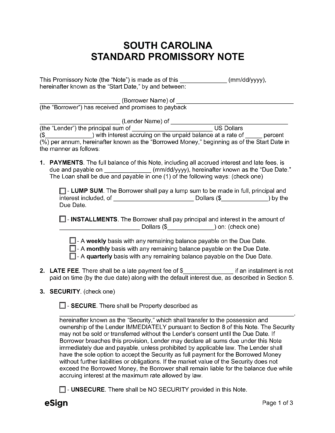

Types (2)

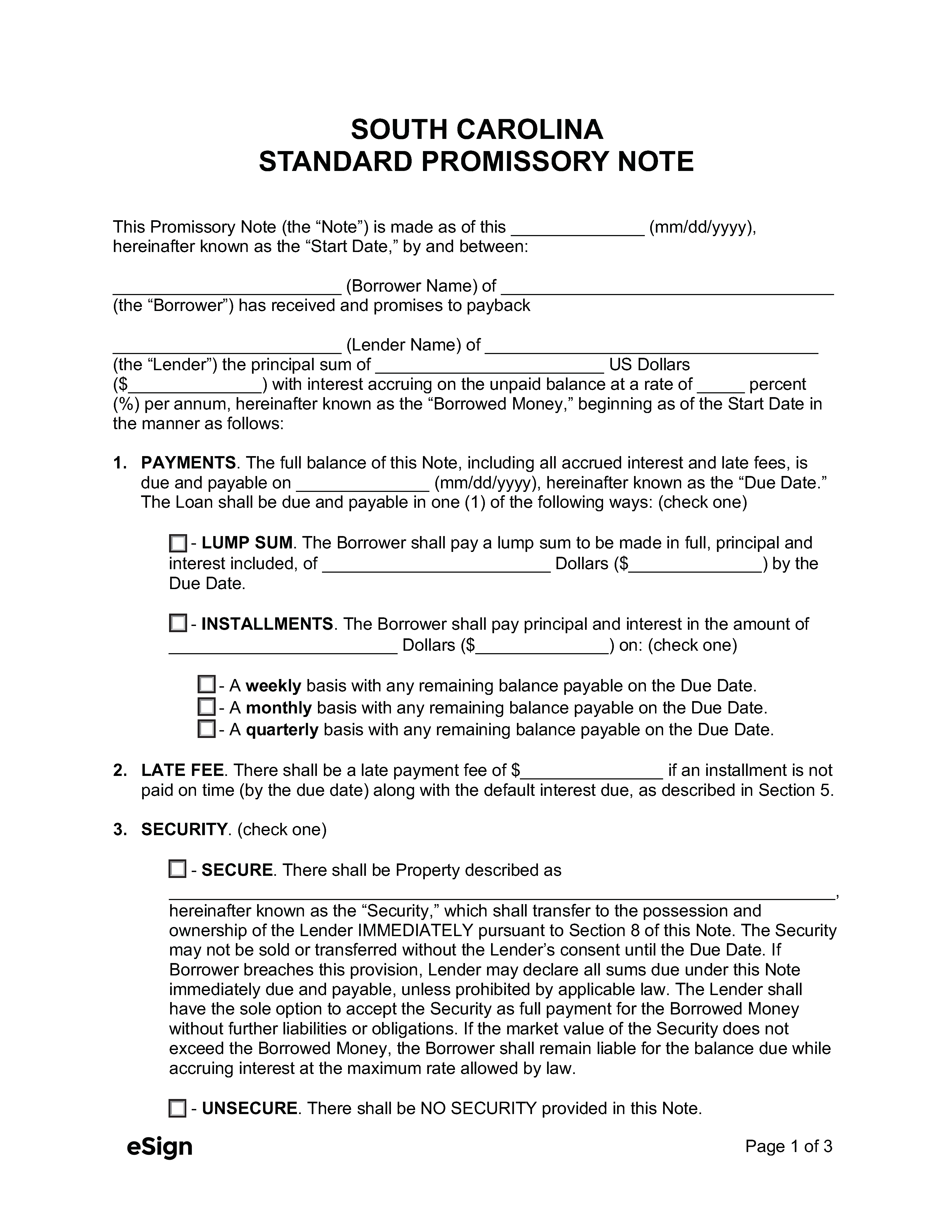

Secured Promissory Note – Borrowers must provide “security” by putting up collateral to receive a loan with this agreement.

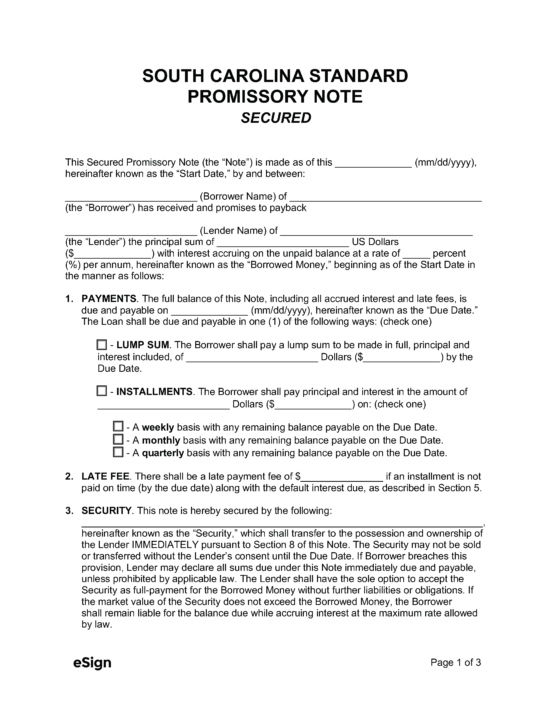

Secured Promissory Note – Borrowers must provide “security” by putting up collateral to receive a loan with this agreement.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 34, Chapter 31 – Money and Interest & Title 37, Chapter 3, Loans

- Usury Rate in General (§ 34-31-20(A)): 8.75%

- Usury Rate for Unsupervised Loans (§ 37-3-201(1)): 12%

- Usury Rate for Supervised Loans (§ 37-3-201(2)(c)): 18%

- Usury Rate for Monetary Judgments (§ 34-31-20(B)): For each year damages are rewarded, interest will be calculated with the prime rate listed in the first Wall Street Journal published for each calendar year plus 4%, compounded annually. For older judgments, interest will be calculated as follows:

- 14% a year for judgments entered before January 1, 2001

- 12% a year for judgments entered between January 1, 2001, and June 30, 2005