s Name

The name of the LLC must not already be registered by another entity in the state in order to be used. Go to the Secretary of State Business Search and search for potential entity names.

As per § 10A-1-5.06, the entity name must contain “Limited Liability Company,” “L.L.C.,” or “LLC” (most popular).

Once a suitable name has been found, the name must be reserved. Name reservations can be made online OR by mail.

- Online: Go to the Secretary of State Online Services page.

- Cost: $28.00 for Non-Subscribers (credit card only) and $27.00 for Subscribers (ACH accounts only).

- Mail: Complete the Name Reservation Request Form (Domestic | Foreign)

- Cost: $25.00 (payment options include check, money order, or credit card).

- Mail to: PO Box 5616, Montgomery, AL 36103.

Step 2 – File the Certificate of Formation

This step is what makes the business legitimate in the eyes of Alabama law. Filing can be completed online (in some counties) or by mail.

Method 1 – Online

Head to the Secretary of State Online Services and click Continue to application.

- Cost: For domestic filings, the cost is $208 ($100 county fee + $100 Secretary of State fee + $8 filing fee). For foreign filings, the cost is $156 ($100 Secretary of State fee + $6 filing fee).

Method 2 – Mail

The process for filing via mail varies depending on if the LLC is a brand new entity being formed in Alabama (domestic) versus one that already exists out-of-state (foreign).

Domestic Companies

- Download the Domestic LLC Certificate of Formation. Complete it in full. It must be TYPED (not handwritten).

- Make one (1) copy of the completed and signed form.

- Attach a copy of the name reservation certificate (from Step 1).

- Attach a self-addressed, stamped envelope.

- Include a $200 check/money order payable to the “Alabama Secretary of State” OR provide bank or credit card details on the form.

- Mail the entire filing package to: Secretary of State, Business Services, PO Box 5616, Montgomery, Alabama 36103-5616.

Foreign Companies

- Download and complete the Foreign LLC Application for Registration. All information must be TYPED into the form (handwriting is prohibited).

- Make one (1) copy of the completed form.

- Attach a copy of the name reservation certificate (see Step 1).

- Attach a self-addressed + stamped envelope.

- Include a check/money order for $150 (make payable to the “Alabama Secretary of State”) OR write the necessary bank or credit card information into the form.

- Mail everything to: Secretary of State, Business Services, PO Box 5616, Montgomery, Alabama 36103-5616.

Note on Registered Agents:

The Secretary of State requires a registered agent to be nominated. A registered agent is a person that will collect documents and other important notices on behalf of the LLC. The registered agent must be:

- Eighteen (18) years or older and be a resident of Alabama (if a person);

- Available during standard business hours; and

- Have an address in the state (for receiving said documentation).

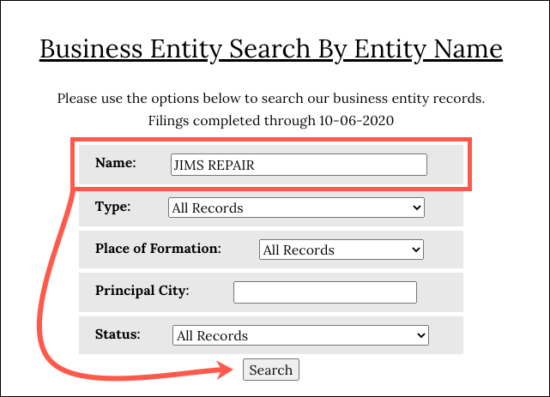

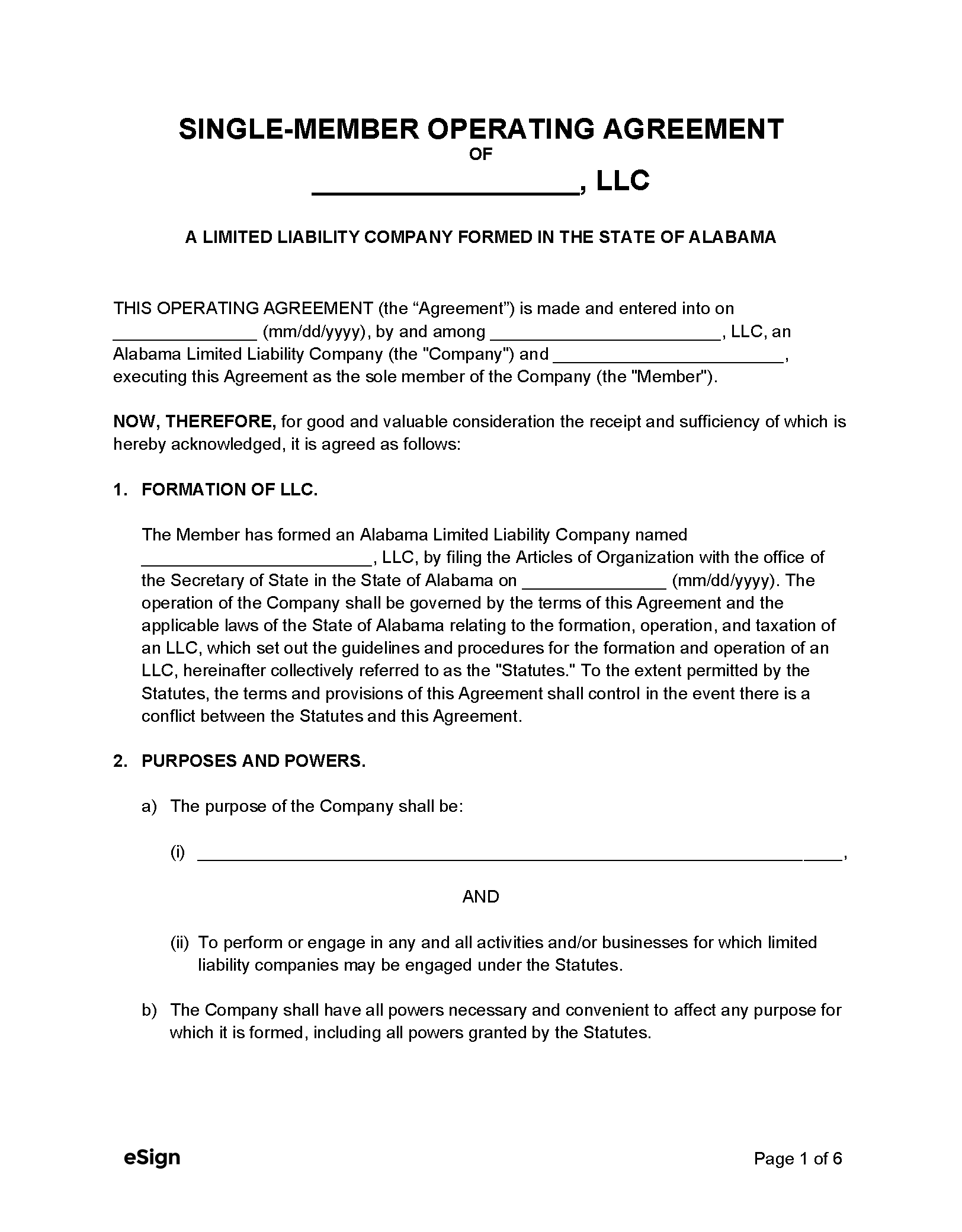

Step 3 – Create an Operating Agreement

The state of Alabama does not require LLCs to have an operating agreement. Regardless of this fact, completing one is highly recommended for improving the organization of the company.

Step 4 – Obtain an EIN

While not a requirement for all LLCs, those that intend to open a business bank account, apply for a loan, or acquire certain business licenses will need to apply for an EIN (Employer Identification Number). Applications must be made after the LLC filing (Step 2) has been approved (search the state’s entity database to check for approval). An EIN can be obtained from the IRS online or by mail.

- Online: Head to this page and click Apply Online Now.

- Mail: Complete Form SS-4 (see mailing information).

Step 5 – File an Initial Privilege Tax Return

Newly-formed LLCs must file an Initial Privilege Tax Return (Form BPT-IN) and pay the tax reported on the return within the first two and a half (2.5) months after the date of qualification to do business in Alabama.

- Complete the most current version of the Initial Privilege Tax Return (Form BPT-IN). Other versions are available here.

- Use the preparation instructions if assistance is needed when filling out the return.

- If filing the return by mail, complete Form BPT-V and attach a check for the amount of tax due. Make the check payable to the “Alabama Department of Revenue.”

- Submit the tax return to the Alabama Department of Revenue.

- Online – Scan the tax return and upload it to the MAT online service (requires an account). Pay the tax using a credit card or ACH account.

- Mail – Mail all items to: Alabama Department of Revenue, Business Privilege Tax Section PO Box 327320, Montgomery, AL 36132-7320.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|