By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

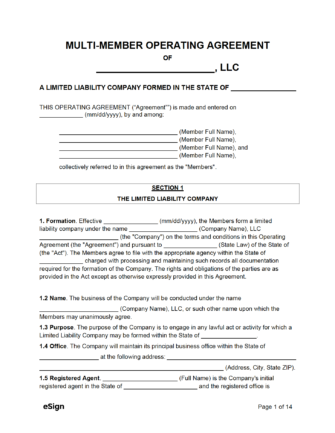

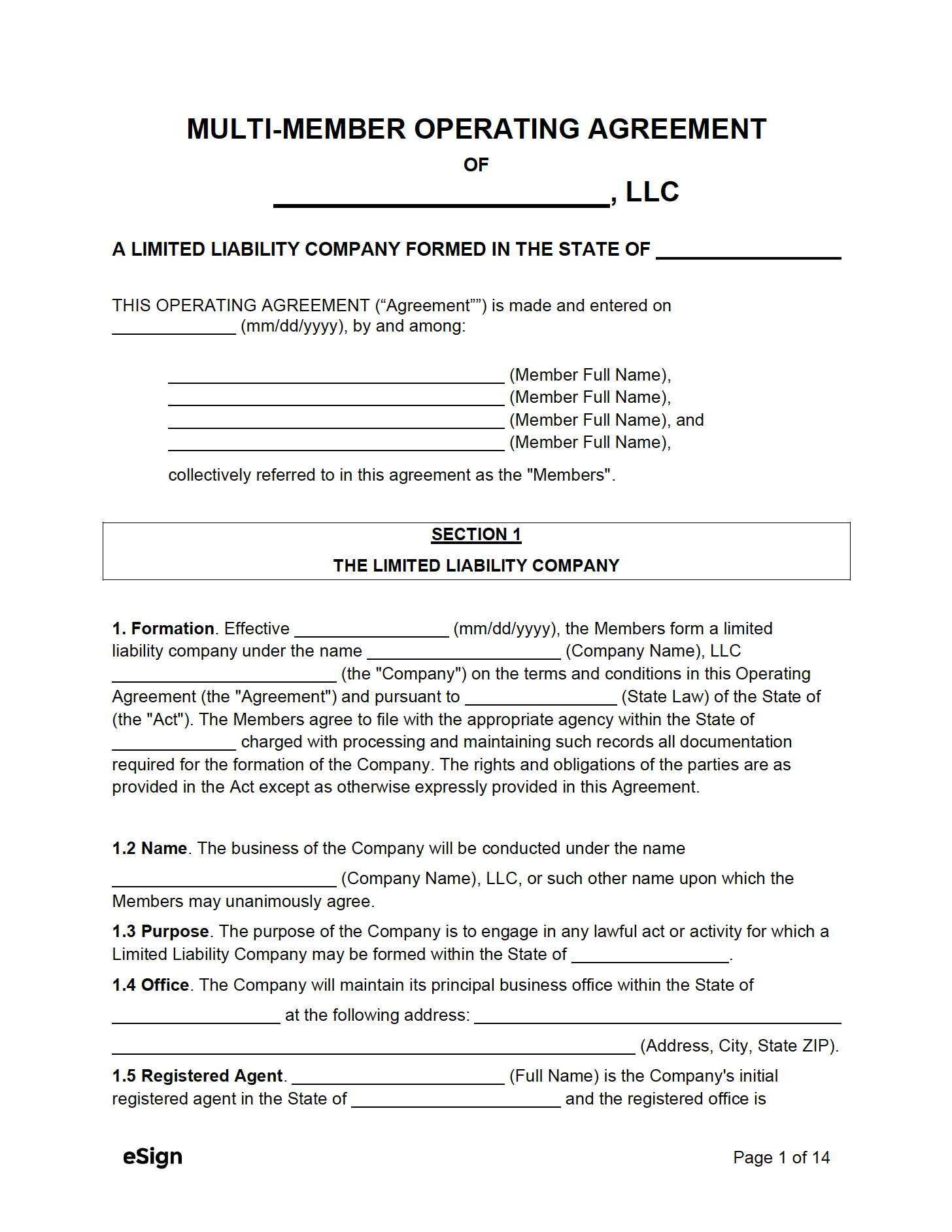

Importance of an LLC Operating Agreement

Executing a multi-member LLC agreement allows the managing members to establish rights and obligations, ensuring rules, procedures, and structure of the LLC are clearly defined.

Without an operating agreement, the entity is governed by the rules and standards listed in the statutes of the state in which it is formed, which may or may not align with the company’s goals.

Typical Operating Agreement Inclusions

- Basic company details (name, formation, office, purpose, registered agent)

- Management structure (member-managed or manager-managed)

- Ownership percentages and capital contributions

- Profit and loss allocation

- Indemnification and limitation of liability

- Manager and member duties, powers, and rights

- Salaries, treatment of taxes, and accounting procedures

- Transfer or sale of a member’s interest

- Division of company interests upon a member’s exit or death

- Dissolution and winding-up procedures

- Amendments and governing law