Mississippi law does not require the creation of an operating agreement; however, without the agreement, state law will govern the operations of the LLC, and the company owners will take on more personal liability.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 79, Chapter 29

- Definitions: § 79-29-105

- Formation: § 79-29-201

- Naming of LLCs: § 79-29-109

How to File (6 Steps)

- Step 1 – Choose the Entity’s Name

- Step 2 – Select a Registered Agent

- Step 3 – Filing a Certificate of Formation

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Report

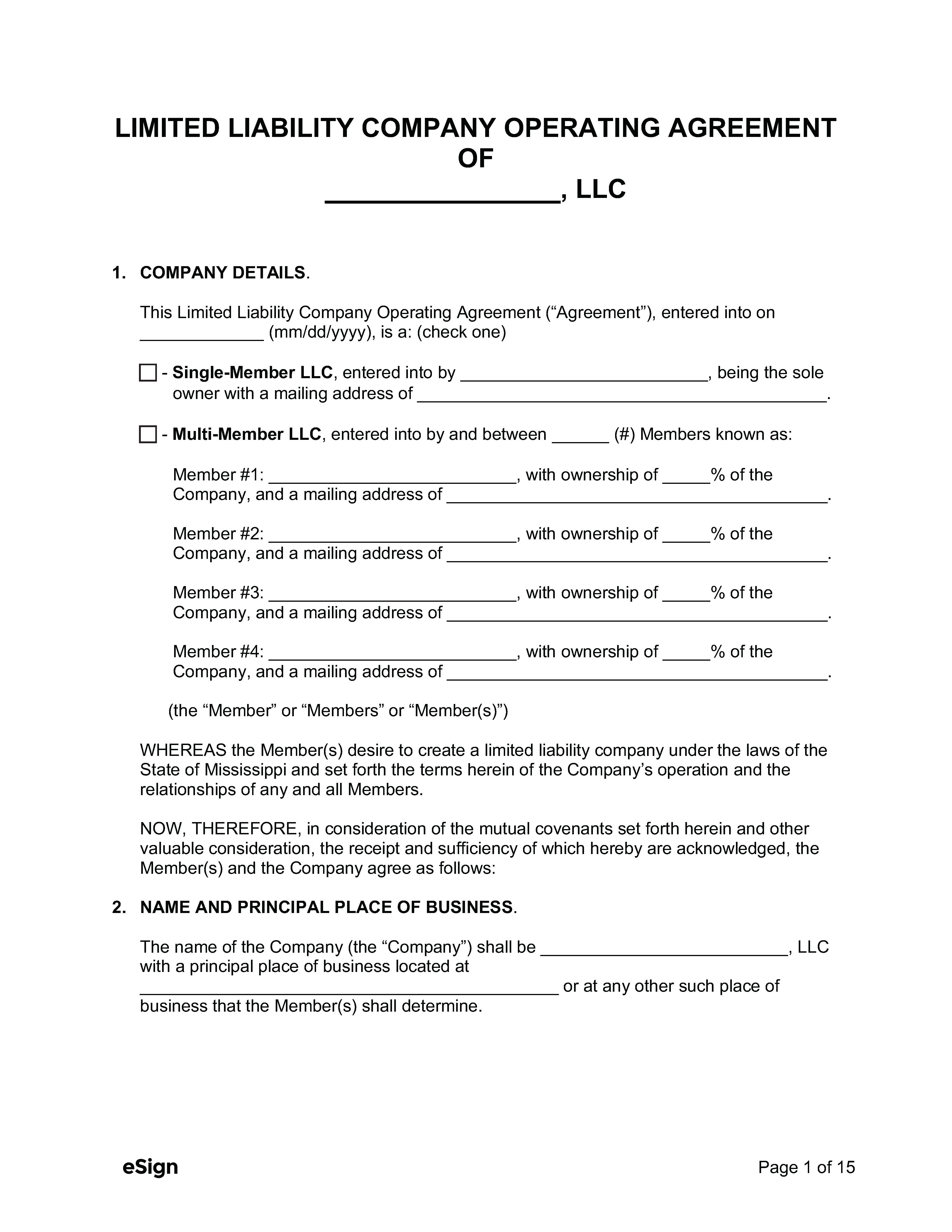

Step 1 – Choose the Entity’s Name

Mississippi requires that every LLC operate with a name that is unique and distinguishable from other registered LLC’s; therefore, a Business Name Search should be done to verify the LLC’s uniqueness.

Note on LLC Names:

In accordance with § 79-29-109(1)(d), no LLC name may include any of these words: “bank,” “banker,” “bankers,” “banking,” “trust company,” “insurance,” “trust,” “corporation,” “incorporated,” “partnership,” “limited partnership.”

Furthermore, it must include either “limited liability company,” “L.L.C.,” or “LLC.”

Online registration with the Mississippi Secretary of State must be completed prior to reservation of the name, and to submit any other necessary documentation. Once a suitable name has been chosen, it may be reserved for 180 days via an Application for Name Reservation. The fee for name reservation is $25 for domestic LLCs and $50 for foreign LLCs.

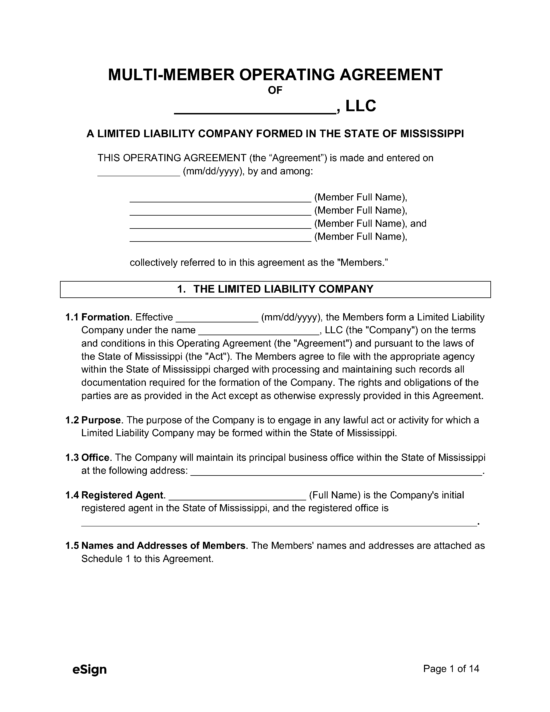

Step 2 – Select a Registered Agent

LLC’s in Mississippi must select a registered agent to accept legal documents on the company’s behalf. The selected agent may be a resident of Mississippi or an entity authorized to do business in the state. The registered agent must have a physical street address in Mississippi.

Step 3 – Filing a Certificate of Formation

To form a limited liability company in the state of Mississippi, a Certificate of Formation must be filed with the Secretary of State, detailing the information stated above, the names and signatures of all owners, and the type of business as defined by its NAICS code. Foreign LLCs must file a Certificate of Authority with the Secretary of State.

The documents must be filed online through the Mississippi Secretary of State website.

The filing fees are $50 for domestic LLCs and $500 for foreign LLCs.

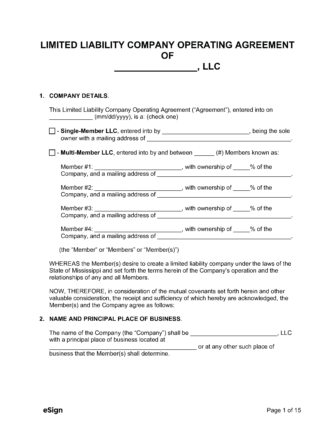

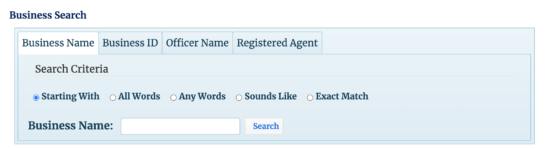

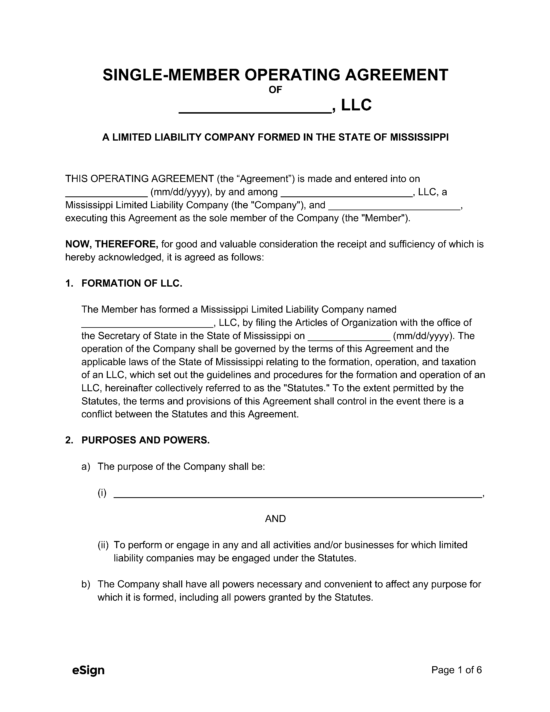

Step 4 – Create an Operating Agreement

An operating agreement allows company owners to detail the internal structure of how their LLC will operate. It provides a clear delineation of each member’s rights and obligations within the company. Therefore, even though it is not required by the state, it is recommended that newly registered limited liability companies draft and execute the agreement as soon as possible after filing the Certificate of Formation with the Secretary of State.

Step 5 – Obtain an EIN

A multi-member LLC is obligated to obtain an Employer Identification Number (EIN) from the IRS. A single-member LLC can skip the process if they don’t plan on hiring employees or being taxed as a corporation. An EIN may be obtained using either of the following methods:

- Online – Click Apply Online Now on the IRS website and follow the prompts.

- Mail – Submit the completed physical Form SS-4 to the IRS.

Step 6 – File Annual Report

An annual report must be submitted between January 1st and April 15th to the Mississippi Secretary of State by every LLC doing business in the state. The report keeps the LLC’s business records up to date with the state.

This report must be completed online and has an administrative fee of $250.

ResourcesFiling Options: Online Costs:

Forms:

Links:

|