By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

What is a Multi-Member LLC?

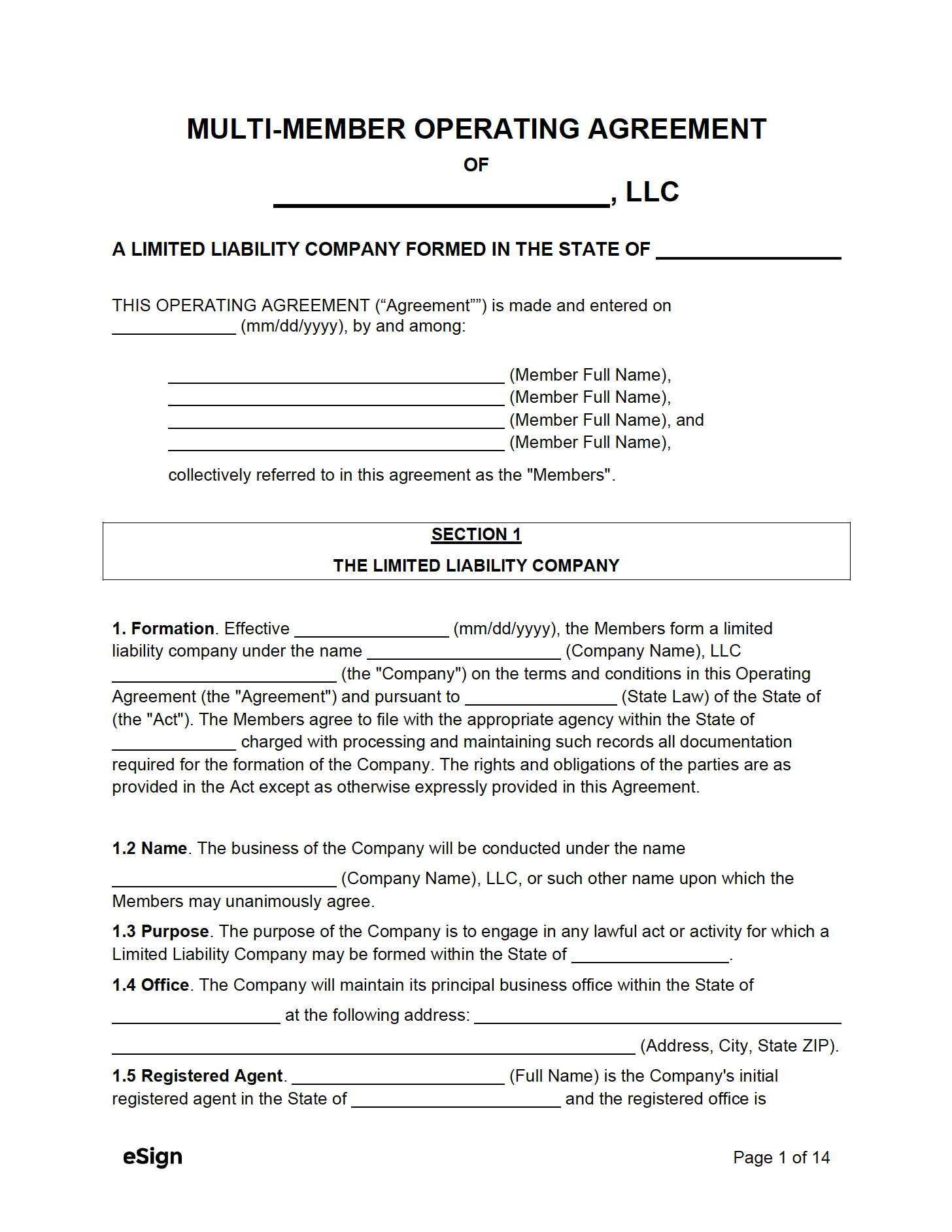

A multi-member LLC operating agreement is a business form used to provide the framework of an LLC where ownership is shared between two (2) or more people.

The agreement is a legally-binding company guide that contains the member structure, ownership, and rules of governance by which all members are bound. The form itself will often vary from one company to the next but in general they all maintain a similar overall structure.

What It Covers

The operating agreement contains the following fundamental sections:

- Basic entity details (name, state of incorporation, founding date, etc.).

- Capital contributions (what each member paid to fund the company).

- Profit and loss allocation.

- Indemnification.

- The duties and powers of managers.

- Salaries, taxes, and accounting.

- Transfer of a member’s interest (ownership).

- Dissolution (closing of a company).

- General company provisions.

- Signatures of all members.

By downloading the form in the Word (.docx) format, one can easily modify the document’s language and add or remove sections. However, if modifications will be made, it is recommended that sections be reworded instead of being deleted altogether; some provisions contain important language necessary for the legal protection of the entity and its members.