Related Forms

Download: PDF, Word (.docx), OpenDocument

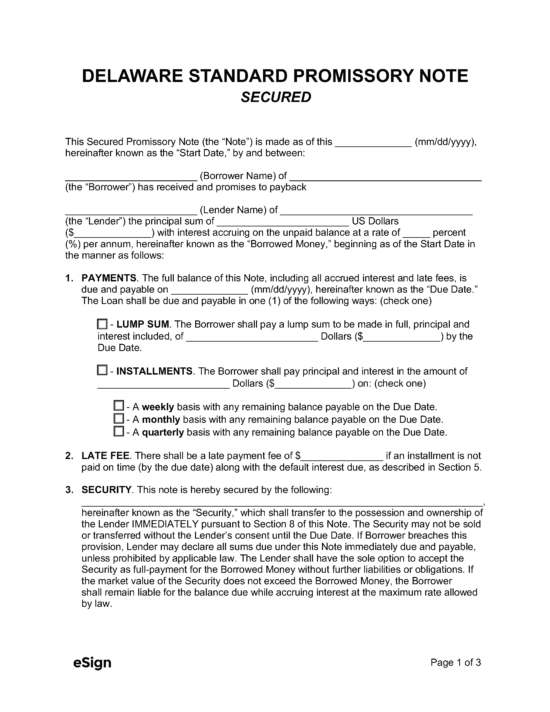

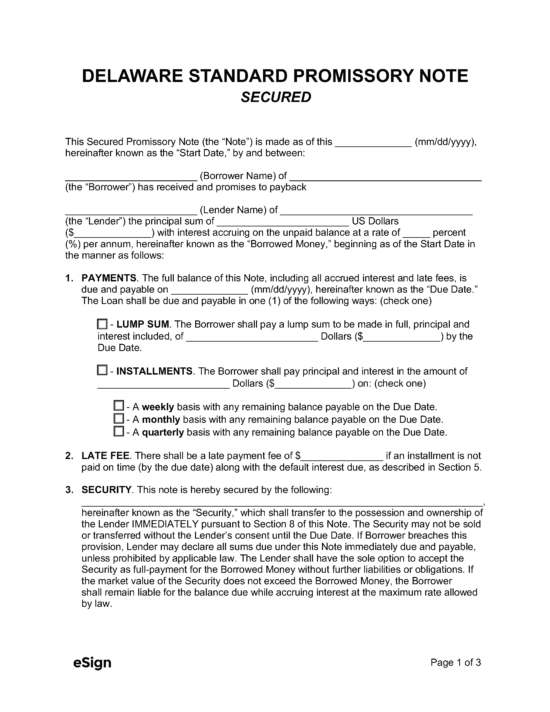

A Delaware unsecured promissory note is a financial contract for the borrowing of money between a lender and a borrower in which the borrower isn’t required to put up something of value to secure the loan. The contract is “unsecured” because there is no attached collateral to provide security for the lender’s expense. Due to the lack of collateral, the lender should be certain that the borrower can be counted on to repay the loan on time. The agreement will include the principal sum, interest rate, term, and payment schedule of the loan. Once both parties have signed the document, it becomes legally binding.

A Delaware unsecured promissory note is a financial contract for the borrowing of money between a lender and a borrower in which the borrower isn’t required to put up something of value to secure the loan. The contract is “unsecured” because there is no attached collateral to provide security for the lender’s expense. Due to the lack of collateral, the lender should be certain that the borrower can be counted on to repay the loan on time. The agreement will include the principal sum, interest rate, term, and payment schedule of the loan. Once both parties have signed the document, it becomes legally binding.

Download: PDF, Word (.docx), OpenDocument