Types (2)

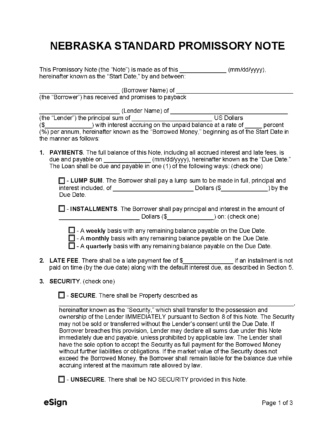

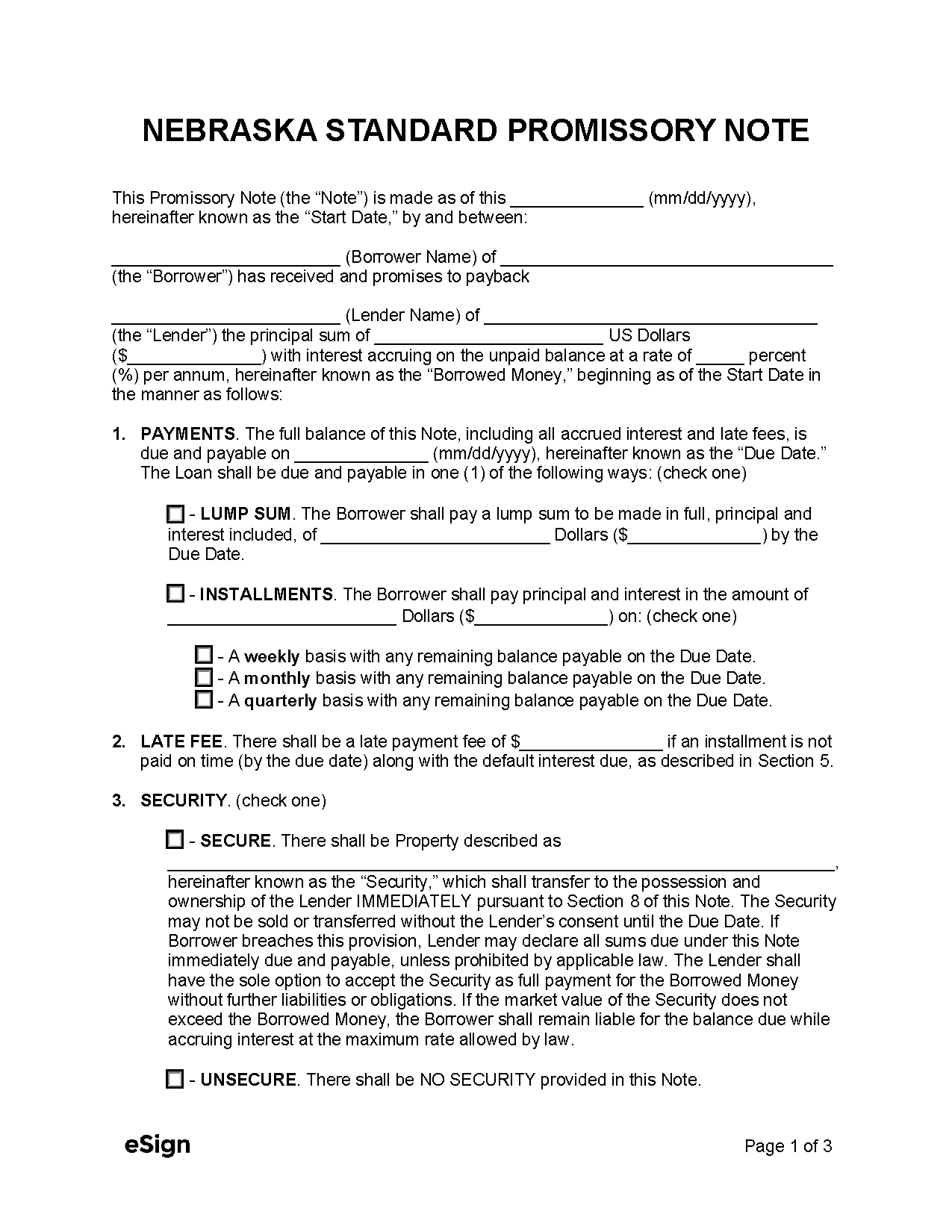

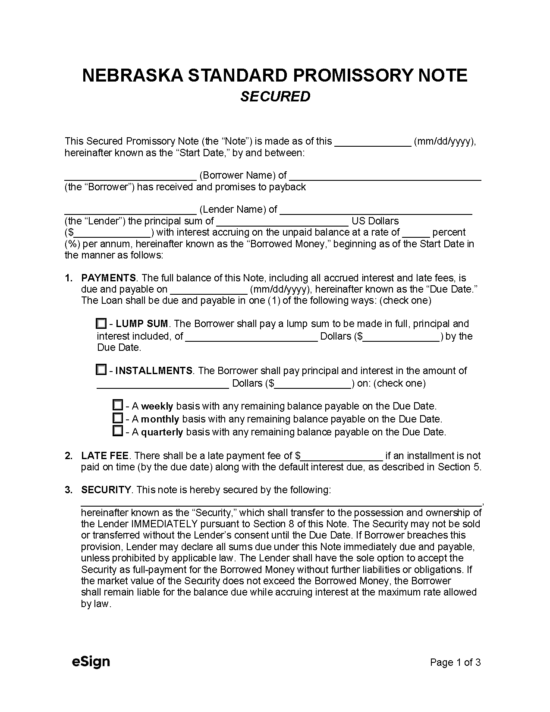

Secured Promissory Note – Allows a borrower to use their property as collateral to ensure the lender’s repayment.

Download: PDF, Word (.docx), OpenDocument

![]() Unsecured Promissory Note – The borrower is not required to provide any collateral in this agreement.

Unsecured Promissory Note – The borrower is not required to provide any collateral in this agreement.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 45

- Usury Rate in General (§ 45-101.03): 16%, except for loans indicated in § 45.101.04

- Usury Rate with a Contract (§ 45-104): 12%, unless otherwise specified.

- Usury Rate without a Contract (§ 45-102): 6%

- Usury Rate for Judgements (§ 45-103): 2% above the bond investment yield of the average accepted auction price for the first auction of each annual quarter of the twenty-six (26) week United States Treasury bills, unless the judgment is for action with an interest rate specified by the law or in a contract agreed to by the parties involved in the action.

- Usury Rate for Delinquent Tax Payments (§ 45-104.01): 14%