Related Forms

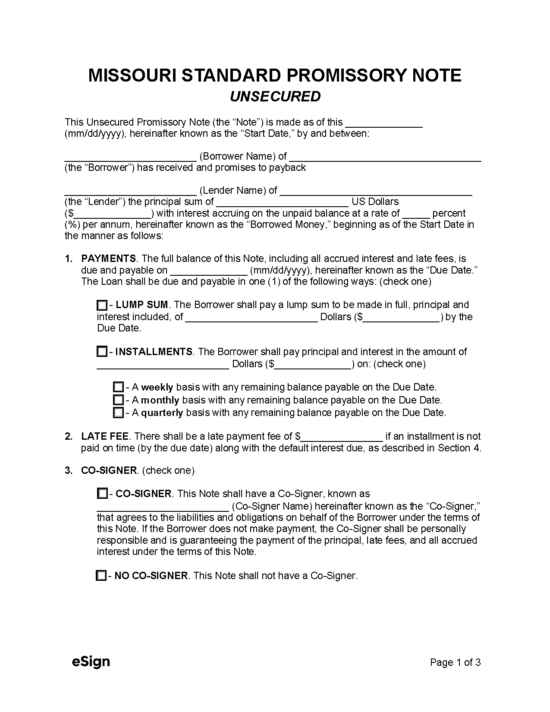

Unsecured Promissory Note – Used to grant money to a debtor without requiring collateral as backing.

Unsecured Promissory Note – Used to grant money to a debtor without requiring collateral as backing.

Download: PDF, Word (.docx), OpenDocument

A Missouri secured promissory note is used to establish a loan in which the lender may acquire the borrower’s pledged assets if they fail to repay in accordance with the contract terms. The parties will need to sign off on the terms of the arrangement, including the payment plan, the due date, and the interest rate. A secured promissory note will also require the borrower to put up something of value to be used as collateral, known as the “security.” This asset must be sufficient in covering the cost of the money lent, such as a property title, vehicle, or savings account.

If the borrower does not comply with any of the terms and conditions, the lender has the right to declare all remaining balances due immediately, including the borrower’s security. The lender has the option of keeping the security until the borrower pays off their obligation in full, or accepting the security in lieu of payment and considering the debt settled.

A Missouri secured promissory note is used to establish a loan in which the lender may acquire the borrower’s pledged assets if they fail to repay in accordance with the contract terms. The parties will need to sign off on the terms of the arrangement, including the payment plan, the due date, and the interest rate. A secured promissory note will also require the borrower to put up something of value to be used as collateral, known as the “security.” This asset must be sufficient in covering the cost of the money lent, such as a property title, vehicle, or savings account.

If the borrower does not comply with any of the terms and conditions, the lender has the right to declare all remaining balances due immediately, including the borrower’s security. The lender has the option of keeping the security until the borrower pays off their obligation in full, or accepting the security in lieu of payment and considering the debt settled.

Unsecured Promissory Note – Used to grant money to a debtor without requiring collateral as backing.

Unsecured Promissory Note – Used to grant money to a debtor without requiring collateral as backing.

Download: PDF, Word (.docx), OpenDocument