Related Forms

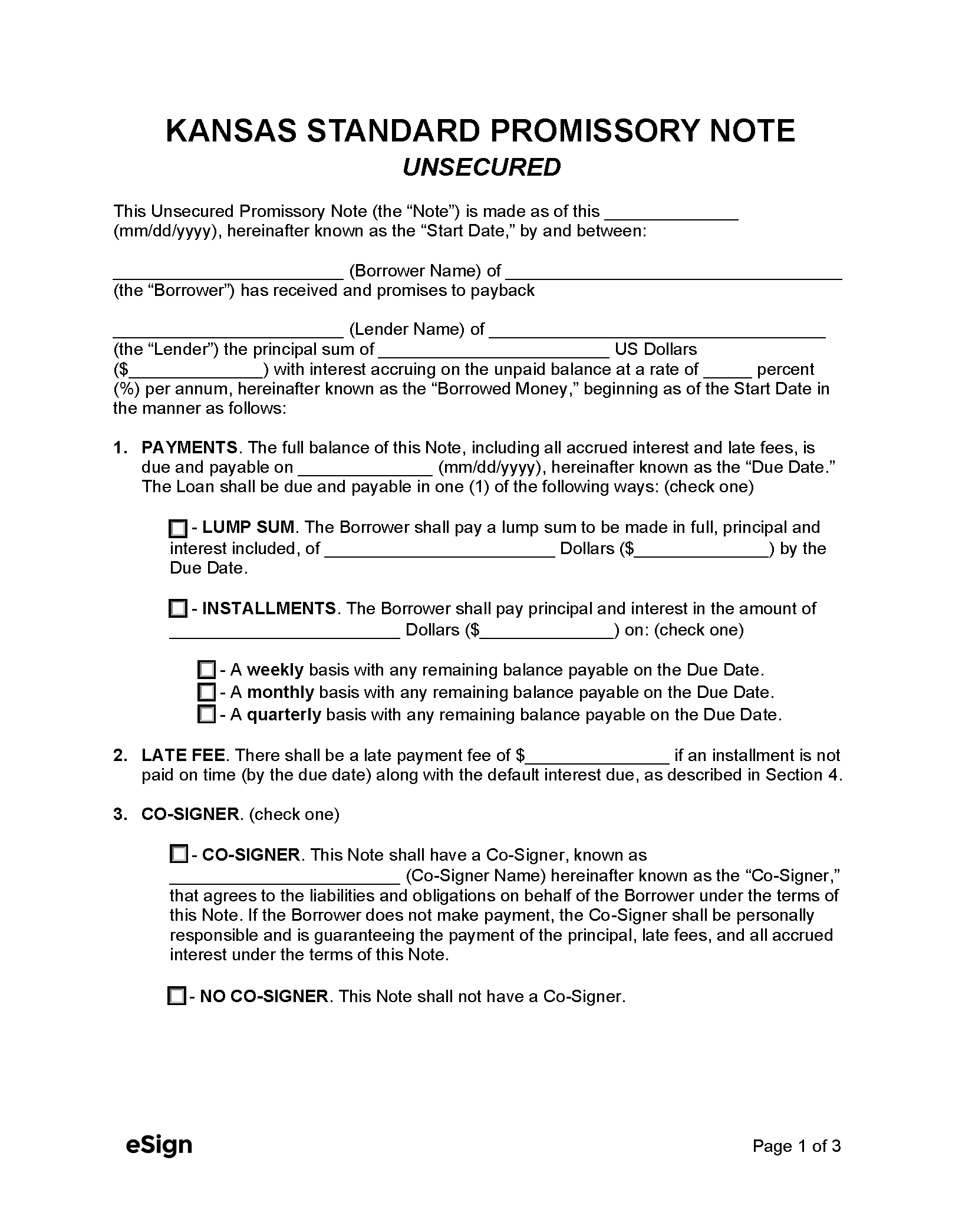

Unsecured Promissory Note – A lending agreement where money is granted without the necessity for collateral to secure the debt.

Unsecured Promissory Note – A lending agreement where money is granted without the necessity for collateral to secure the debt.

Download: PDF, Word (.docx), OpenDocument

A Kansas secured promissory note is a debt instrument backed by a pledge of collateral from the borrower to the lender. When requesting a secured loan, the borrower must offer something of value to serve as security in the event of missed payment. This security is most often the borrower’s real estate or vehicle, but can be any asset so long as the lender determines its value is adequate to offset the loan cost. If any portion of the loan remains unpaid by the due date established in the note, the lender has the right to confiscate the collateral and sell it if they so desire.

A Kansas secured promissory note is a debt instrument backed by a pledge of collateral from the borrower to the lender. When requesting a secured loan, the borrower must offer something of value to serve as security in the event of missed payment. This security is most often the borrower’s real estate or vehicle, but can be any asset so long as the lender determines its value is adequate to offset the loan cost. If any portion of the loan remains unpaid by the due date established in the note, the lender has the right to confiscate the collateral and sell it if they so desire.

Unsecured Promissory Note – A lending agreement where money is granted without the necessity for collateral to secure the debt.

Unsecured Promissory Note – A lending agreement where money is granted without the necessity for collateral to secure the debt.

Download: PDF, Word (.docx), OpenDocument