Types (2)

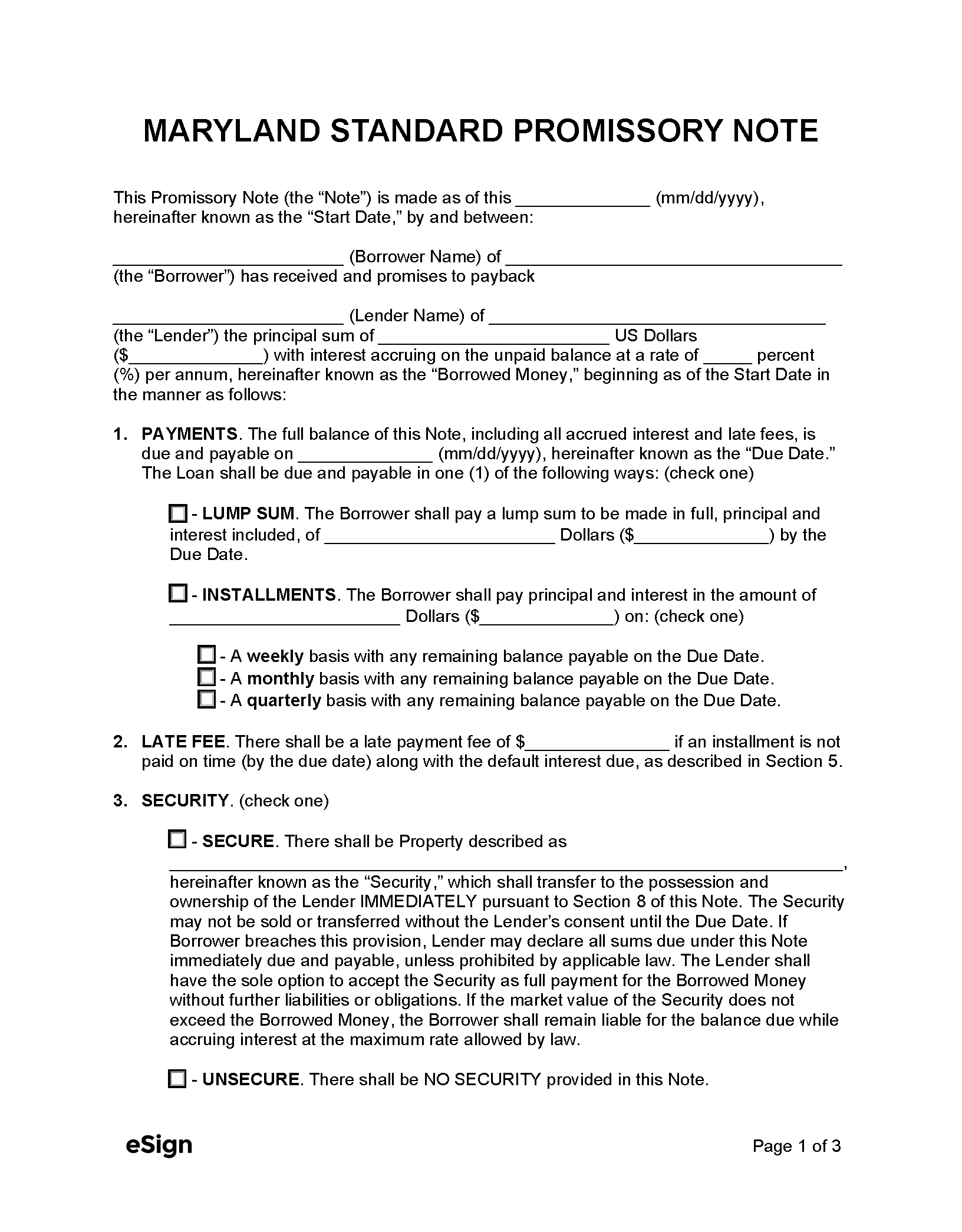

Download: PDF, Word (.docx), OpenDocument

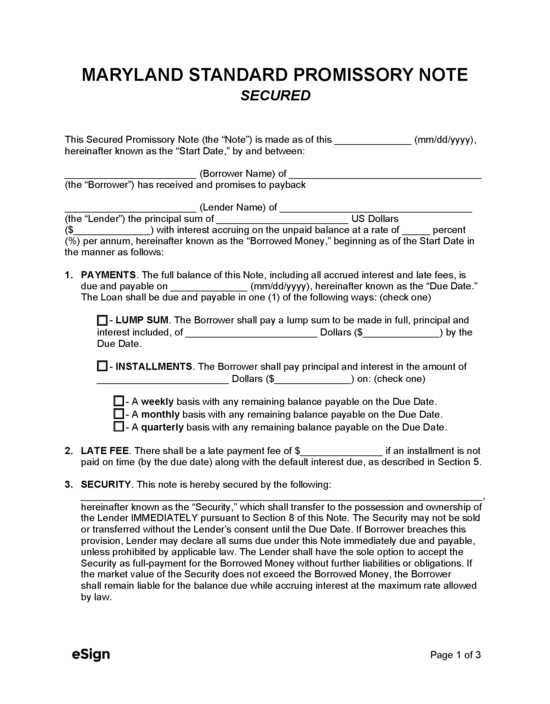

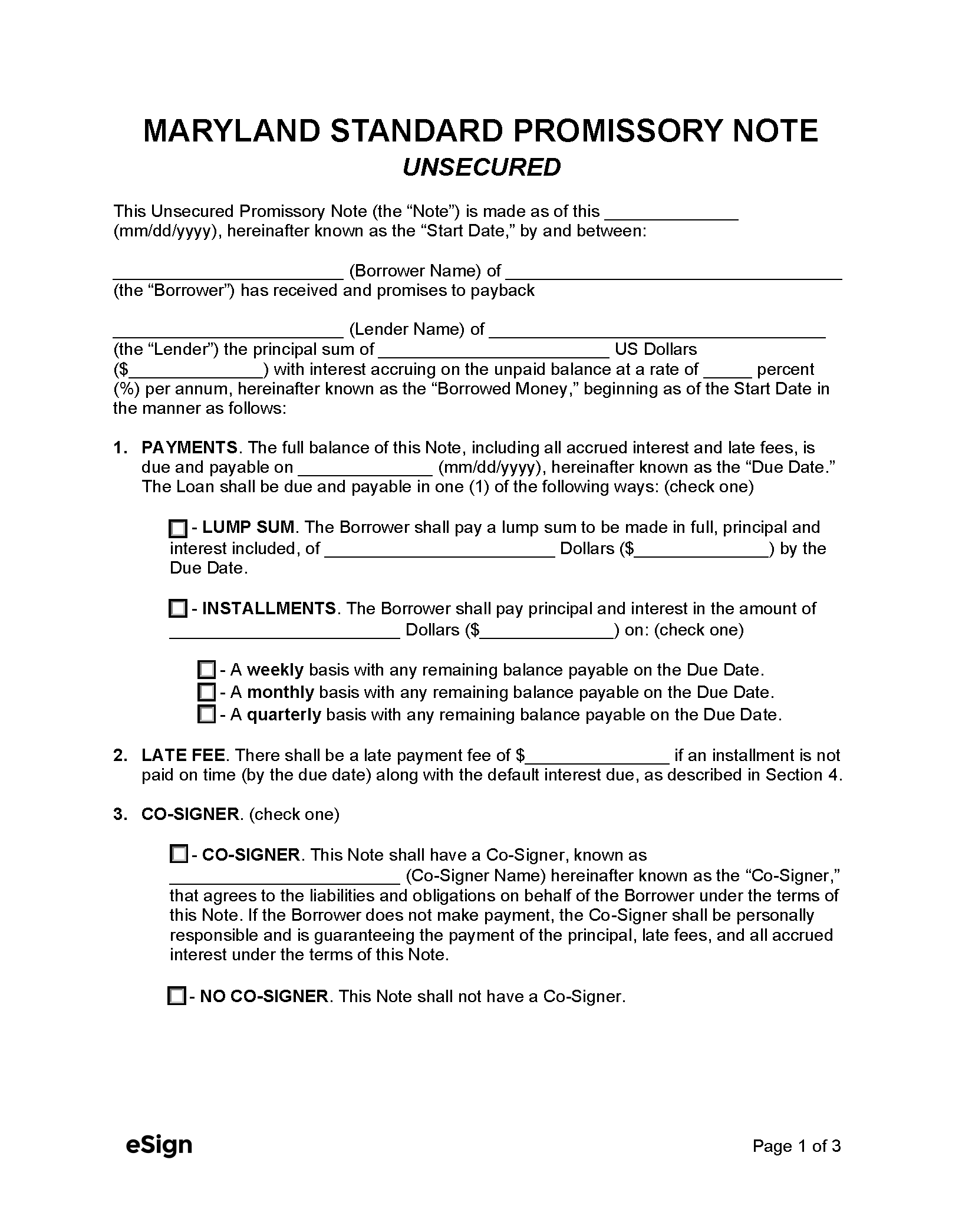

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Com. Law, Title 12, Sub. 1

- Usury Rate for Written Contract (§ 12-103(a)(1)): 8%

- Usury Rate in General (§ 12-102): 6%

- Usury Rate for Loan Secured by Certificate of Deposit (§ 12-103(a)(2)): 2% above the interest rate on the certificate of deposit.

- Usury Rate for Loan Secured by Mortgage or Deed of Trust (§ 12-103(d)): No maximum; must comply with federal law.

- Exceptions for Written Contract: Certain loans permit a maximum interest rate of 24%, or 18% if the loan is made before July 1, 1982. Applicable loans include unsecured loans, installment loans not secured by real property, and loans secured by something other than a savings account. However, to impose a 24% interest rate, the loan must comply with the requirements set in § 12-103(a)(3) et seq.

- Additional Exceptions: Any rate of interest may be applied to the following transactions:

- Loans to corporations (§ 12-103(e)(1)(i))

- Commercial loans over $15,000 not secured by residential real property (§ 12-103(e)(1)(ii))

- Commercial loans in excess of $75,000 secured by residential real property (§ 12-103(e)(1)(iii))

- Interest owed to a broker/dealer for a debit balance that is payable on demand and secured (§ 12-103(f))