Types (2)

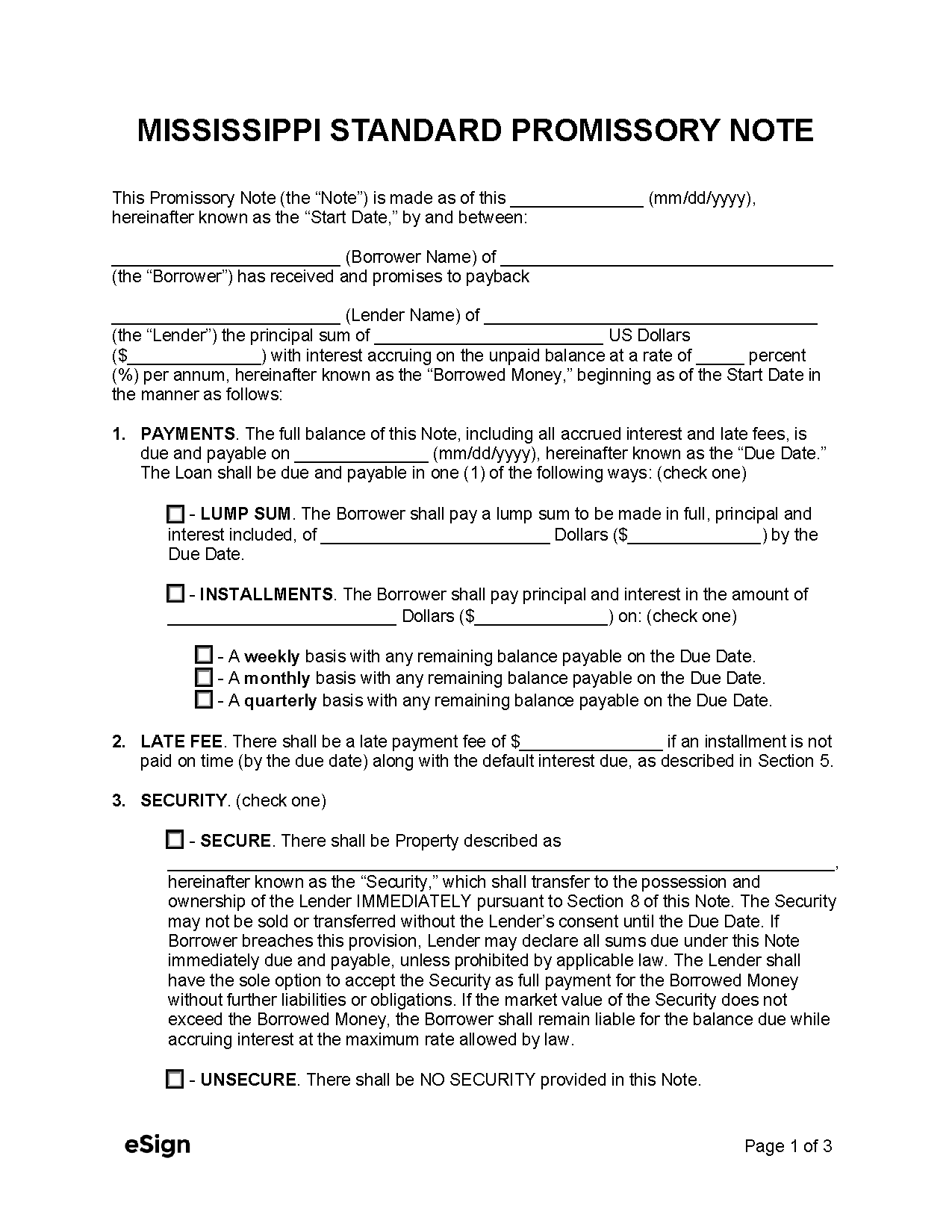

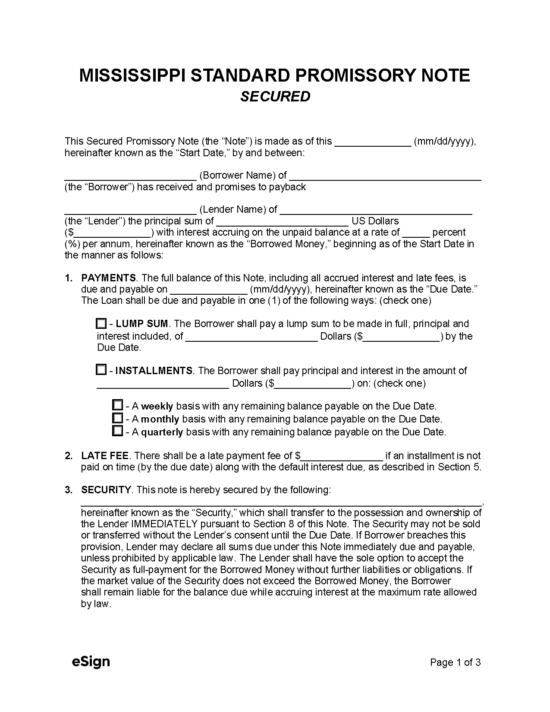

Secured Promissory Note – Used for a loan transaction where the borrower pledges certain assets as a security interest for the lender.

Download: PDF, Word (.docx), OpenDocument

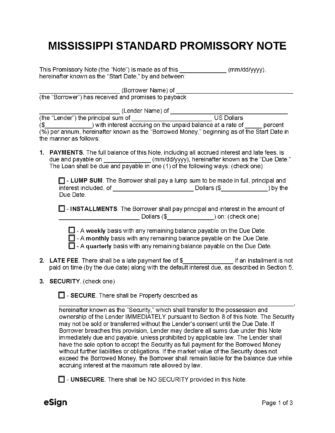

![]() Unsecured Promissory Note – Contains the same provisions as a secured promissory note, only there is no collateral backing the loan.

Unsecured Promissory Note – Contains the same provisions as a secured promissory note, only there is no collateral backing the loan.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 75, Chapter 17

- Usury Rate in General (§ 75-17-1(1)): 8%

- Illegal Rate for Finance Charges on Contracts (§ 75-17-1(2)): 10% or 5% above the Federal Reserve discount rate, whichever is greater.

- Usury Rate for Judgements (§ 75-17-7): As stated in contract, or if no contract, as determined by judge.

- Usury Rate for Business Entities and Religious Societies (§ 75-17-1(3)): 15%, or 5% above the 90-day commercial paper discount rate on amounts over $2,500, whichever is greater.

- Usury Rate for Consumer Loans (§ 75-17-21 & § 75-67-181):

- A monthly finance charge (in lieu of interest) not to exceed an APR of 59% of the unpaid balance on loans of $4,000 or less

- 36% of unpaid balance on loans of $1,000 or less

- 33% of unpaid balance on loans between $1,000 and $2,500

- 24% of unpaid balance on loans between $2,500 and $5,000

- 14% of unpaid balance on loans over $5,000

In lieu of the consumer loan interest rates indicated above, on loans of $25,000 or greater, a licensee has the option to contact a maximum finance charge equal to an annual rate of 18% of the unpaid balance.

- Usury Rate for General/Limited Obligation Tax Bonds (§ 75-17-101): 11%

- Usury Rate for Revenue Bonds (§ 75-17-103): 13%

- Usury Rate for Tax Anticipation Notes (§ 75-17-105): 11%

- Usury Rate for Interim Financing (§ 75-17-107): 9%

- Usury Rate for Pawnbrokers (§ 75-67-313): 25%

- Usury Rate for Installment Loans (Weekly/Monthly) (§ 75-67-39): 7%*

*A loan contract as authorized in Section 75-67-39 may include a provision stating that if the loan is paid before the maturity date, or the lender defaults under the agreement entitling the lender to declare all outstanding balances due immediately, the borrower may instead be charged an interest rate of 10% (§ 75-67-41).