Related Forms

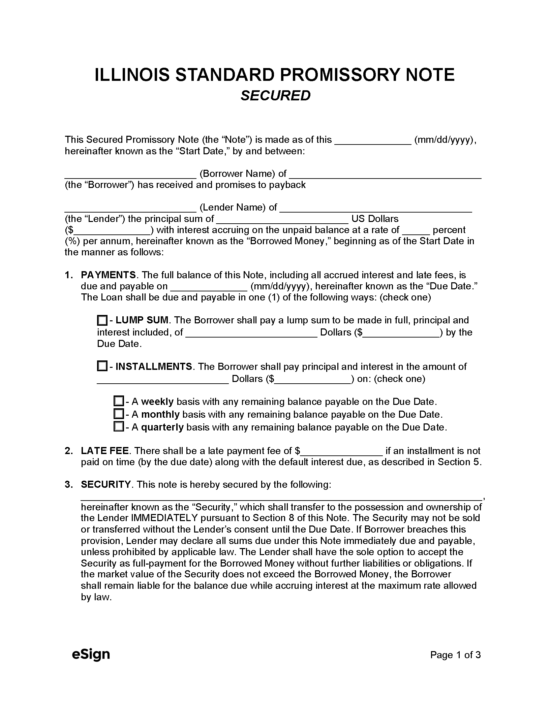

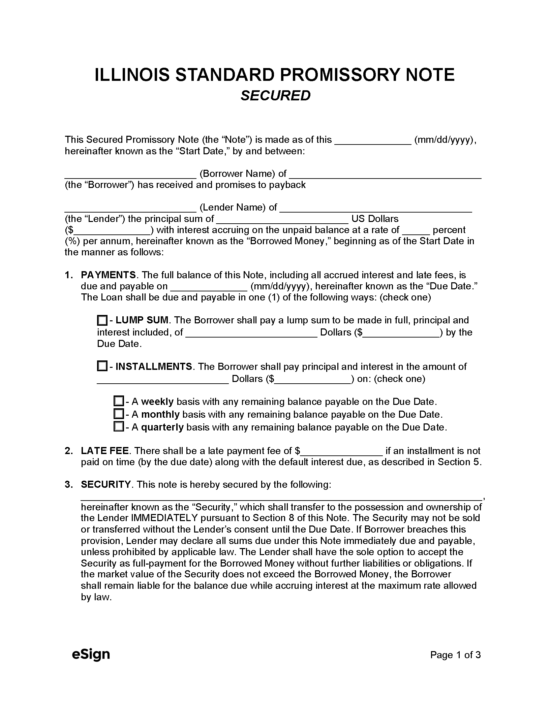

Secured Promissory Note – Specifies one’s promise to repay a debt that is backed, or “secured,” by collateral.

Secured Promissory Note – Specifies one’s promise to repay a debt that is backed, or “secured,” by collateral.

Download: PDF, Word (.docx), OpenDocument

An Illinois unsecured promissory note is an agreement formed between two (2) parties whereby a borrower promises to repay an uncollateralized loan to a lender. While the primary purpose of the note is to prove that a debt is owed, it also outlines specific instructions for the loan’s repayment. The note explains how often payments are due, the interest rate applied to the loan, the penalties for delinquent installments, and the date when the entire balance must be refunded to the lender.

Because an unsecured note is absent of collateral, the lender cannot claim any assets or property if the borrower is unable to satisfy their debt obligations. Consequently, the lender will issue an unsecured loan only to those with a strong credit history or those they personally trust.

An Illinois unsecured promissory note is an agreement formed between two (2) parties whereby a borrower promises to repay an uncollateralized loan to a lender. While the primary purpose of the note is to prove that a debt is owed, it also outlines specific instructions for the loan’s repayment. The note explains how often payments are due, the interest rate applied to the loan, the penalties for delinquent installments, and the date when the entire balance must be refunded to the lender.

Because an unsecured note is absent of collateral, the lender cannot claim any assets or property if the borrower is unable to satisfy their debt obligations. Consequently, the lender will issue an unsecured loan only to those with a strong credit history or those they personally trust.

Secured Promissory Note – Specifies one’s promise to repay a debt that is backed, or “secured,” by collateral.

Secured Promissory Note – Specifies one’s promise to repay a debt that is backed, or “secured,” by collateral.

Download: PDF, Word (.docx), OpenDocument