A Rhode Island LLC operating agreement is a document that binds the members of a limited liability company to an agreement regarding the ownership structure and internal operations of their company. The contract will include terms that delineate taxation, annual meetings, contributions, management, and distributions. Creating and executing an operating agreement protects the members from personal liability and prevents internal disagreements regarding ownership and financial interests.

Contents |

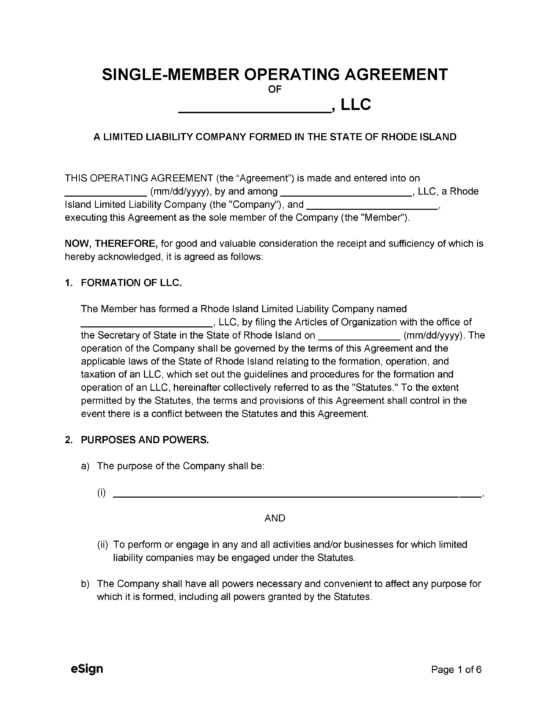

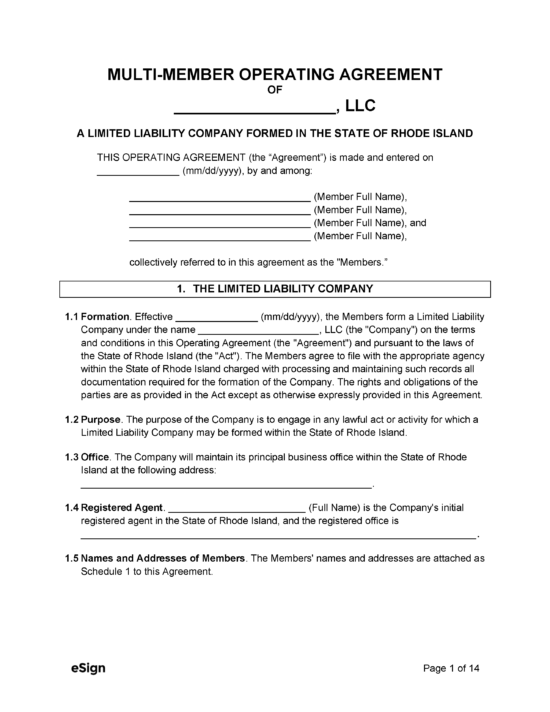

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 7-16

- Definitions: § 7-16-2

- Formation: § 7-16-5

- Naming of LLCs: § 7-16-9

How to File (5 Steps)

- Step 1 – Find a Unique Business Name

- Step 2 – Register LLC with Secretary of State

- Step 3 – Create Operating Agreement

- Step 4 – Obtain an EIN

- Step 5 – Annual Report

Step 1 – Find a Unique Business Name

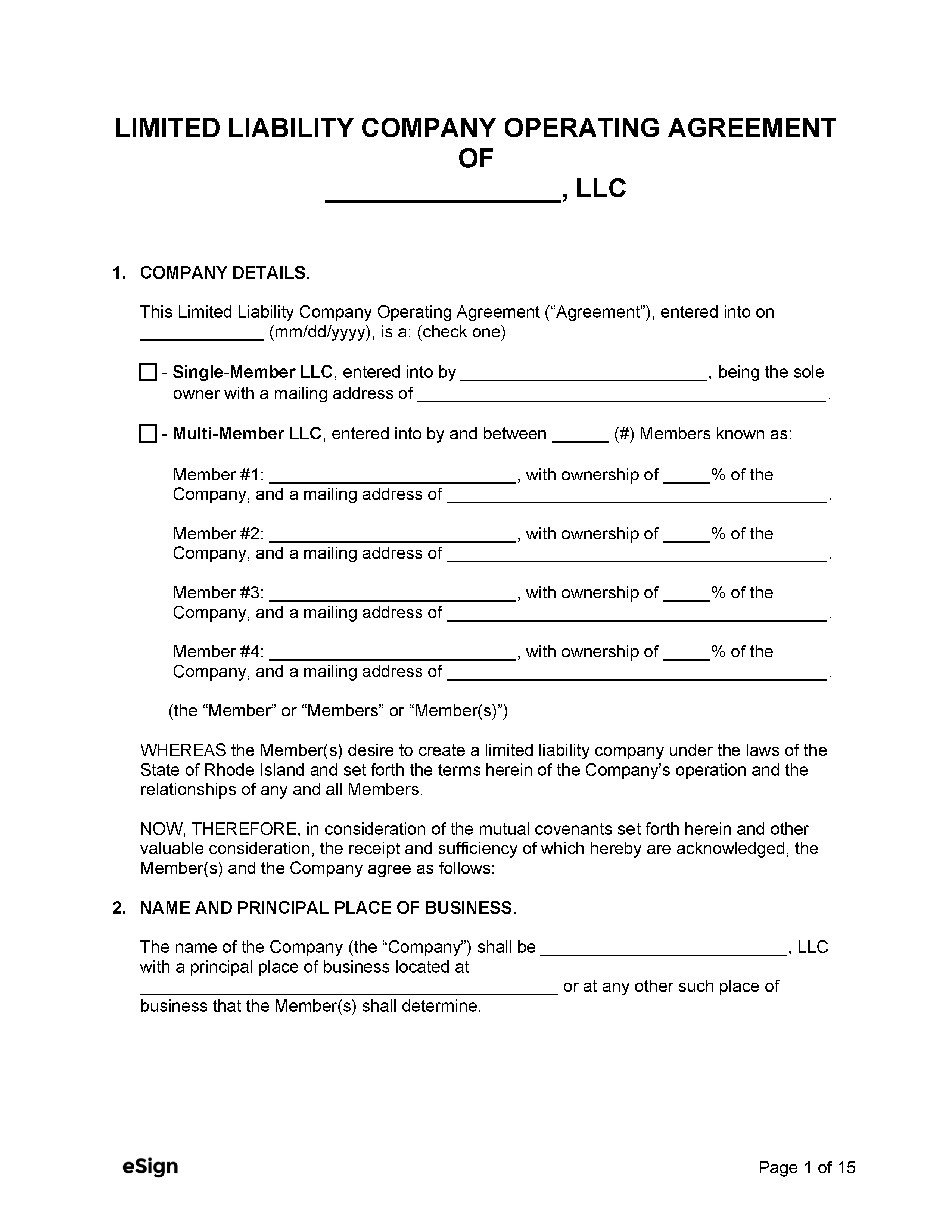

An LLC must select a name for their company that another company has not already registered in Rhode Island. Verify if a chosen name is available by following the steps below.

- Navigate to the Department of State’s Entity Search website.

- Select “Search by entity name.”

- Enter the entity name in the “Enter name” field.

- Select Exact match from the “Search type” menu.

- Scroll to the bottom of the page and click Search.

- If there are any exact matches to the desired name, try another name and repeat the process until a unique name is found.

Note on Name Reservations (optional)

Entity names can be reserved for a period of one hundred twenty (120) days by completing and filing the online Reservation of Name form. The reservation fee is $50.

Step 2 – Register LLC with Secretary of State

Domestic LLCs

Any new company being created in Rhode Island is considered a domestic LLC. Domestic companies are registered after they have filed the Articles of Organization with the Department of State and been accepted. Filing can be completed online, by mail, or in person.

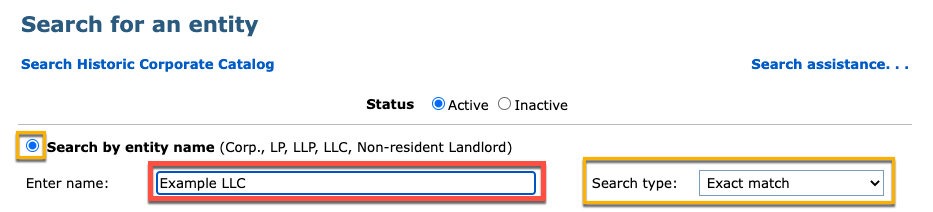

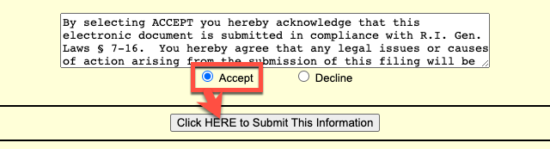

File Online

- Navigate to the Articles of Organization online fillable form.

- Click File New Business Entity.

- Complete the form.

- Select “Accept” to agree to the submission terms before clicking Click HERE to Submit This Information.

- Complete payment of the $150 filing fee (credit card required).

File by Mail / In Person

- Download and complete the Articles of Organization.

- Prepare a filing fee payment of $150 by check or money order payable to the “RI Department of State.” If filing in person, payment may be made by cash or credit.

- Send the Articles of Organization and filing fee payment to the Business Services Division (address below) by mail or go directly to the office and file in person.

Foreign LLCs

A foreign LLC is a company that is already registered in another state and is expanding its operations into Rhode Island. Foreign LLCs register using an Application for Registration and a Certificate of Good Standing from their original jurisdiction. Filing must be completed by mail or in person.

File by Mail / In Person

- Obtain a Certificate of Good Standing (or equivalent document) from the state in which the LLC is already registered.

- Download and complete the Application for Registration.

- Make a check or money order for $150 payable to the “RI Department of State” as payment for the filing fee.

- Mail or hand-deliver the certificate, application, and payment to the below address. If delivery is performed in person, the payment may also be made by cash or credit card.

Office of the Secretary of State

Business Services Division

148 W. River Street

Providence, Rhode Island 02904-2615

Step 3 – Create Operating Agreement

While the Articles of Organization relay a company’s organization for recognition by the state, an operating agreement defines the LLC’s internal structure, rules, and operations. Although the agreement isn’t required, the governance of the LLC will default to state law in the absence of one. Furthermore, an agreement will help define the company as an LLC for tax purposes.

Step 4 – Obtain an EIN

Unless the LLC is a single-member company without employees that doesn’t wish to be taxed as a corporation, they will need to apply for an Employer Identification Number (EIN) from the IRS. The Application for EIN can be filed by mail at the address below or online. There is no application fee.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Step 5 – File Annual Report

Rhode Island LLCs are required to file an annual report with the Department of State to provide updates on their company’s status. The report is due between September 1st and November 1st, starting the year after the LLC was formed. Companies can download the Annual Report and mail or hand-deliver it to the Business Services Division (address below) once completed. The filing fee is $50. Filing can also be completed online.

Office of the Secretary of State

Business Services Division

148 W. River Street

Providence, Rhode Island 02904-2615

ResourcesFiling Options: Online (Domestic LLCs only) / By Mail Costs:

Forms:

Links:

|