Types (2)

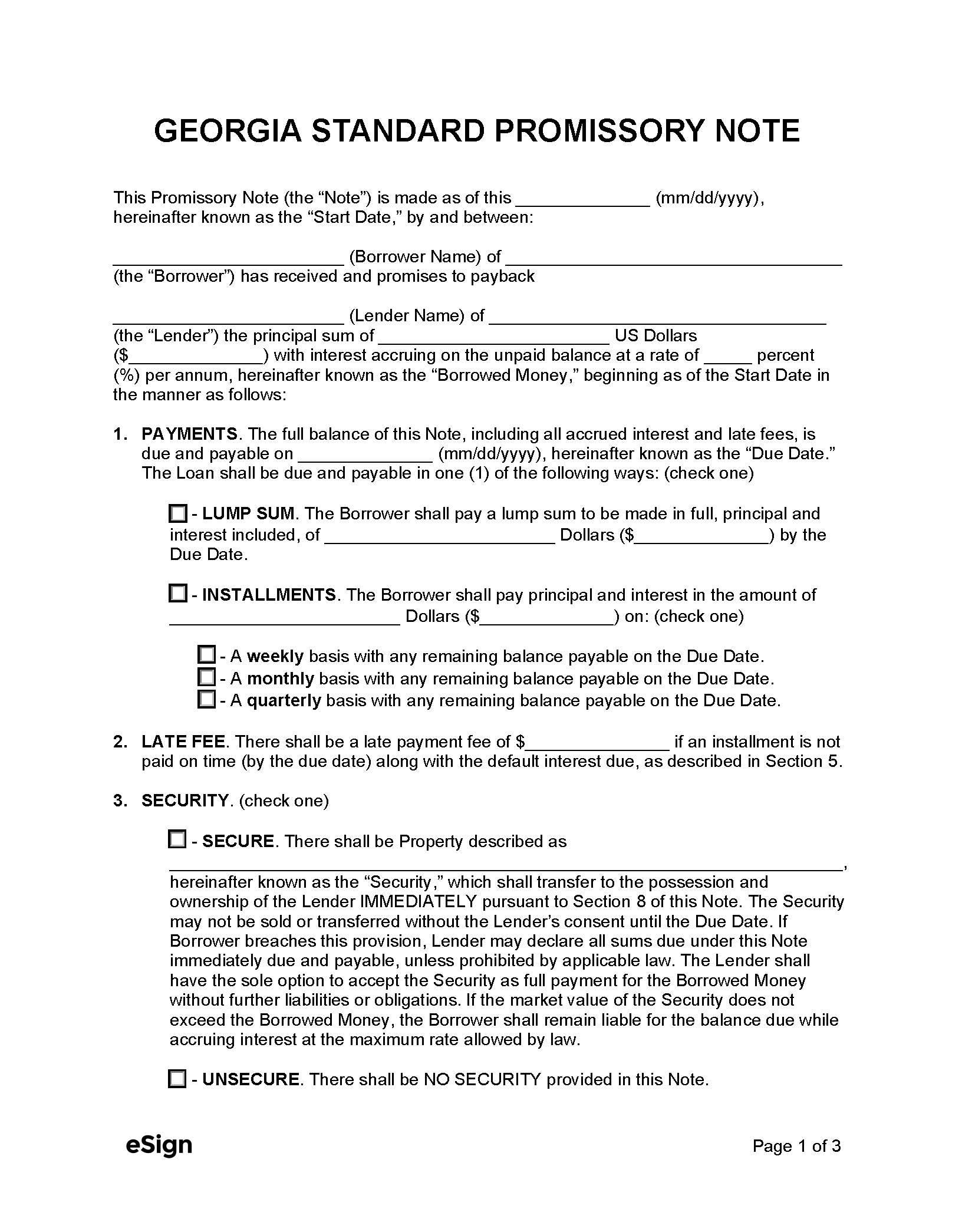

Download: PDF, Word (.docx), OpenDocument

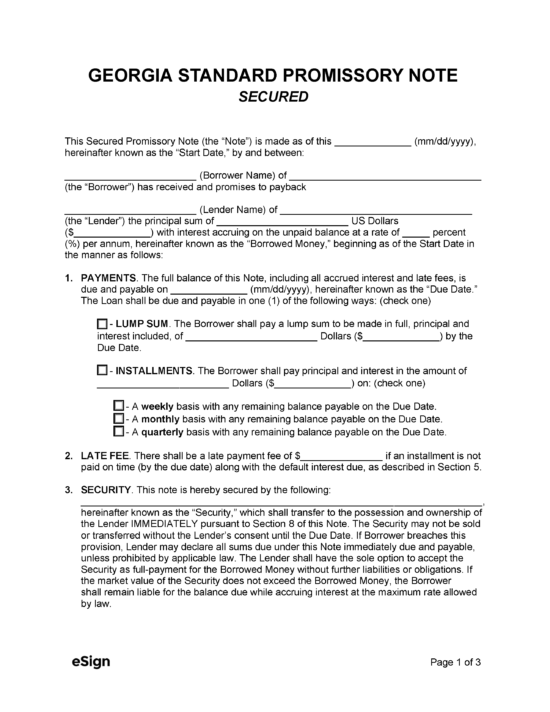

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 7, Chapter 4, Article 1

- Usury Rate With Contract ($3,000 – $250,000) (§ 7-4-2(a)(1)(A) and § 7-4-18(a)): 5% per month

- Usury Rate Without Contract (§ 7-4-2(a)(1)(A)): 7%

- Usury Rate With a Contract ($3,000 or Less) (§ 7-4-2(a)(2)): 16%

- Usury Rate on Judgments (§ 7-4-12(a)): Over federal prime rate plus 3%.

- Usury Rate for Commercial Accounts (§ 7-4-16): 1.5% per month (after 30 days due)

- Usury Rate Installment Loans ($3,000 or Less) (§ 7-3-11(1)): 10%

- Usury Rate for Pawnbrokers (§ 44-12-131(a)(4)): 25% per month for first ninety (90) days; 12.5% per month beyond ninety (90) days (including shop charges).