Types (2)

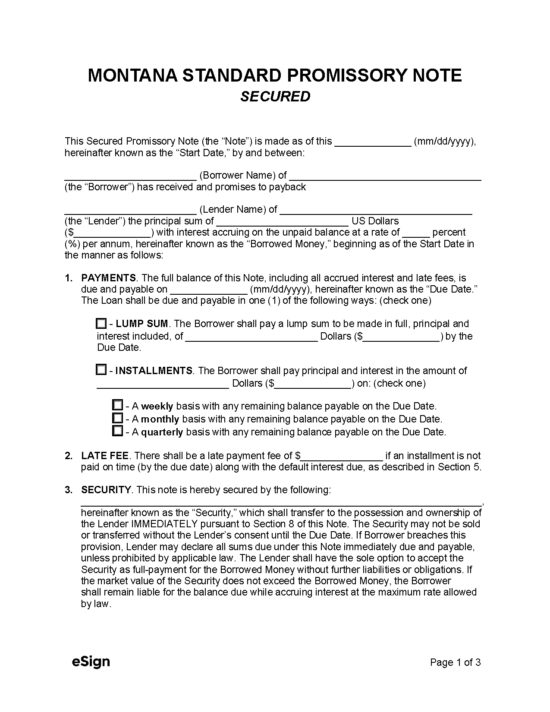

Secured Promissory Note – A loan agreement that requires the borrower to pledge their personal assets as a security interest.

Download: PDF, Word (.docx), OpenDocument

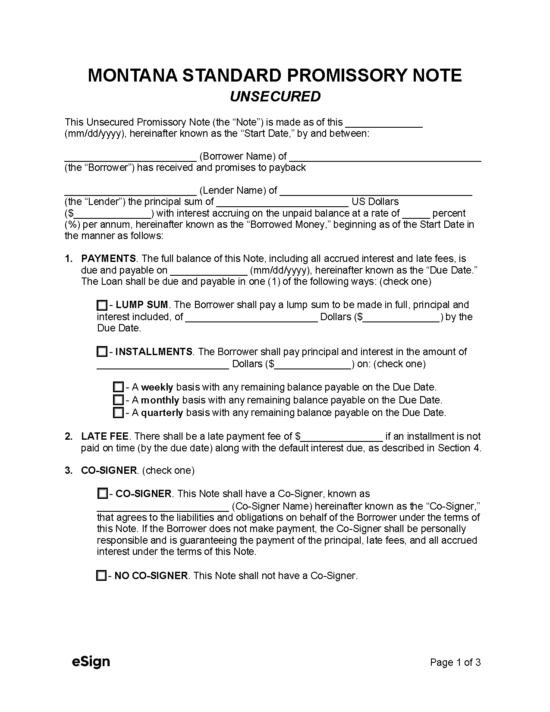

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 31, Chapter 1, Part 1

- Usury Rate in General (§ 31-1-106): 10%

- Usury Rate with a Contract (§ 31-1-107): 15%, or 6% per year above prime rate published by the federal reserve system three (3) business days prior to the execution of the agreement, whichever is greater. These rates do not apply to regulated lenders (§ 31-1-111).

- Usury Rate for Judgements (§ 25-9-205): The rate stated in the contract, or, if no contract, the rate for bank prime loans plus 3%.

- Usury Rate for Unlicensed Pawnbrokers (§ 31-1-401): 10%