If this document is not executed, company policies will fall under state law, and members will be at significantly higher risk should the company face litigation or acquire debts. Therefore, a carefully constructed operating agreement is highly beneficial to LLC owners, despite not being a legal requirement in the state of Nevada.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 86

- Definitions: NRS 86.011

- Formation: NRS 86.201

- Naming of LLCs: NRS 86.171

How to File (6 Steps)

- Step 1 – Reserve the Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File Articles of Organization

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Report (Annual List)

Step 1 – Reserve the Entity’s Name

An LLCs name must be unique and discernable from that of other business entities that are registered with the Nevada Secretary of State. The availability of a name may be verified with the Nevada Business Search.

A selected unique name may be reserved for up to ninety (90) days by filing a Name Reservation Request form with the Secretary of State (address below).

The Name Reservation Request, Consent, or Release form allows entities to give permission to release a reserved name to another entity or to allow another party to use an entity name already on file. The document also allows for expedited processing times. The name reservation may be submitted by mail to the address below.

Secretary of State

202 North Carson Street Carson City,

Nevada 89701-4201

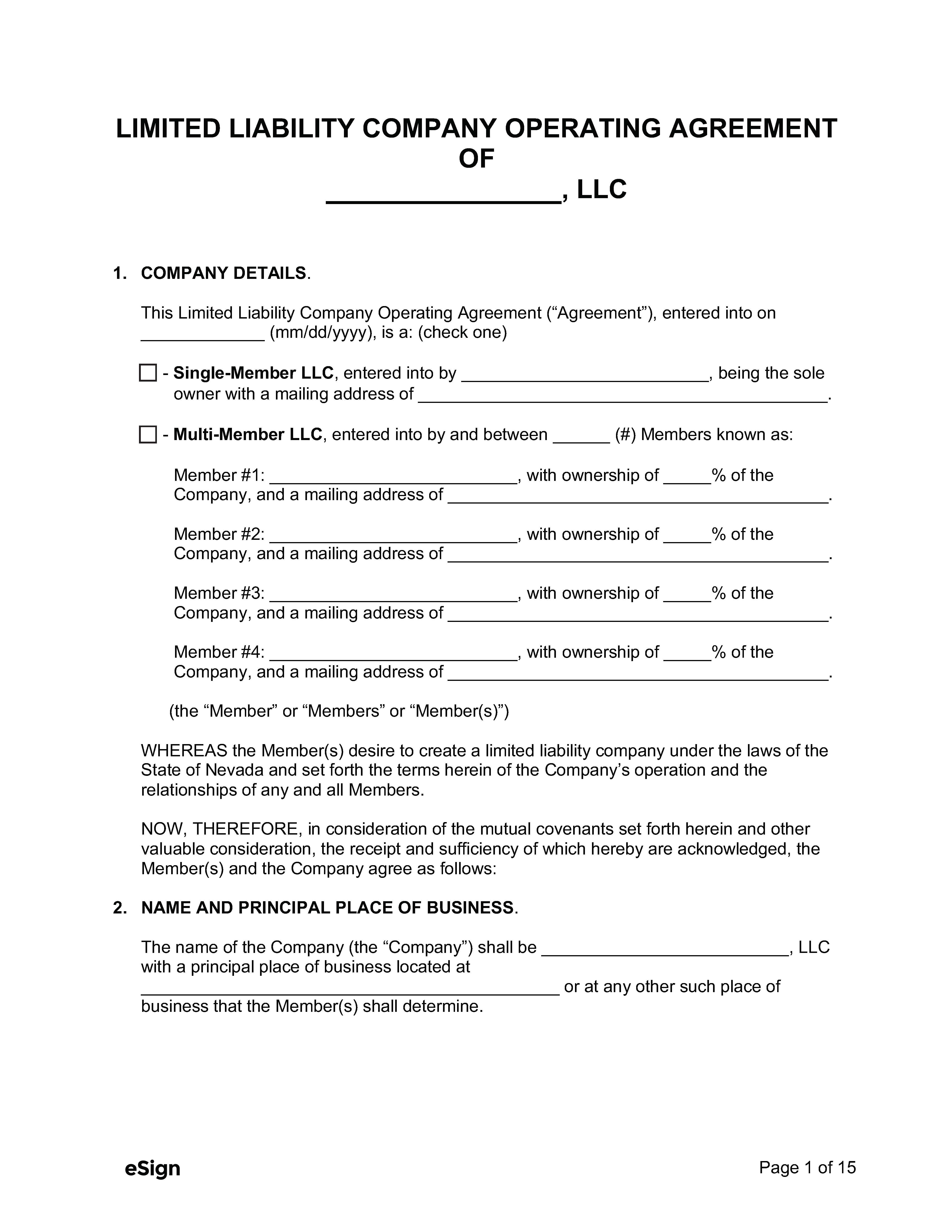

A name reservation may also be carried out online by registering with the SilverFlume portal.

Note on Fees: The name reservation has a filing fee of $25. This process may be expedited for additional fees:

- 24-hour processing: +$50 fee.

- 2-hour processing: +$500 fee.

- 1-hour processing: +$1000 fee.

Step 2 – Select a Registered Agent

Every LLC in Nevada must select an agent for service of process in the state. The registered agent may be an individual resident of the state or a business entity that is authorized to do business in Nevada. The business or individual must agree to accept legal documents on behalf of the LLC.

The state of Nevada provides a list of businesses that provide registered agent services here.

Step 3 – File Articles of Organization

Filing Articles of Organization with the Secretary of State is what forms and legitimizes the limited liability company in the eyes of the state.

Method 1 – Online

For domestic LLCs filing online, a SilverFlume account must be created, Once logged in, the requisite info can be submitted and the fees paid to file the formation documents.

Foreign entities may not file online.

Method 2 – In-Person, Mail, or Fax

Both domestic and foreign entities must download the Formation – Limited-Liability Company form, select the appropriate checkbox (domestic LLC, domestic PLLC, foreign LLC, or foreign PLLC), and fill out the required fields.

Once completed and signed, it may be submitted in-person or by mail to the address below. The application may also be faxed to: 775-684-7138.

Secretary of State

New Filings Division

202 North Carson Street

Carson City, Nevada 89701-4201

Each application should indicate the desired processing speed and include credit card information to pay the required fees.

- Fees:

- Standard processing: $75

- 24-hour processing: additional $25-$125

- 2-hour processing: additional $500

- 1-hour processing: additional $1000

- Acceptance of Registered Agent: $60

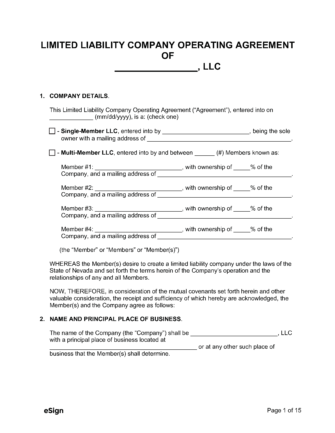

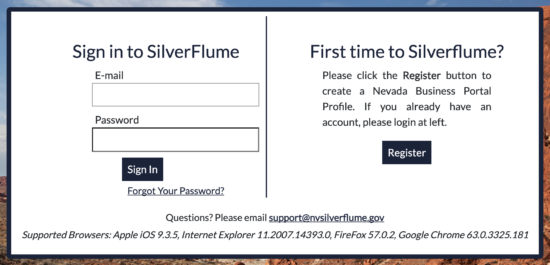

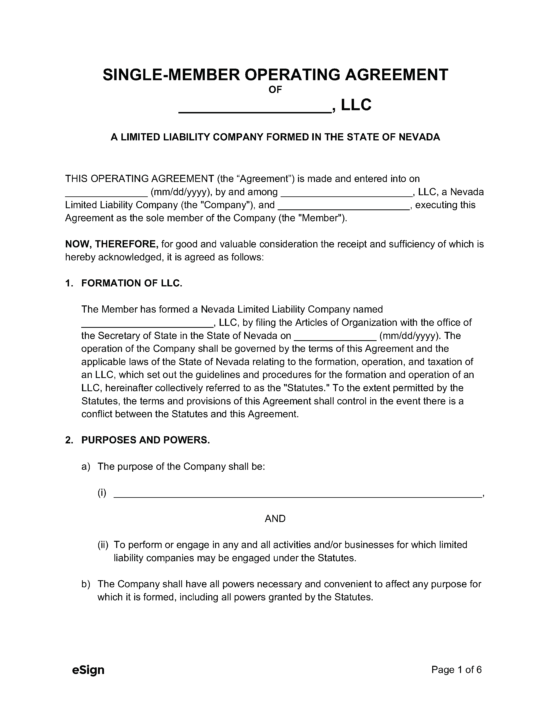

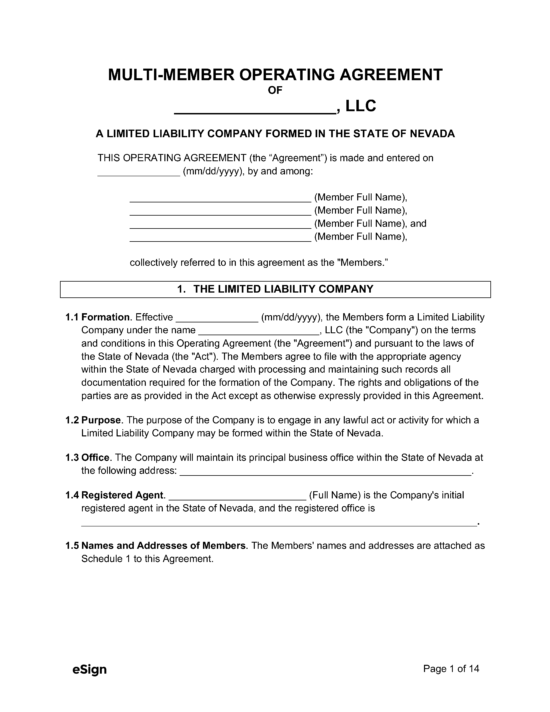

Step 4 – Create an Operating Agreement

The state of Nevada does not require that an operating agreement be executed; however, LLC owners who do elect to create an operating agreement face less liability should the company acquire debts or be sued. The document also allows owners to structure the internal operations of their business as they see fit.

Step 5 – Obtain an EIN

Multi-member LLCs must acquire an Employer Identification Number (EIN). Single-member LLCs may avoid this only if they don’t plan on hiring employees or being taxed as a corporation. The EIN may be obtained via the IRS website application or by mail with Form SS-4.

Step 6 – File Annual Report (Annual List)

Every LLC must provide the state with an annual report which indicates the company president, secretary, treasurer, director, and successor or their equivalents.

The report must be filed by the end of the LLCs registration anniversary month. For example, if the LLC was formed on May 15th, then the annual report must be filed every year by May 31st.

This may be filed with SilverFlume or by paper with the Annual or Amended List and State Business License Application.

ResourcesFiling Options: Online, by fax, in-person, or by mail Costs:

Forms:

Links:

|