Lease Agreements: By Type (6)

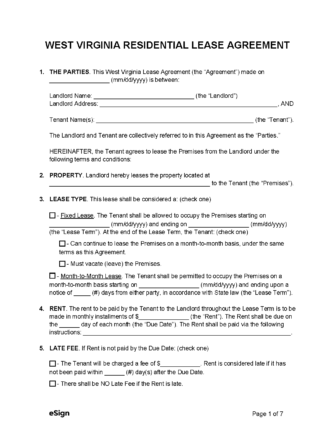

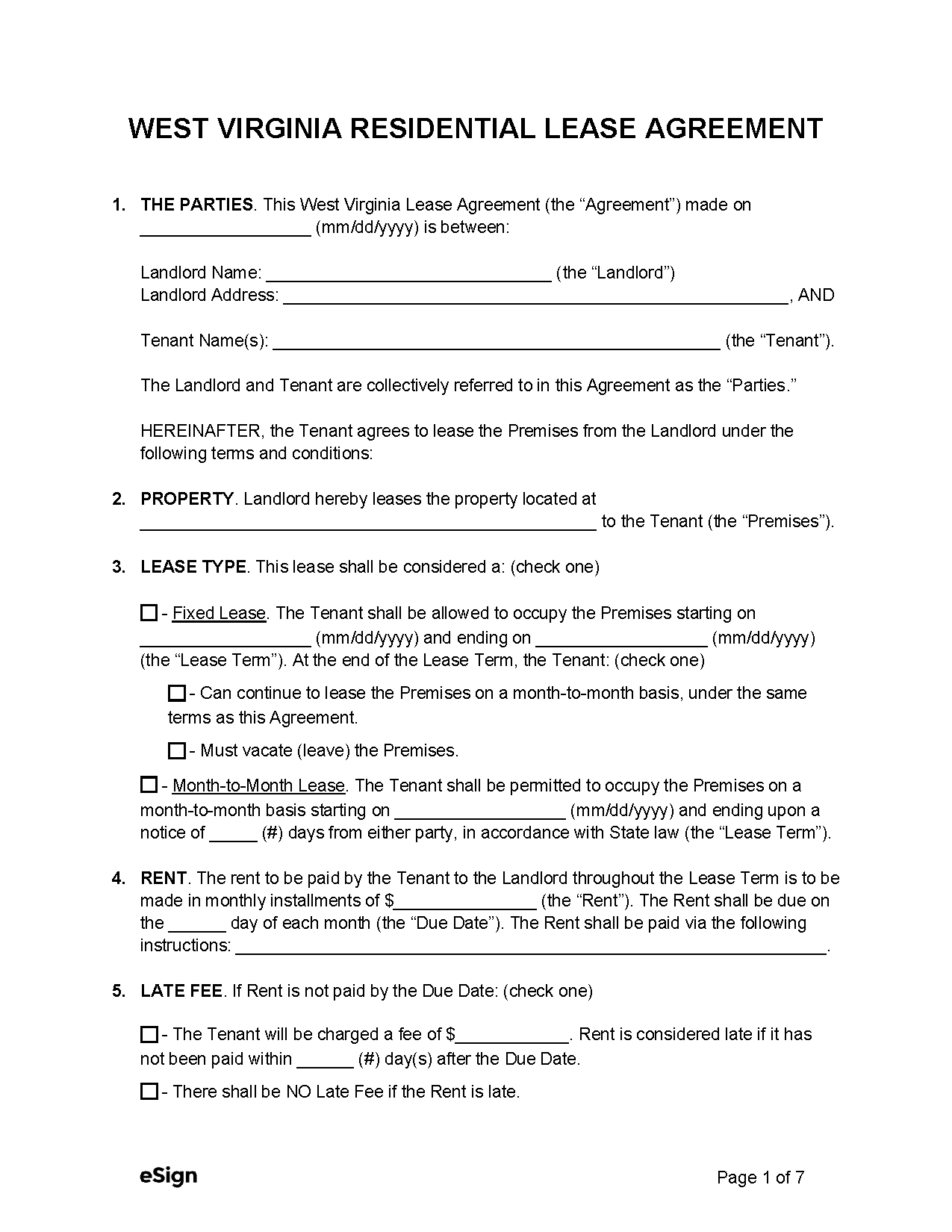

Standard (1-Year) Lease Agreement – Establishes the standard terms of tenancy for a residential property. Standard (1-Year) Lease Agreement – Establishes the standard terms of tenancy for a residential property.

Download: PDF, Word (.docx), OpenDocument |

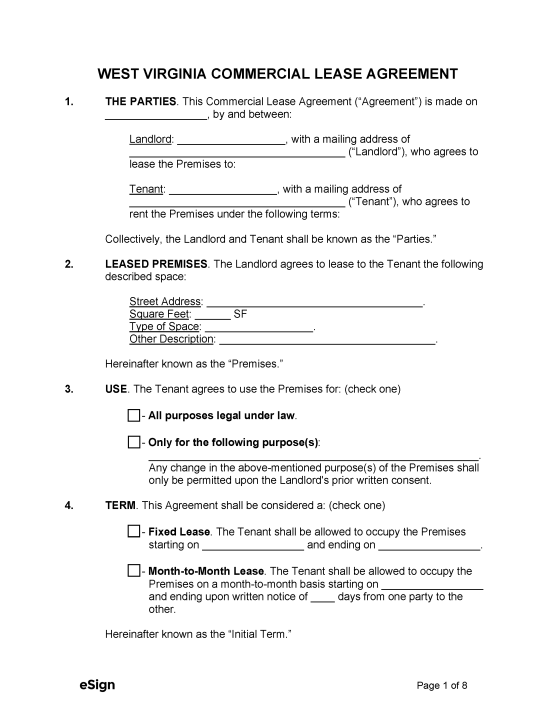

Commercial Lease Agreement – A contract between a landlord and a tenant for the leasing of commercial property. Commercial Lease Agreement – A contract between a landlord and a tenant for the leasing of commercial property.

Download: PDF, Word (.docx), OpenDocument |

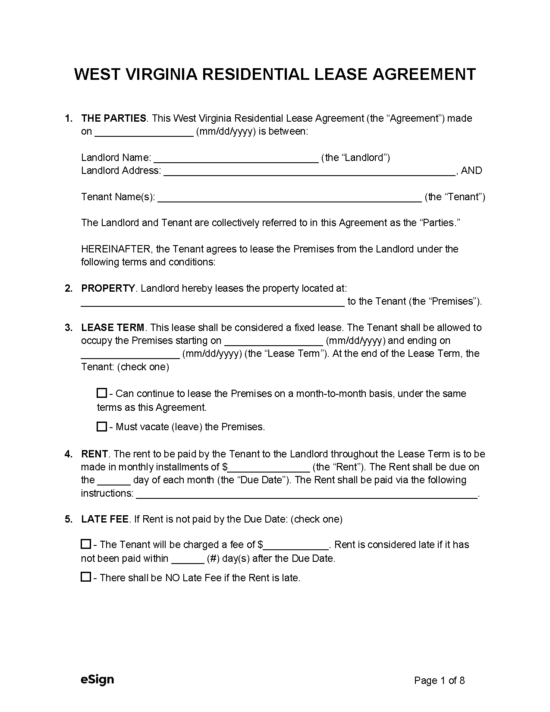

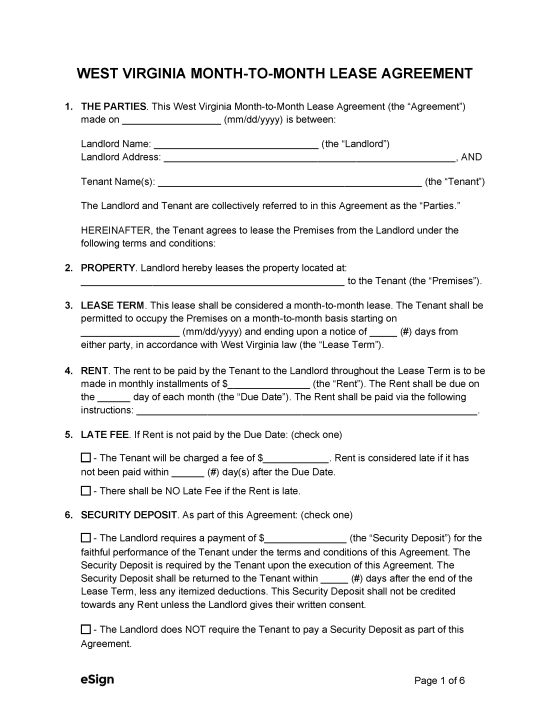

Month-to-Month Lease Agreement – A residential tenancy agreement that continues on a month-by-month basis until either party wishes to terminate the lease. Month-to-Month Lease Agreement – A residential tenancy agreement that continues on a month-by-month basis until either party wishes to terminate the lease.

Download: PDF, Word (.docx), OpenDocument |

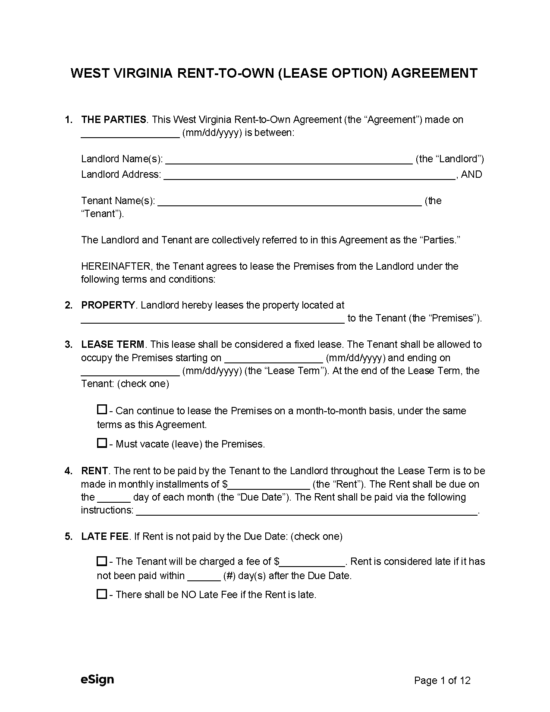

Rent-to-Own Agreement (Lease Option) – A residential lease that gives the tenant the opportunity to purchase the property they’ve been renting. Rent-to-Own Agreement (Lease Option) – A residential lease that gives the tenant the opportunity to purchase the property they’ve been renting.

Download: PDF, Word (.docx), OpenDocument |

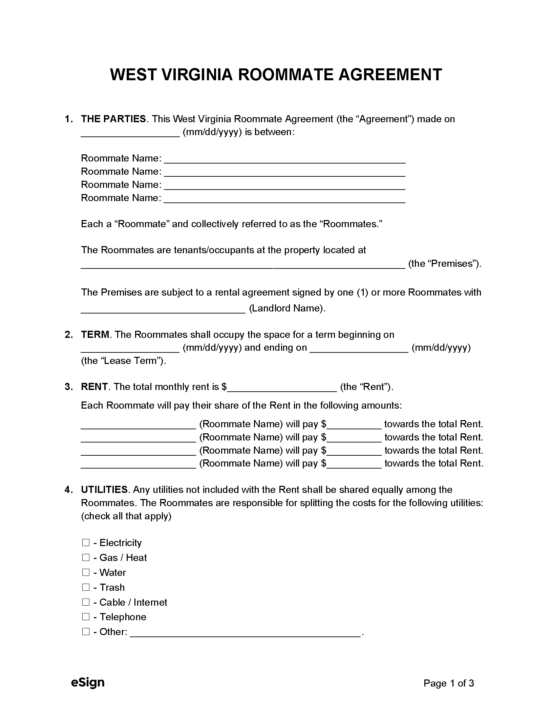

Roommate Agreement – Allows multiple tenants to establish the terms and conditions of their shared living space. Roommate Agreement – Allows multiple tenants to establish the terms and conditions of their shared living space.

Download: PDF, Word (.docx), OpenDocument |

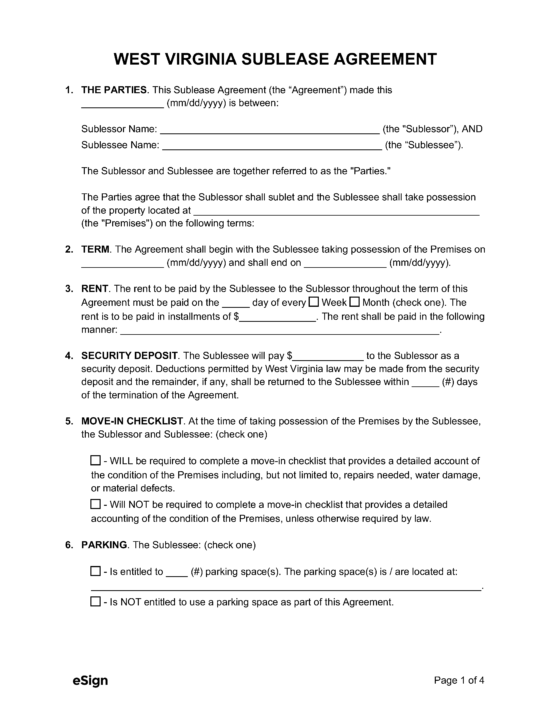

Sublease Agreement – Enables a tenant to rent the property to another party while keeping the original lease with the landlord in place. Sublease Agreement – Enables a tenant to rent the property to another party while keeping the original lease with the landlord in place.

Download: PDF, Word (.docx), OpenDocument |

Required Disclosures (2)

- Lead-Based Paint Disclosure (PDF) – Landlords must disclose whether the premises contains lead-based paint if the property was constructed before 1978.[1]

- Nonrefundable Fees – In order for any application or pet fees to not be included in the security deposit, the parties must agree in writing that these fees are nonrefundable.[2]

Security Deposits

Maximum Amount ($) – There is no maximum security deposit limit established by state law.

Collecting Interest – State statutes do not describe whether security deposit interest must be collected or distributed.

Returning to Tenant – Security deposits must be returned within 60 days of the expiration of the tenancy or within 45 days of the start of the following tenancy, whichever is shorter.[3]

Itemized List Required? – Yes, if the landlord makes deductions to the security deposit for damages, a written statement must be provided to the tenant with the balance of the deposit.[4]

Separate Bank Account? – No, there are no laws obligating the landlord to keep security deposits in a separate bank account.

Landlord’s Entry

General Access – No notice period for landlord entry is mentioned in state law.

Immediate Access – It is generally accepted that landlords can access the property without consent in the case of an emergency.

Rent Payments

Grace Period – There is no grace period for paying rent in West Virginia.

Maximum Late Fee ($) – The maximum fee amount that landlords can charge for late rent is not covered in state statutes.

Bad Check (NSF) Fee – Landlords may charge a $25 fee for rent checks that bounce due to insufficient funds.[5]

Withholding Rent – Withholding rent is not within a tenant’s right; if a tenant is behind on rent, the landlord is not obligated to make repairs and may even file for eviction.[6]

Breaking a Lease

Non-Payment of Rent – Serving a notice to quit for non-payment of rent is optional; landlords are within their rights to evict anytime past the rent due date.[7]

Non-Compliance – If a tenant does not comply with the lease, the landlord can start an unlawful detainer suit immediately; a notice to quit for non-compliance is optional.

Lockouts – It is illegal for landlords to prevent tenants from accessing their rental unit.[8]

Leaving Before the End Date – If a tenant fails to pay rent and has abandoned the property, the landlord may take back possession of the premises after 30 days by posting a notice on the premises.[9]

- Duty to Re-rent – The landlord may choose to re-rent the property, in which case the original tenant will still owe rent for the remainder of their lease term minus any rent collected from a new tenant.[10]

Lease Termination

Month-to-Month – Monthly lease agreements can be ended by either party using a 1-month notice to quit.[11]

Unclaimed Property – If personal property is left on the premises, the landlord must notify the tenant that they have 30 days to collect it or it becomes property of the landlord.[12]