Types (2)

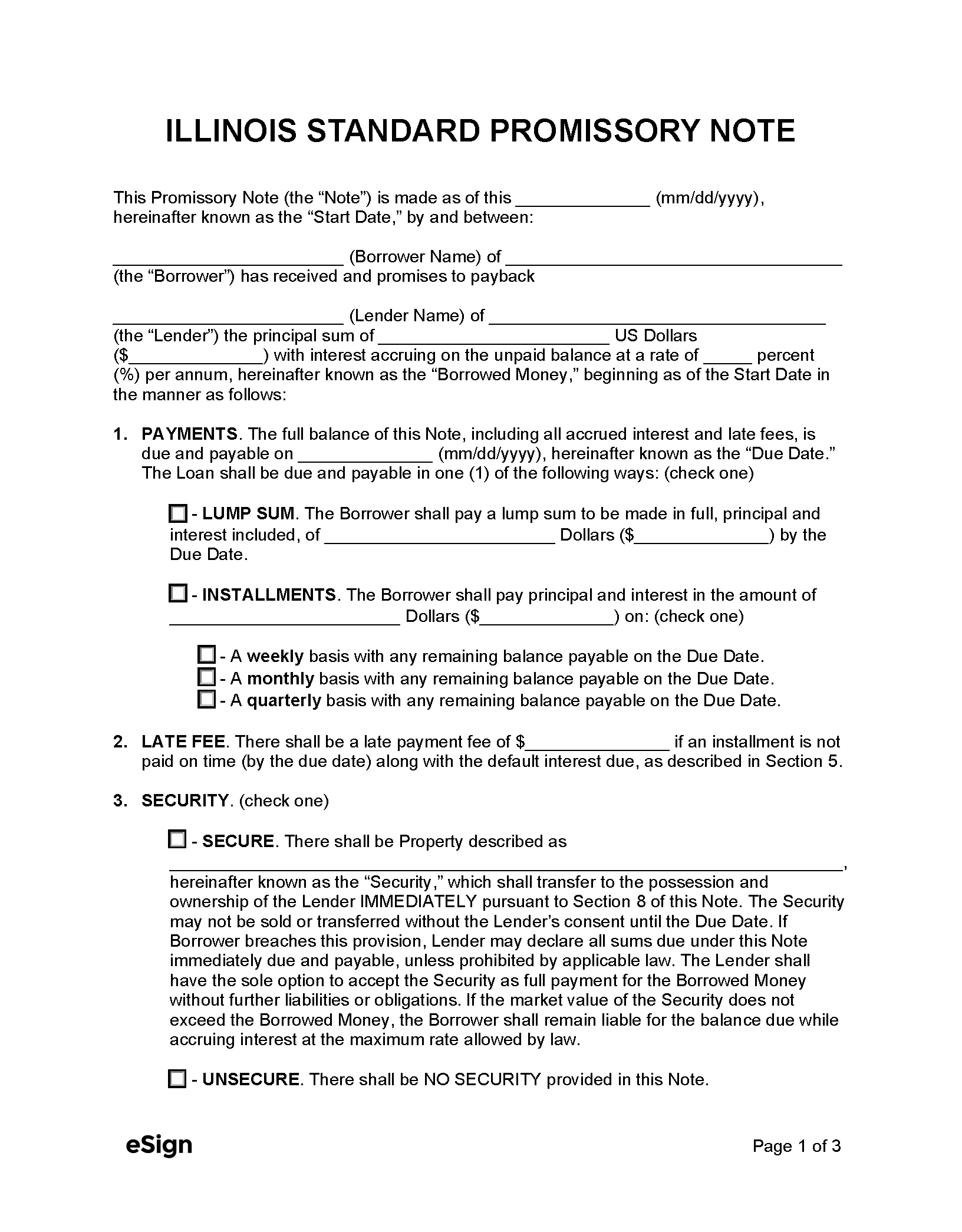

Secured Promissory Note – Requires the borrower to put down an asset as collateral before receiving funds from the lender.

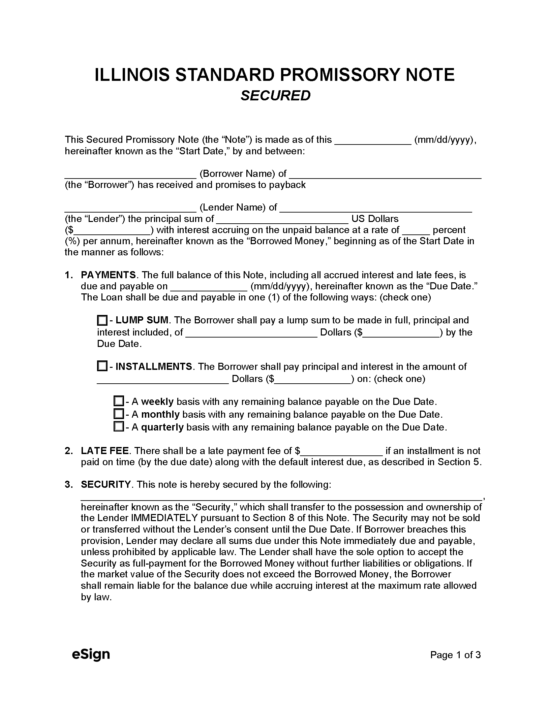

Secured Promissory Note – Requires the borrower to put down an asset as collateral before receiving funds from the lender.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury laws: 815 ILCS 205 & 815 ILCS 123

- Usury Rate for Written Contracts (815 ILCS 205/4): *9% APR, unless otherwise authorized by the Predatory Loan Prevention Act (PLPA), in which case the interest rate cannot exceed 36% APR. **The following transactions are subject to the PLPA:

- Consumer Loans (205 ILCS 670/15(a))

- Payday Loans (815 ILCS 122/2-5(e-5))

- Retail Installment Contracts (815 ILCS 405/27)

- Retail Charge Agreements (815 ILCS 405/28)

- Vehicle Retail Installment Contracts (815 ILCS 375/21)

- Usury Rate for Money Due on Written Instrument (815 ILCS 205/2): 5%

- Usury Rate for Monetary Judgments (735 ILCS 5/2-1303(a)): 9%, or 6% if the debtor is a unit of local government (e.g., county, township, municipality).

- Usury Rate for Loan or Forbearance (815 ILCS 205/1): 5%

- Usury Rate for Pawnbrokers (205 ILCS 510/2): 3% per month.

*Any rate of interest may be charged by banks and savings banks. Furthermore, any rate of interest may be applied with respect to the transactions listed in 815 ILCS 205/4(1)(a) – (n), unless specifically prohibited by the PLPA.

**The PLPA does not apply to banks, savings banks, savings and loan associations, credit unions, and insurance companies.