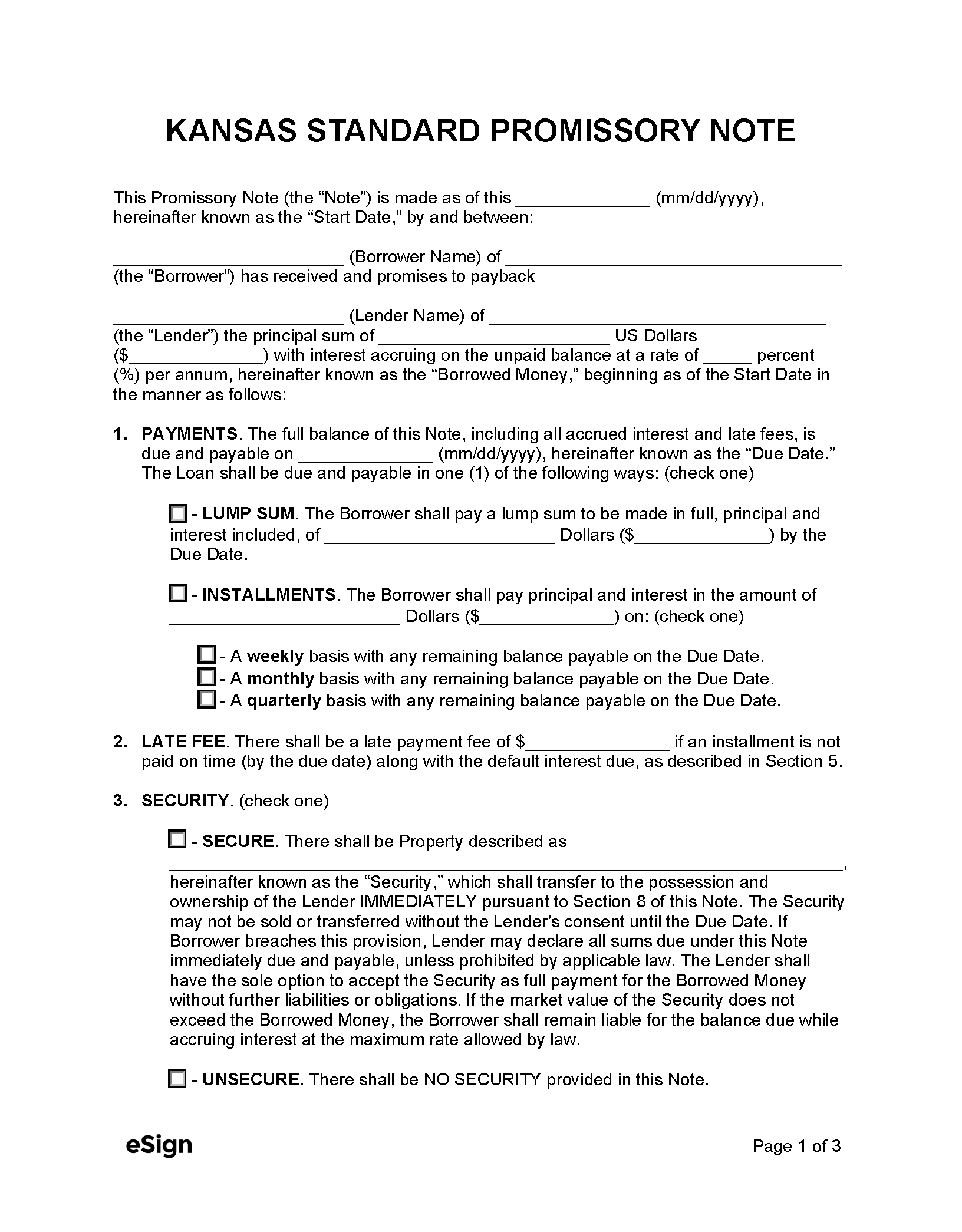

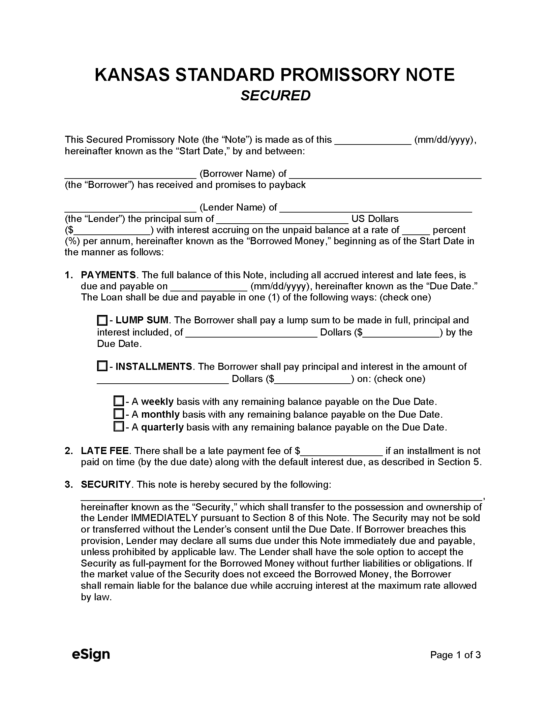

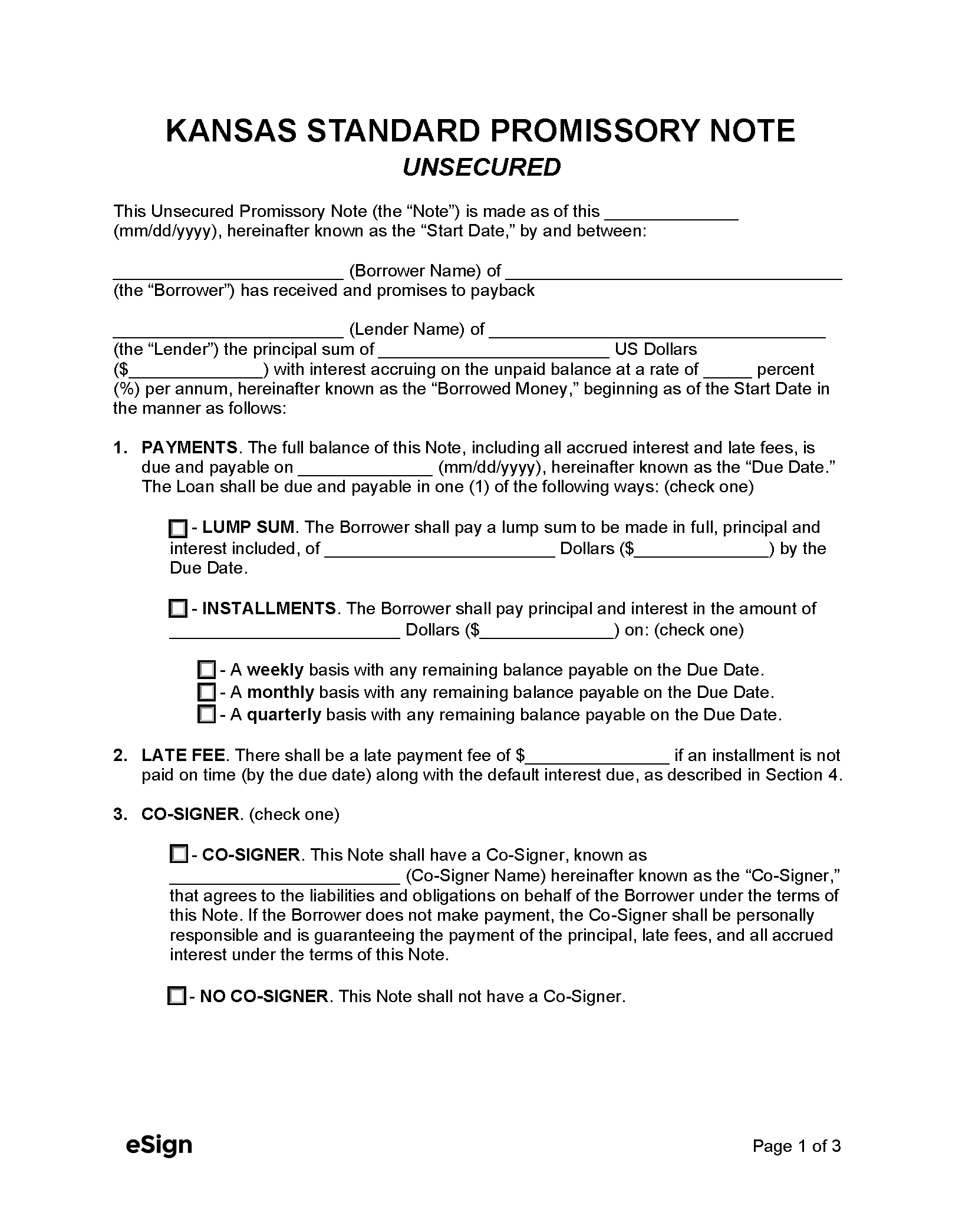

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Ch. 16, Article 2

- Usury Rate in General (§ 16-201): 10%, unless another rate is agreed upon, in which case the interest rate cannot exceed the agreed-upon rate.

- Usury Rate for Contracts (§ 16-207(a)): 15%, unless a higher interest rate is authorized by § 16-207(e) et seq.

- Usury Rate for Judgments (§ 16-204(e)(1)): 4% above the *federal discount rate.

- Usury Rate for Judgments on Contract (§ 16-205(a)): The contract rate applies.

*The federal discount rate is the interest rate on loans issued to commercial banks and other depository institutions by the Federal Reserve Bank.