Types (2)

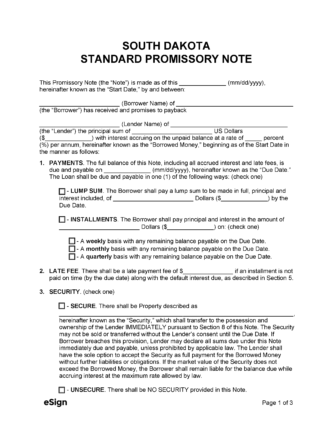

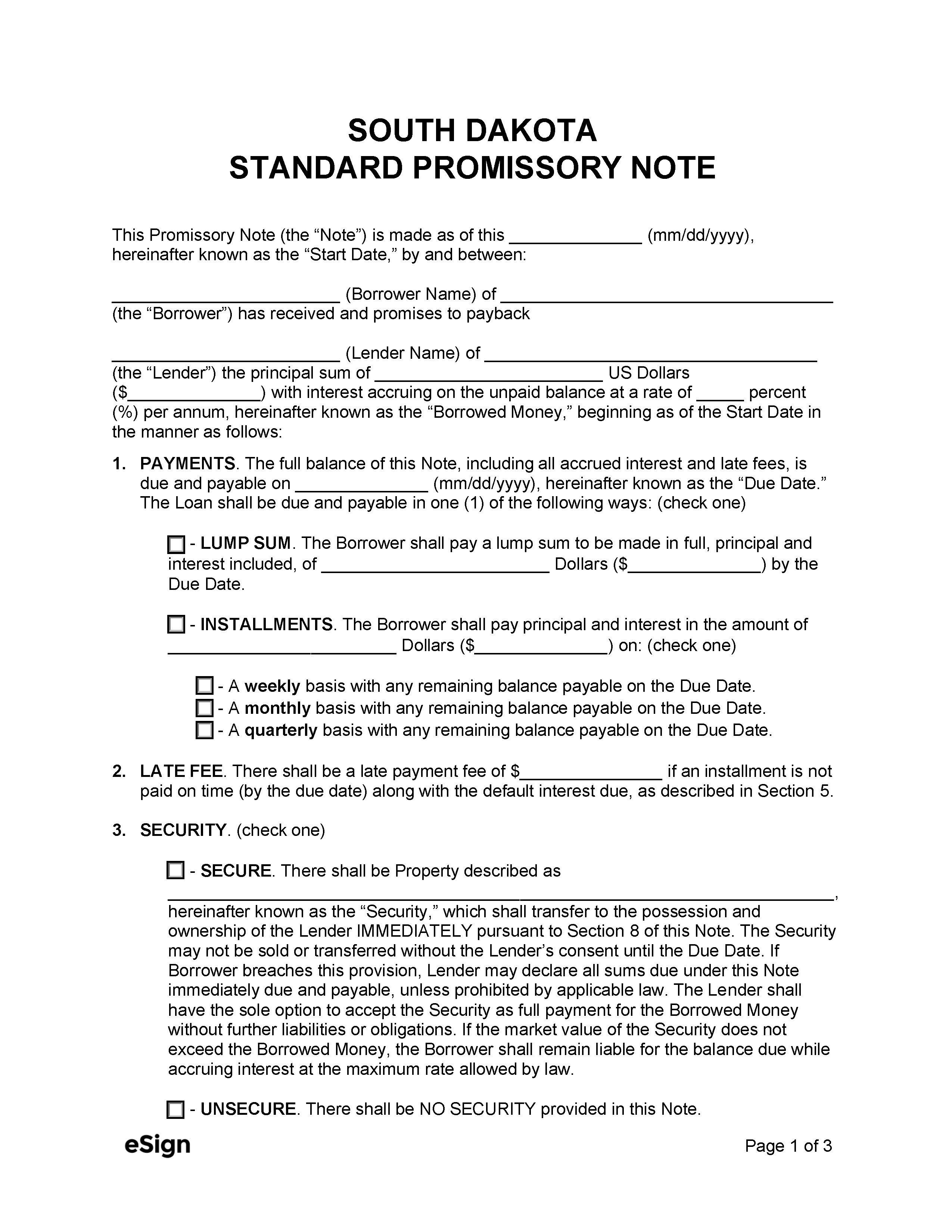

Download: PDF, Word (.docx), OpenDocument

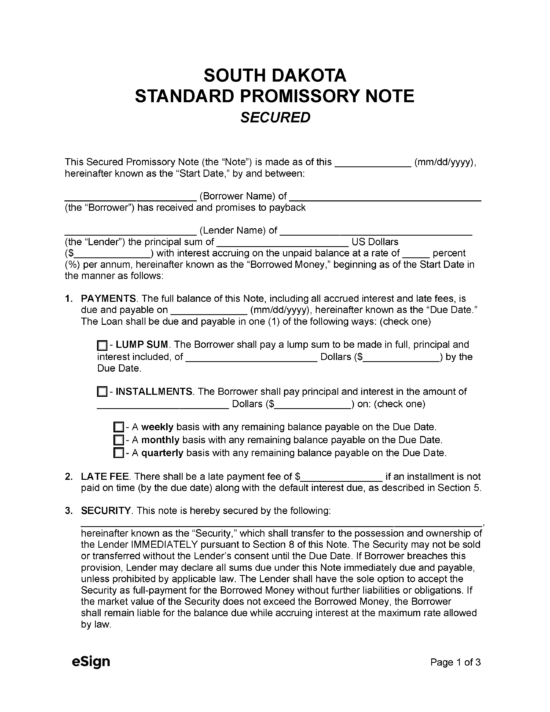

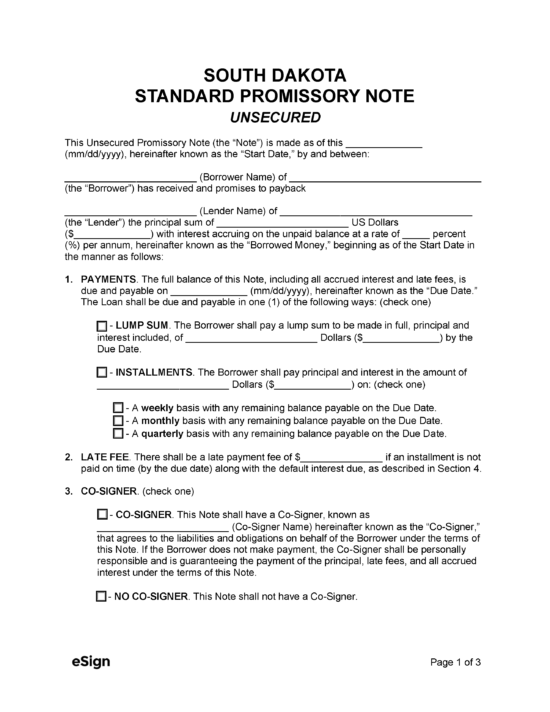

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 54-3 – Interest and Usury

- Usury Rate with Contract (§ 54-3-4): No limit

- Usury Rate without Contract (§ 54-3-4, § 54-3-16(3)): 12%

- Usury Rate for Judgments and Statutory Liens (§ 54-3-5.1, § 54-3-16(2)): 10%

- Usury Rate for Support Debts or Judgments (§ 25-7A-14, § 54-3-16(4)): 1% or less

- Usury Rate for Inverse Condemnation Actions (§ 54-3-5.1, § 54-3-16(1)): 4.5%

- Usury Rate for Past Due Money (§ 54-3-5, § 54-3-16(6)): 15%

- Usury Rate for Past Due Money on Bills, Statements, and Invoices (§ 54-3-5): 18%