Types (2)

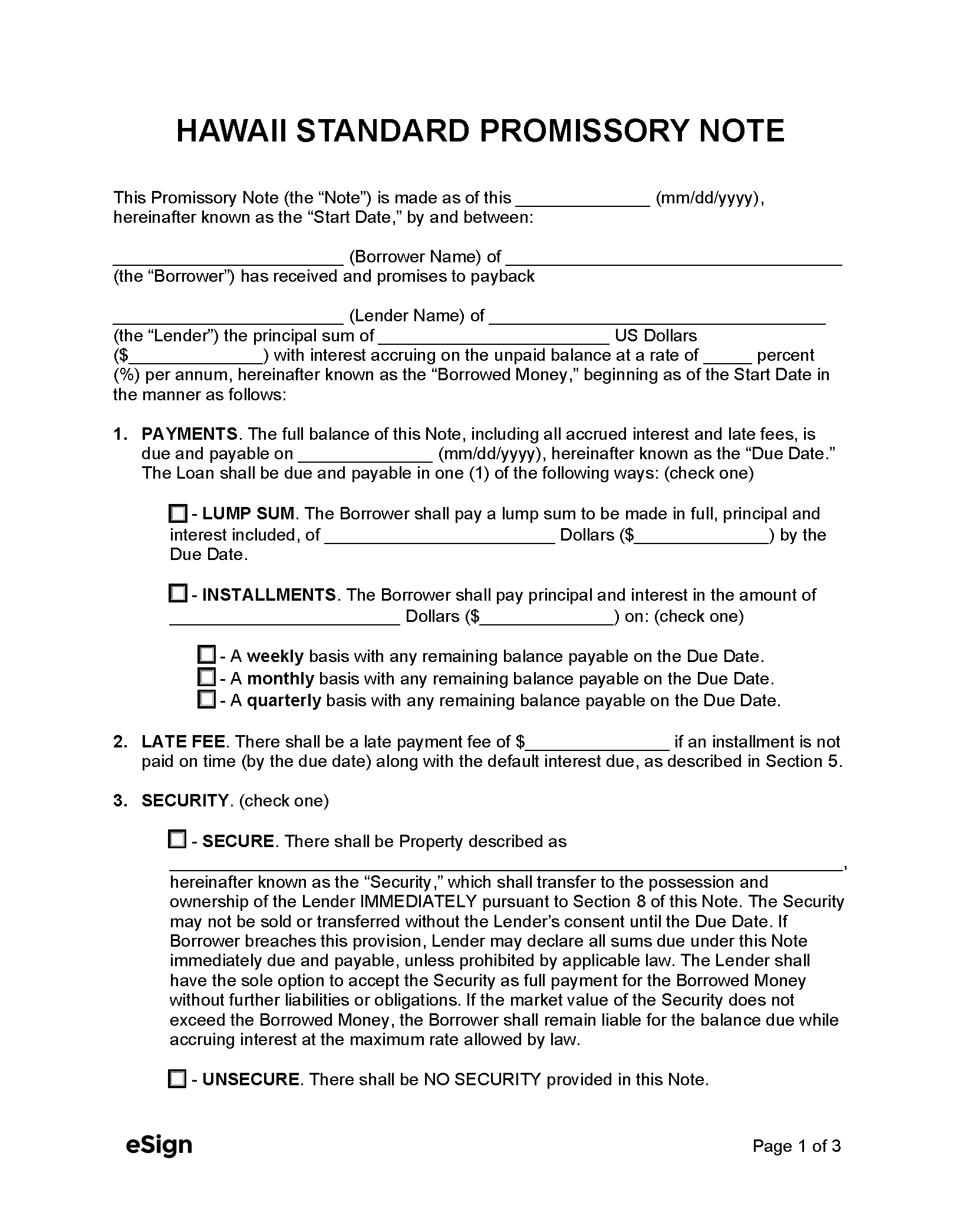

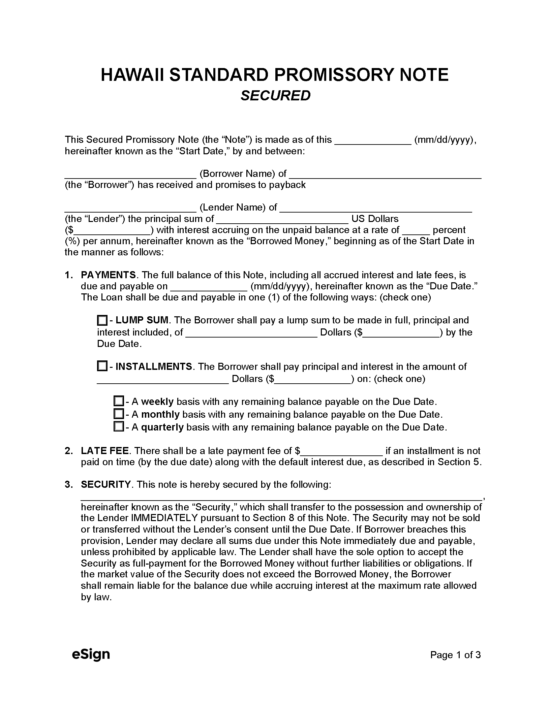

Secured Promissory Note – Under the terms of a secured promissory note, the borrower must pledge an asset as collateral before receiving funds.

Secured Promissory Note – Under the terms of a secured promissory note, the borrower must pledge an asset as collateral before receiving funds.

Download: PDF, Word (.docx), OpenDocument

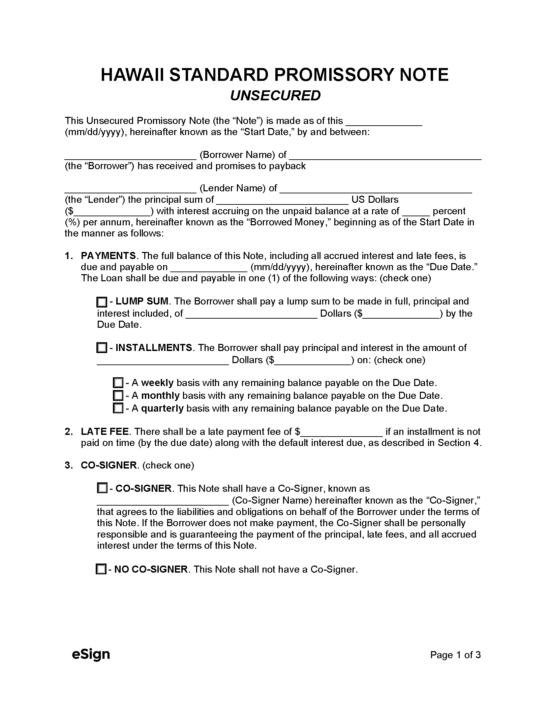

Unsecured Promissory Note – This promissory note does not require the borrower to provide collateral to the lender.

Unsecured Promissory Note – This promissory note does not require the borrower to provide collateral to the lender.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 26, Chapter 478

- Usury Rate in General (§ 478-2): 10%, unless there is a written contract fixing a different rate, in which case the interest rate cannot exceed the contract rate.

- Usury Rate for Judgments (§ 478-3): 10%

- Usury Rate for Home Business Loans (§ 478-4): *1% per month or 12% per year.

- Usury Rate for Consumer Credit Transactions (§ 478-4): *1% per month or 12% per year (excluding credit card agreements).

*If the lender is a financial institution other than a credit union or trust company, the maximum interest rate is 2% per month or 24% per year.