Types (2)

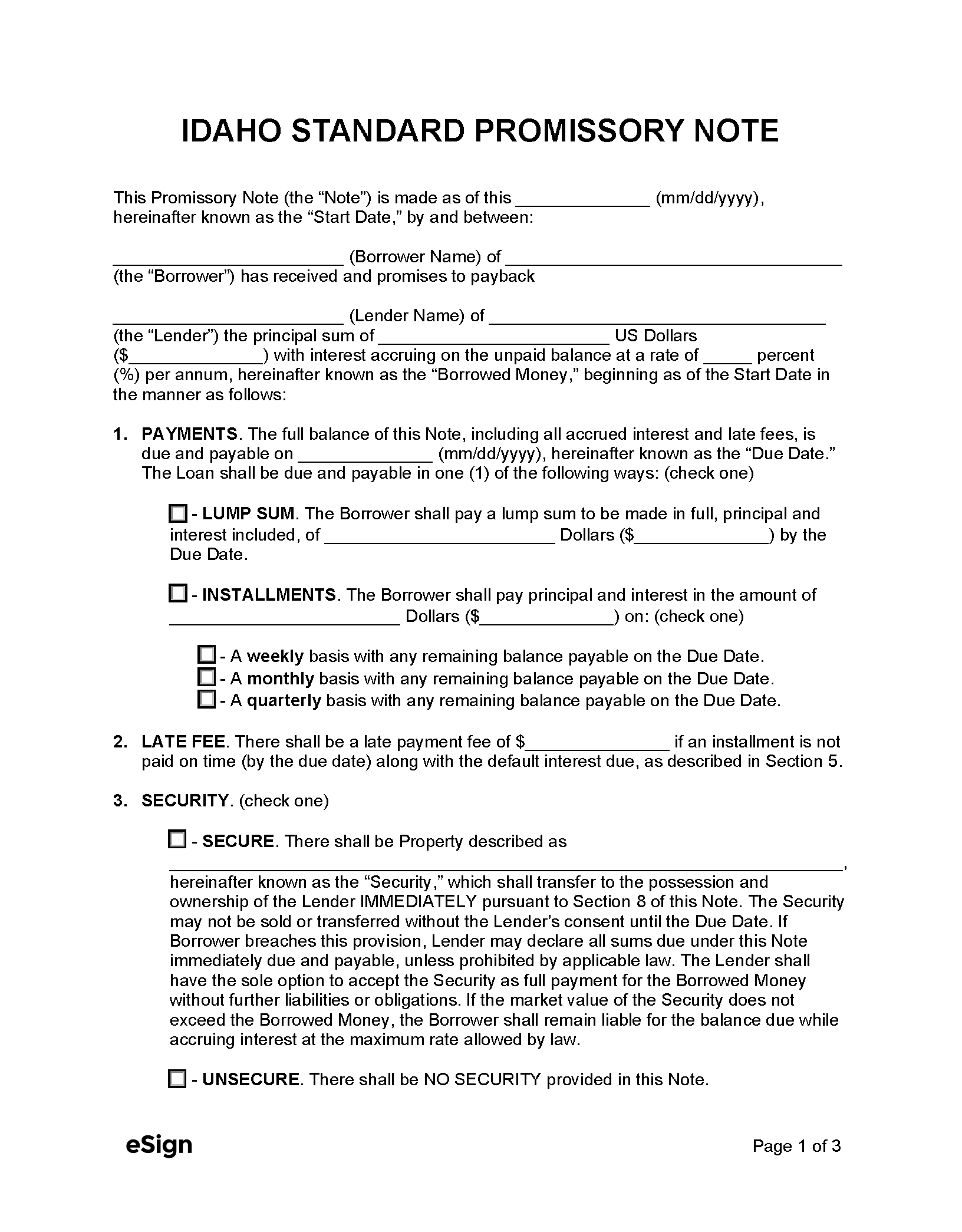

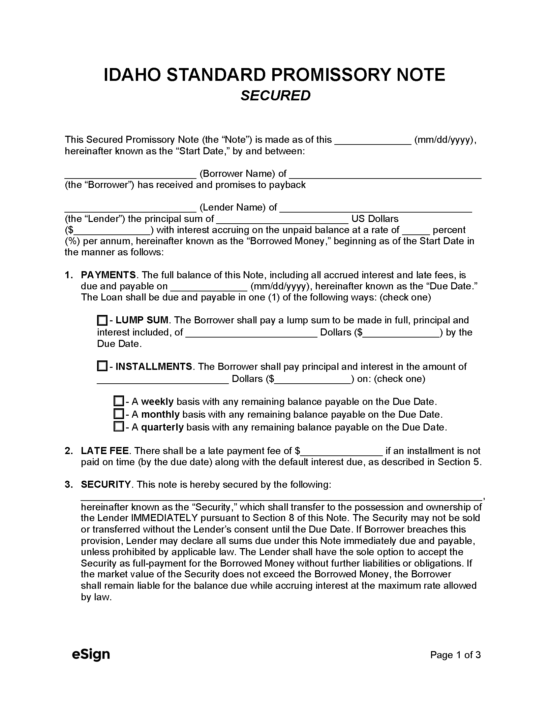

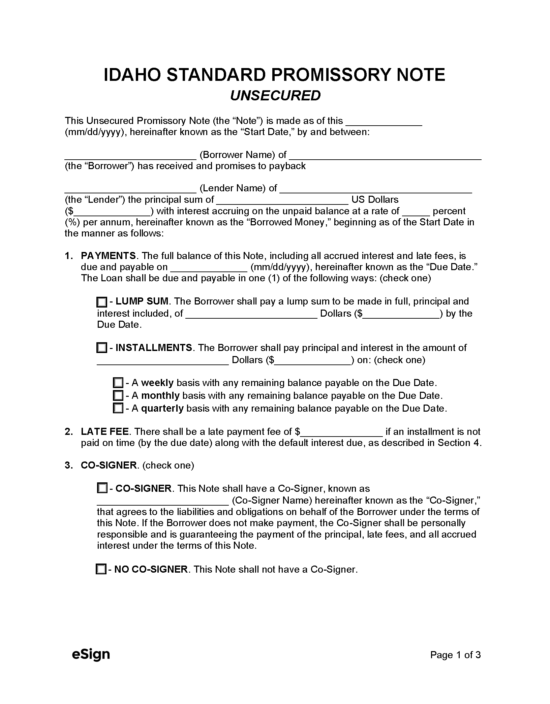

Secured Promissory Note – A money lending agreement that affords protection to the lender in the form of collateral.

Secured Promissory Note – A money lending agreement that affords protection to the lender in the form of collateral.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 28, Chapter 22

- Usury Rate in General (§ 28-22-104(1)): 12%, unless there is a written contract fixing a different rate, in which case the interest rate cannot exceed the contract rate.

- Usury Rate for Money Judgments (§ 28-22-104(2)): 5% plus the base rate set by the Idaho State Treasurer.