Related Forms

Download: PDF, Word (.docx), OpenDocument

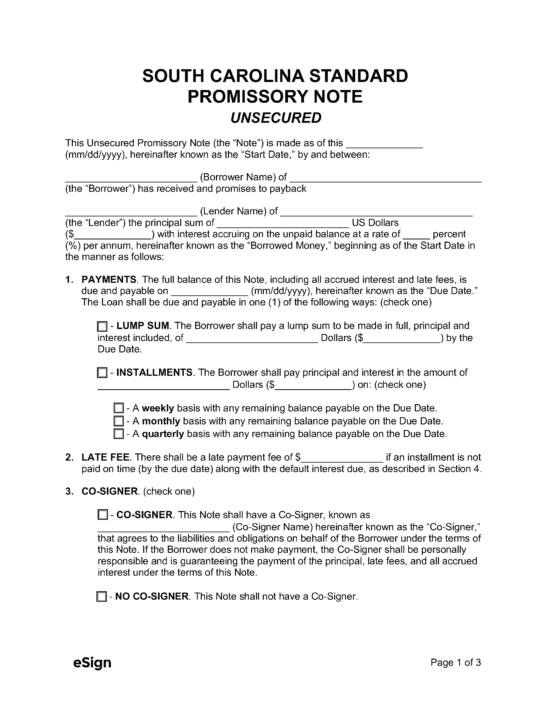

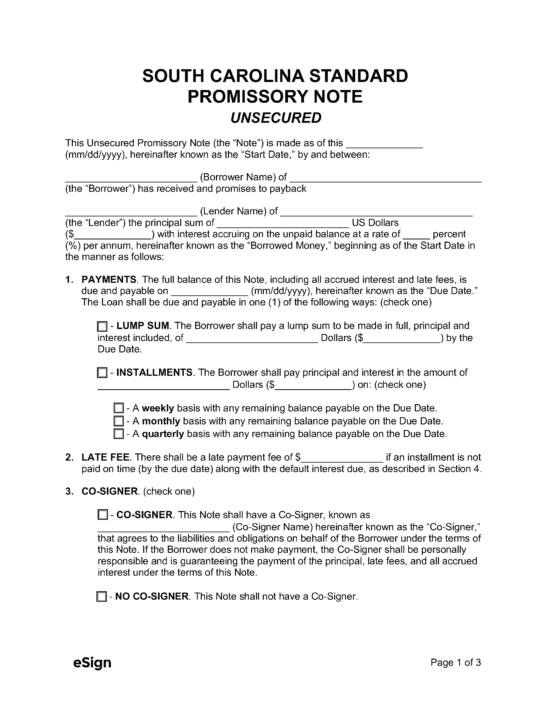

A South Carolina secured promissory note is a means by which borrowers may secure a loan from a moneylender by putting up their assets as collateral. A promissory note may be risky for the lender; therefore, adding “security” to the repayment terms reduces the lender’s risk, as they can sell the assets to make up for any financial loss. If the value of the assets depreciates and does not cover the total amount of the loan, the borrower will still be liable for the balance remaining. The document should detail the loan amount, the interest rate, when payments are due, and a complete description of the assets securing the note.

A South Carolina secured promissory note is a means by which borrowers may secure a loan from a moneylender by putting up their assets as collateral. A promissory note may be risky for the lender; therefore, adding “security” to the repayment terms reduces the lender’s risk, as they can sell the assets to make up for any financial loss. If the value of the assets depreciates and does not cover the total amount of the loan, the borrower will still be liable for the balance remaining. The document should detail the loan amount, the interest rate, when payments are due, and a complete description of the assets securing the note.

Download: PDF, Word (.docx), OpenDocument