Types (2)

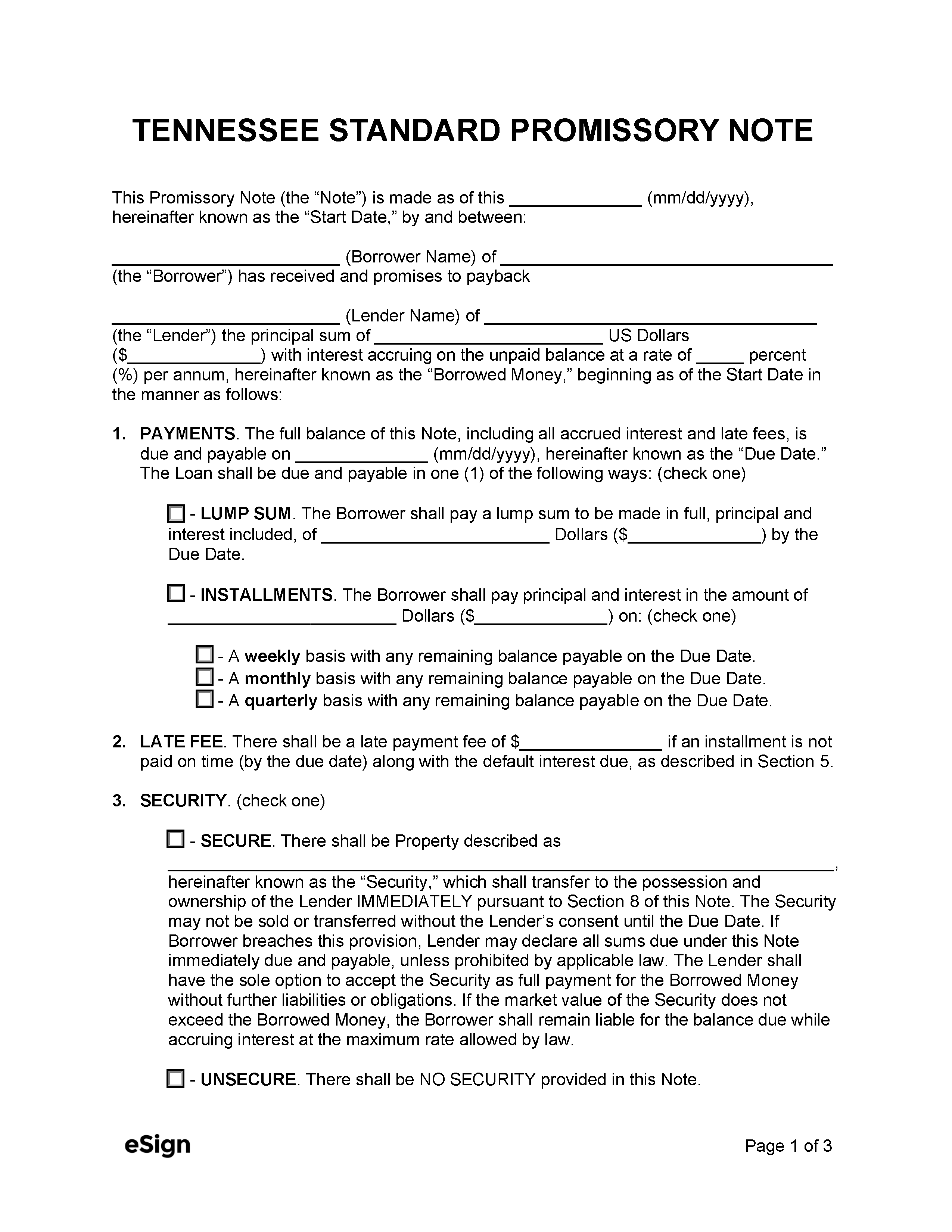

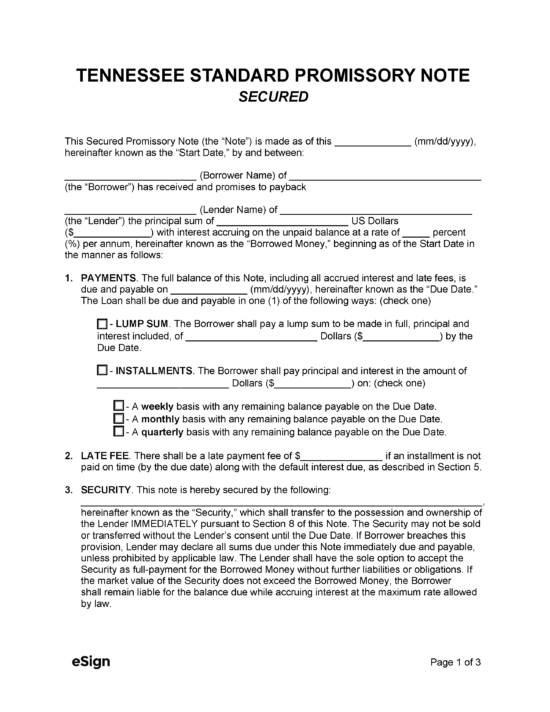

Secured Promissory Note – An agreement whereby the borrower pledges an asset or personal property as collateral.

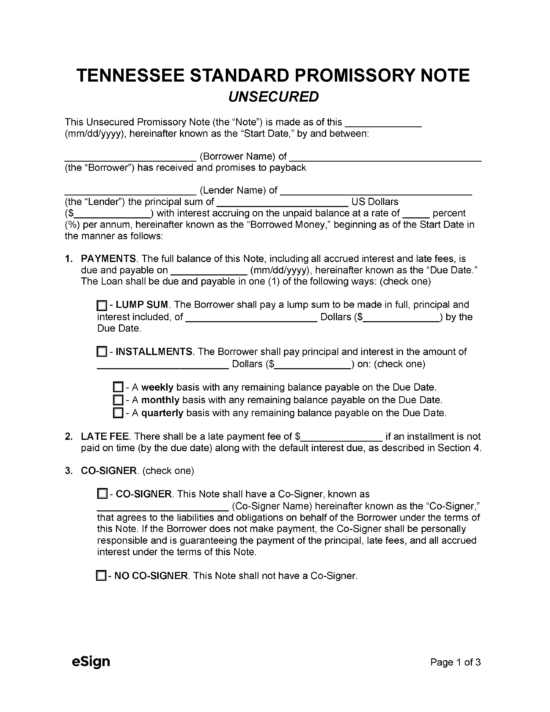

Secured Promissory Note – An agreement whereby the borrower pledges an asset or personal property as collateral.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 14 – Interest Rates Generally, Chapter 15 – Interest On Home Loans

- Usury Rate with Contract (§ 47-14-103(2), TN Dept. of Financial Institutions): 7.25%

- Usury Rate without Contract (§ 47-14-103(3)): 10%

- Usury Rate for Small Single-Payment Loans (§ 47-14-104(a)(1)): 10% if a single-payment loan is for an amount of $1,000 or less.

- Usury Rate for Home Loans (§ 47-15-102(b), TN Dept. of Financial Institutions): 5.91%