Types (2)

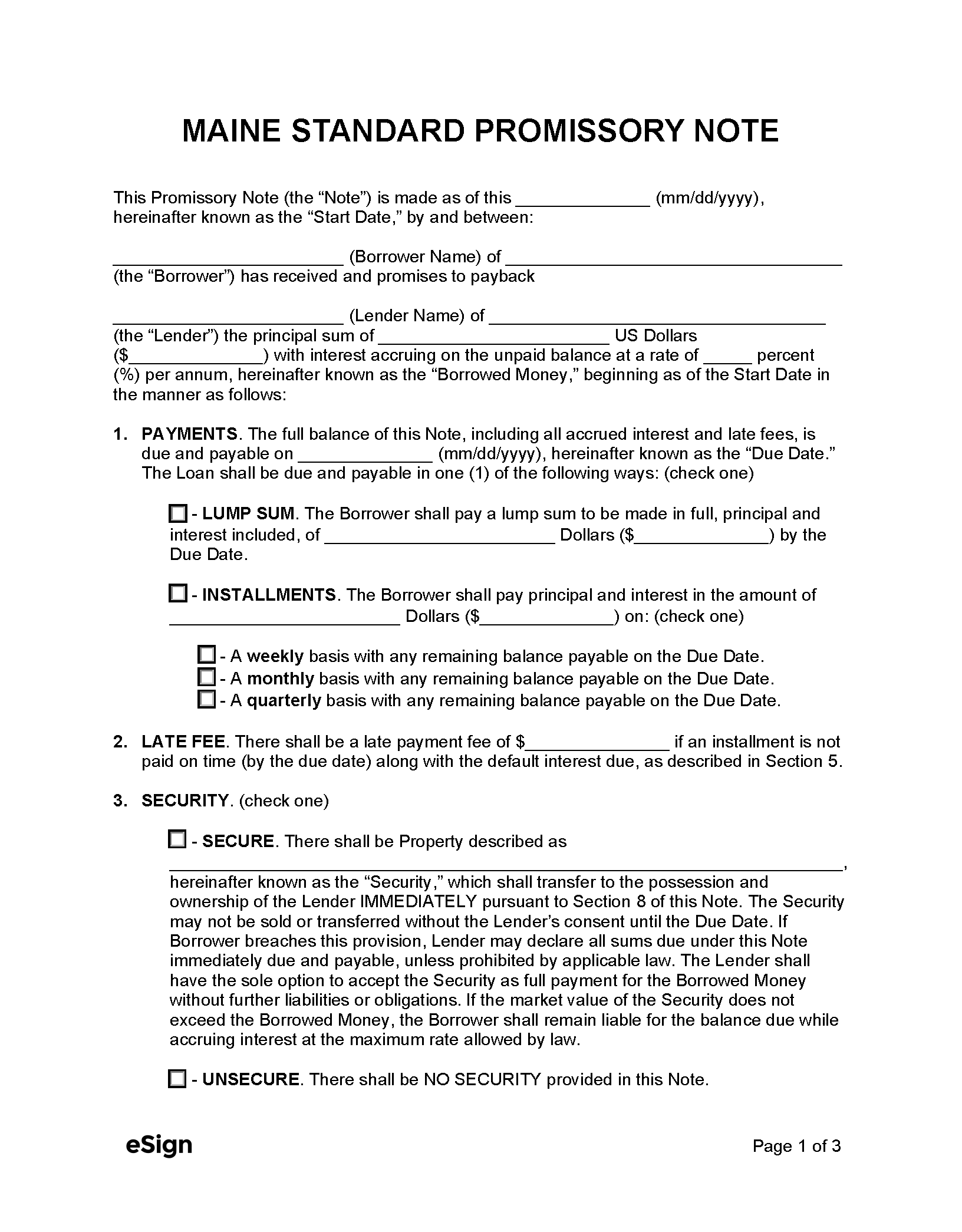

Download: PDF, Word (.docx), OpenDocument

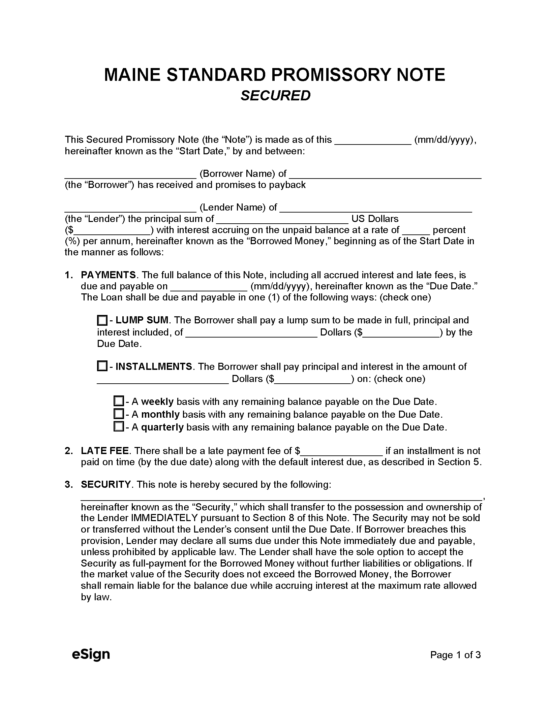

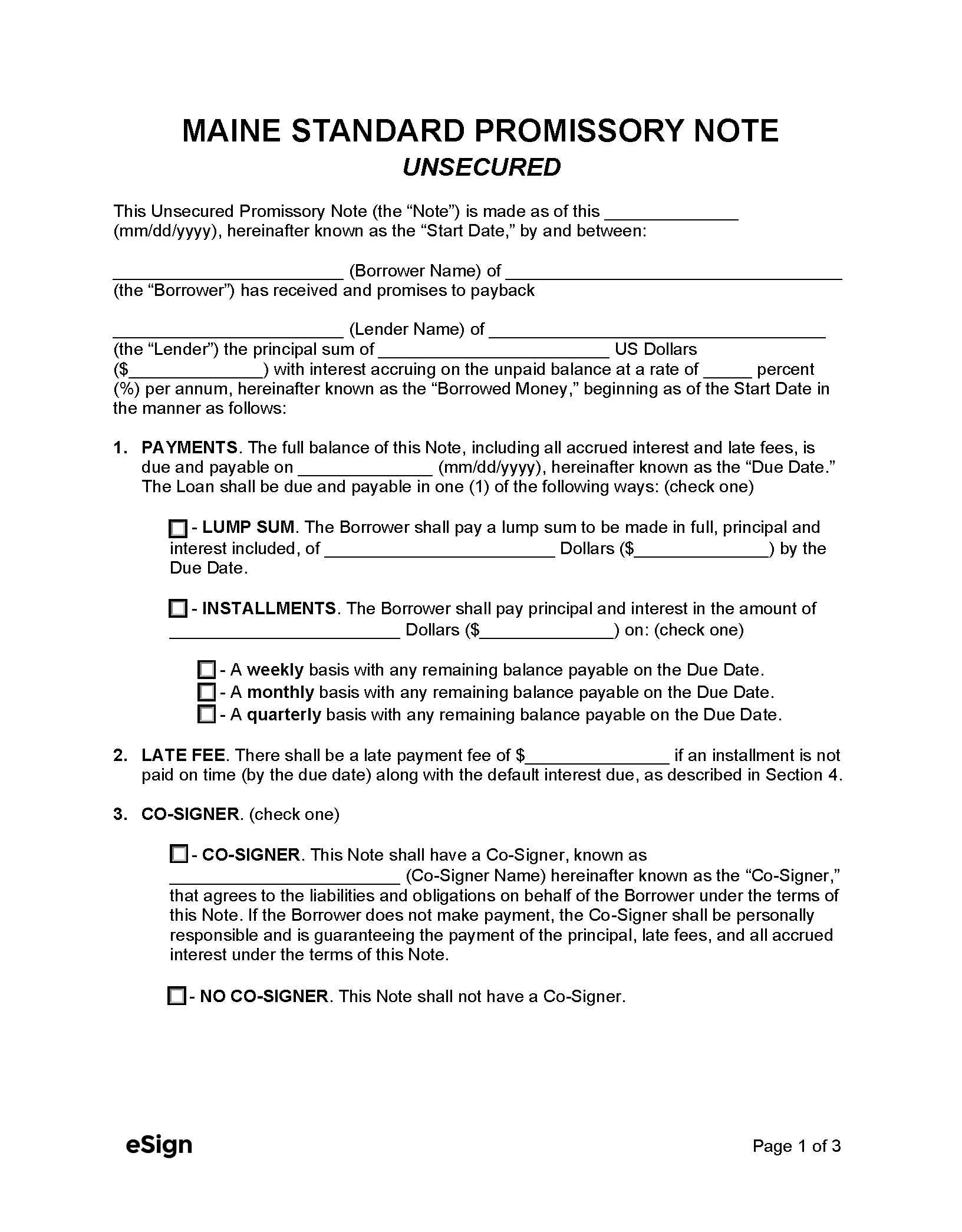

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 9-B § 432 & Title 9-A, Art. 2

- Usury Rate for Written Loans by Financial Institution (§ 432(1)): No stated maximum.

- Usury Rate for Non-Written Loans by Financial Institution (§ 432(1)): 6%

- Usury Rate for Consumer Loans (§ 2-401(2)): *The finance charge for a consumer loan cannot exceed the following:

- 30% on the unpaid balance for loans $2,000 or less.

- 24% on the unpaid balance for loans more than $2,000 but less than $4,000.

- 18% on the unpaid balance for loans more than $4,000.

- 18% on the entire loan amount for loans more than $8,000.

- Usury Rate for Pawnbrokers (§ 3963(1)): 25% per month for loans $500 or less; 20% for loans more than $500.

- Usury Rate for Prejudgment Interest (§ 1602-B): The one-year United States Treasury bill rate + 3%, unless there is a contract or note establishing a different rate.

- Usury Rate for Postjudgment Interest (§ 1602-C): The interest rate cannot exceed the greater of the following:

- The one-year United States Treasury bill rate + 6%; or

- The rate established in any contract or note.

*Consumer loans rates do not apply to the following transactions: